Forecast for November 20:

Analytical review of currency pairs on the scale of H1:

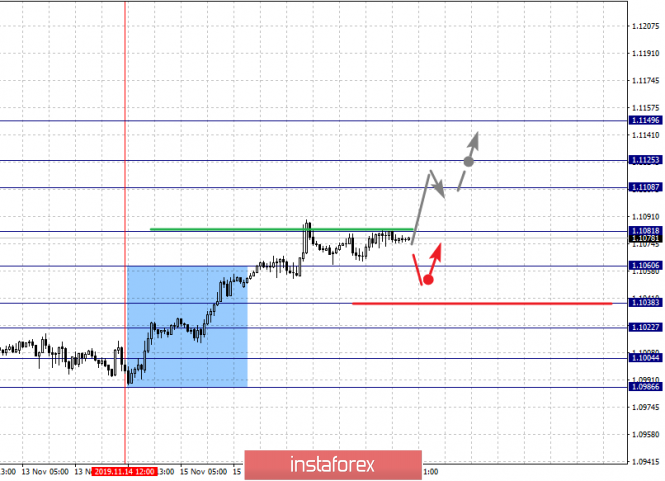

For the euro / dollar pair, the key levels on the H1 scale are: 1.1149, 1.1125, 1.1108, 1.1081, 1.1060, 1.1038, 1.1022 and 1.1004. Here, we are following the development of the ascending structure of November 14. We expect short-term upward movement, as well as consolidation, in the range of 1.1060 - 1.1081. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1108. Price consolidation is in the range of 1.1108 - 1.1125. For the potential value for the top, we consider the level of 1.1149. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is expected in the range of 1.1038 - 1.1022. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1004. This level is a key support for the upward structure. Its breakdown will allow us to count on movement to the first potential target - 1.0986.

The main trend is the upward structure of November 14.

Trading recommendations:

Buy: 1.1083 Take profit: 1.1106

Buy: 1.1025 Take profit: 1.1146

Sell: 1.1038 Take profit: 1.1022

Sell: 1.1021 Take profit: 1.1005

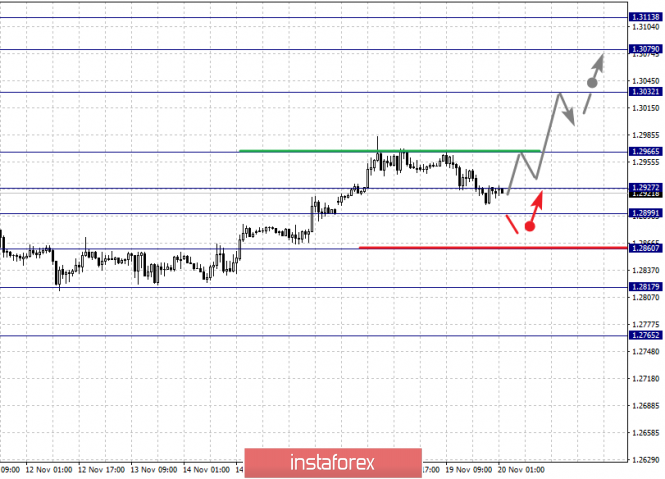

For the pound / dollar pair, the key levels on the H1 scale are: 1.3113, 1.3079, 1.3032, 1.2966, 1.2927, 1.2899, 1.2860 and 1.2817. Here, we continue to monitor the development of the upward cycle of November 8. The continuation of the movement to the top is expected after the breakdown of the level of 1.2966. In this case, the target is 1.3032. Price consolidation is near this level. The breakdown of the level of 1.3032 should be accompanied by a pronounced upward movement. Here, the target is 1.3079. For the potential value for the top, we consider the level of 1.3113. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.2927 - 1.2899. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2860. This level is a key support for the upward structure from November 8. Its passage in price will lead to the development of a downward trend. Here, the first goal is 1.2817.

The main trend is the upward cycle of November 8.

Trading recommendations:

Buy: 1.2967 Take profit: 1.3030

Buy: 1.3034 Take profit: 1.3079

Sell: 1.2927 Take profit: 1.2900

Sell: 1.2896 Take profit: 1.2860

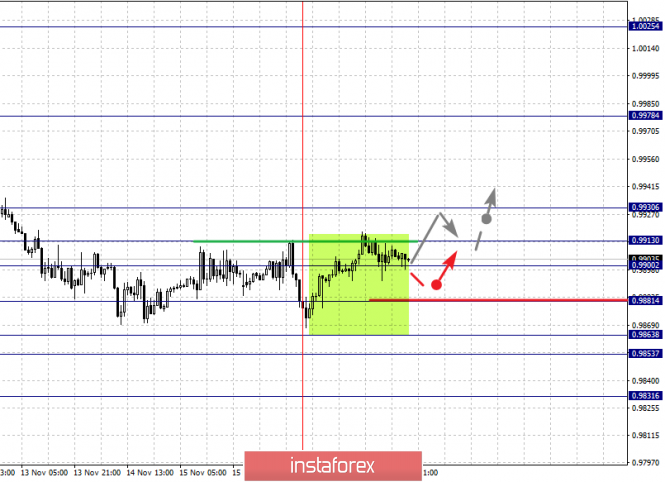

For the dollar / franc pair, the key levels on the H1 scale are: 0.9930, 0.9913, 0.9900, 0.9881, 0.9863, 0.9853 and 0.9831. Here, we are following the development of the downward cycle of November 8. At the moment, the price is in correction and has developed the potential for the upward movement of November 18. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9881. In this case, the target is 0.9863. Price consolidation is in the range of 0.9863 - 0.9853. For the potential value for the bottom, we consider the level of 0.9831. The expressed movement to which is expected after the breakdown of the level of 0.9851.

