On Monday, major US stock indices closed at new record levels, primarily due to a number of corporate news about mergers / acquisitions. In addition, positive news was added by reports of a conversation between Liu Hye, China's chief trade negotiator, US sales representative Lighthizer and US Treasury Secretary Mnuchin. According to the Chinese side, "consensus has been reached on the proper resolution of relevant issues." That is, it can be assumed that no sharp unilateral steps will be taken.

On the other hand, Powell's speech last night contained nothing new and was ignored by the markets.

As of Tuesday morning, positive growth is noticeable, but it is limited and has not yet led to movement in the currency exchange and commodity markets.

EUR/USD

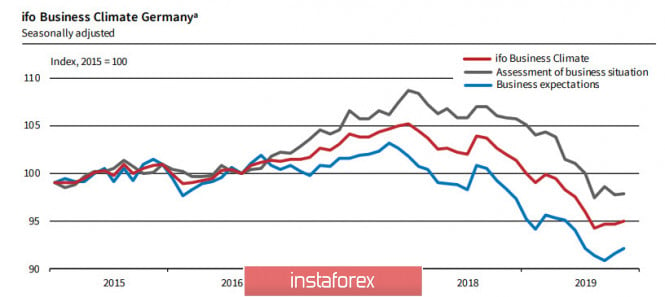

The expected pullback did not happen - In Germany, the Ifo business optimism indices for November are at the same levels as a month ago. The manufacturing index, in turn, declined again after slight increase a month ago, as companies note a very low level of current orders and plan to further reduce production. In the services sector, the situation is slightly better, but expectations have been in negative territory for four months in a row. The same situation is also considered in the construction sector.

The only one who feels confident is the sphere of trade, which is understandable due to the fact that Christmas is approaching, however, trading optimism is clearly not enough to hope for a reversal. The euro fell during the European session on Monday, responding to weak Ifo, as well as confirming the weak PMI published on Friday. Meanwhile, the German economy barely escaped a technical recession in the 3rd quarter; the lack of fiscal stimulus is already clearly holding back economic growth.

At the same time, ECB's head Lagarde announced last Friday that there will be an upcoming monetary policy review. According to her, the ECB will find out what is the relationship between low interest rates and potential negative side effects. Lagarde's position probably indicates a possible revision of the ECB's plans, which, due to growing uncertainty, puts pressure on the euro.

Technically, the euro remains under pressure. The support 1.0988 has resisted, so there is a chance of a pullback to the zone 1.1050 / 65, where sales are highly likely to be resumed.

GBP/USD

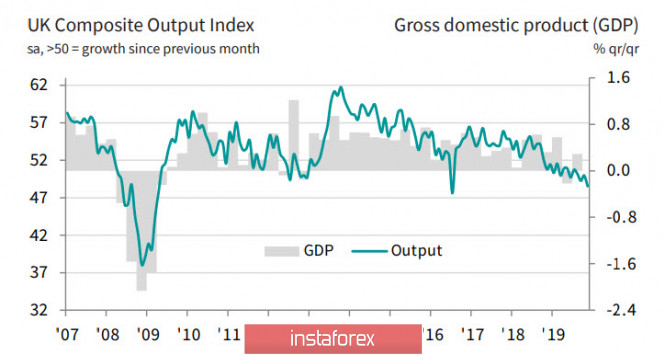

The UK PMI index fell to 48.6p in November, steadily falling into negative territory. The composite index reached a 40-month low and there is no doubt that business activity is on the decline. Given the correlation of PMI with output, one should expect a decline in GDP's growth rates.

The pound remains to be a hostage to the political situation, focusing primarily on forecasts for the results of the general elections on December 12. Regardless of whether Johnson wins, it is becoming increasingly apparent that the Bank of England should prepare for a decisive action to stimulate the economy, as the situation is developing in a negative way.

The Bank of England, in turn, continues to take a break, waiting for the Brexit saga to end. The endless postponements of the final decision to reduce the time for making a decision, and increase the chances that BoE does not start with a symbolic reduction in the rate of a quarter point, but immediately proposes a comprehensive plan that combines both the reduction in the rate and the buyback of assets, and, possibly, some other measures.

Therefore, the market takes into account the probability of the pound falling after such drastic measures, but proceeds from the fact that BoE will be ready to announce a plan to support the economy at a meeting in March and not earlier, since it will take time after leaving the EU on January 31. Accordingly, in the short term, the pound feels confident and will focus on the growth of the Tories' chances to win the election.

Technically, the pound is trading in the range on Tuesday morning. The forecast is neutral with a slight margin of bullish sentiment. An attempt to develop growth above 1.2890 with an eye on 1.2950 is likely, but the chances of reaching 1.30 are still pretty small. Support 1.2840 / 60, with a decline to which, buying in the expectation of a resumption of growth can be considered.

The material has been provided by InstaForex Company - www.instaforex.com