Gold was the main hope of investors in 2019, but it was also the main disappointment at the beginning of the final fourth quarter. Gold investors were optimistic in September, but then they were disappointed, which last week turned into a panic. So what happened in the gold market and why did it suddenly began to decline instead of continuing to grow? In this article I will try to answer this question and consider the prospects of the precious metal until the end of this year.

If you read my precious metals market analytics published on the InstaForex portal on October 9, then you know that back in September I bet on raising the price of gold. However, in early October, my point of view has changed, suggesting that the price of gold will be in a correction to the rising trend of the daily time until the end of November.

Despite the fact that November is in full swing, today we see that I was right, and the price of gold is actively declining and has reached the level of $1,450 per troy ounce. In this regard, I will try to predict the dynamics of prices in the context of the analysis methods that I used earlier, for which we turn to the data of the futures market, which determines the price of gold in US dollars around the world, due to the fact that the American futures market has the highest liquidity among all other markets.

The main futures contracts in gold are February, April, June, August and December, where June and December play a key role in determining the price of a half-year and a year, as well as calculating profits and losses for these periods. The main buyers of gold in the futures market are the so-called money managers, managing funds or simply speculators. It depends on their moods whether gold will rise in price or not. In the cash market, the function of buyers of gold, determining the price, perform the Exchange Trading Funds (ETFs). Yes, it is speculators, not central banks, that determine the current price of gold in US dollars, and I will prove it to you. That is why we will closely monitor the stock trading funds and money managers.

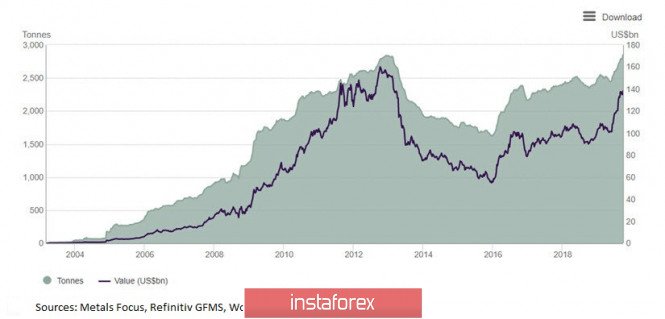

In September, investments in global ETFs secured by gold reached a new record high of 2852.17 tons, exceeding the peak of 2012 (Fig. 1)

Fig. 1: Gold reserves in exchange trading funds exceeded the high of 2012

As you can see, the demand for the so-called "paper gold" was excellent, but it was not confirmed by the demand for gold bullion and coins. According to the World Gold Council, in the third quarter of 2019, the demand for bullion and coins was 50% lower than in the third quarter of 2018, and amounted to only 150.3 tons. Demand in India fell by 35%, demand in China was lower by 51%. Amazing right?

These data, among other things, confirm my assumption that the price is most influenced by the demand of North American speculators, but they also show the discrepancy between the fast - speculative and investment demand for gold. If not for demand from speculators, the price of gold could collapse to the region of $1200, or even $1100, instead of soaring to the level of $ 1550.

In addition to the above, it should be noted that central banks bought 38% less gold in the third quarter of 2019 than in the third quarter of last year. In turn, demand for jewelry also fell by 16%, and in India it fell by -32%, and in China by -12%.

Let's look at what is happening on the futures market. If we talk about the amount of money, since September, the Open Interest has stabilized near the mark of 1 million 50 thousand contracts and now amounts to 1 million 71 thousand. The aggregate positions of speculators have also stabilized at the level of 230 thousand contracts, they are not growing, but they are not falling. In such circumstances, at least it is not rational to expect a price increase. If there is no demand on the market or it remains at constant values, how can the price rise? Rather, the current situation is a reflection of the range that we have seen over the past two months. A range is, of course, a continuation figure, but who's to say that at the top it can't turn into a reversal pattern?

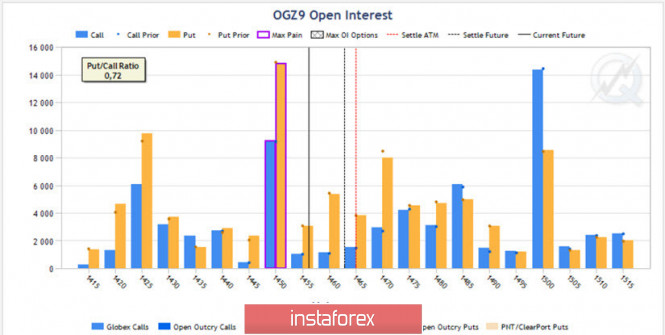

However, it was not without reason that at the beginning of the article I remembered the December gold futures contract as the main contract closing the current year. In the third quarter, option sellers suffered serious losses, and now they need to end the year with a profit, for which the futures price should close in the area of 1450 (Fig. 2).

This follows from theory and practice suggesting that most options close out of money. If sellers had trouble in the third quarter, when they were forced to put gold at unfavorable prices and suffer losses, then allowing it twice in a row, and even doing this in the absence of growth in demand, would be very rash on the part of large structures that actually control given market.

Fig. 2: Distribution of optional barriers, December futures.

Today, the price of gold surpassed the $1,450 mark, but the option contract closes on November 25, that is, in two weeks. Given the date of expiration, it can be assumed that the price of gold may well drop to $1425 and then return to $1450 or close slightly higher. However, taking into account the fact that the level of $1450 is a rather powerful strike in itself, a rebound from this level is possible and a return to the level of $1500, or $1485.

However, there is another circumstance that I would like to draw the attention of traders. Lowering the price below the level of $1450 and closing the week below this value will mean opening new prospects below, due to the fact that the level of $1450 is the key low of October. This, in turn, means the possibility of a deeper decline, for example, in the area of $1375. So far, in the February option contract, closing on December 26, such depths are not visible, but the liquidity there is not very large. If traders see the possibility of a further decline, then gold can very quickly fall to these values, but this will be a different story. Therefore, follow my articles, and I, in turn, will try to respond promptly to a changing situation.

The material has been provided by InstaForex Company - www.instaforex.com