Consolidated movement is possibly in the range of 0.9900 - 0.9913. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 0.9930. This level is the key support for the downward structure. We expect the finalization of the initial conditions for the upward cycle to this level.

The main trend is the downward cycle of November 8, the potential for the top of November 18.

Trading recommendations:

Buy : 0.9900 Take profit: 0.9911

Buy : 0.9914 Take profit: 0.9930

Sell: 0.9880 Take profit: 0.9865

Sell: 0.9852 Take profit: 0.9831

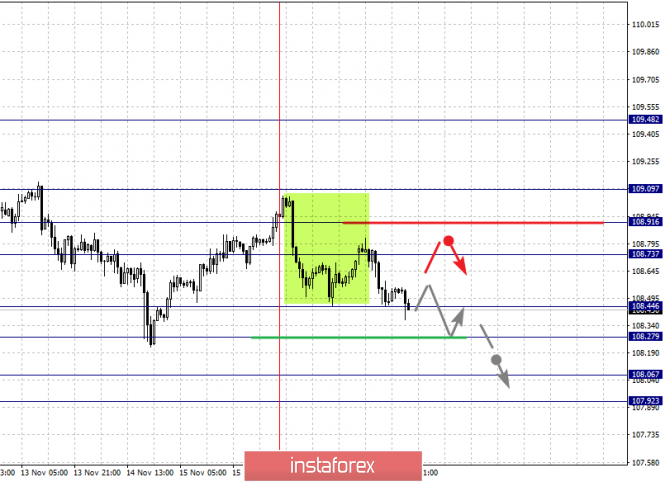

For the dollar / yen pair, the key levels on the scale are : 109.09, 108.91, 108.73, 108.44, 108.27, 108.06 and 107.92. Here, we are following the development of the local descending structure of November 18. Short-term downward movement is expected in the range of 108.44 - 108.27. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 108.06. We consider the level of 107.92 to be a potential value for the bottom. Upon reaching this value, we expect consolidation, as well as a rollback to correction in the range of 108.06 - 107.92.

Short-term upward movement, as well as consolidation, are expected in the range of 108.73 - 108.91. We consider the level 109.09 to be the potential value for the top. We expect the initial conditions for the ascending cycle to be formed until this level.

The main trend: the downward structure of November 7, the local structure of November 18

Trading recommendations:

Buy: 108.73 Take profit: 108.90

Buy : 108.94 Take profit: 109.07

Sell: 108.44 Take profit: 108.29

Sell: 108.25 Take profit: 108.06

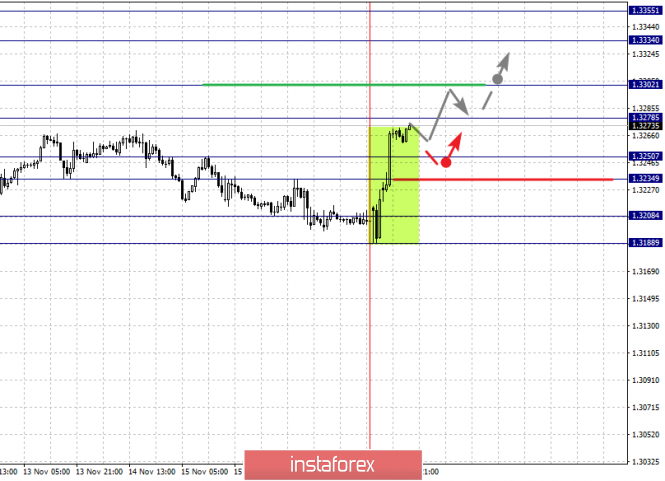

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3355, 1.3334, 1.3302, 1.3278, 1.3250, 1.3234, 1.3208 and 1.3188. Here, the price forms a pronounced potential for the upward movement of November 19. The continuation of the movement to the top is expected after the breakdown of the level of 1.3278. In this case, the target is 1.3302. Price consolidation is near this level. The breakdown of the level of 1.3303 should be accompanied by a pronounced upward movement. Here, the target is 1.3334. For the potential value for the top, we consider the level of 1.3355. Upon reaching this level, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.3250 - 1.3234. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3210. This level is a key support for the upward structure.

The main trend is the formation of potential for the top of November 19.

Trading recommendations:

Buy: 1.3278 Take profit: 1.3300

Buy : 1.3305 Take profit: 1.3334

Sell: 1.3250 Take profit: 1.3235

Sell: 1.3232 Take profit: 1.3210

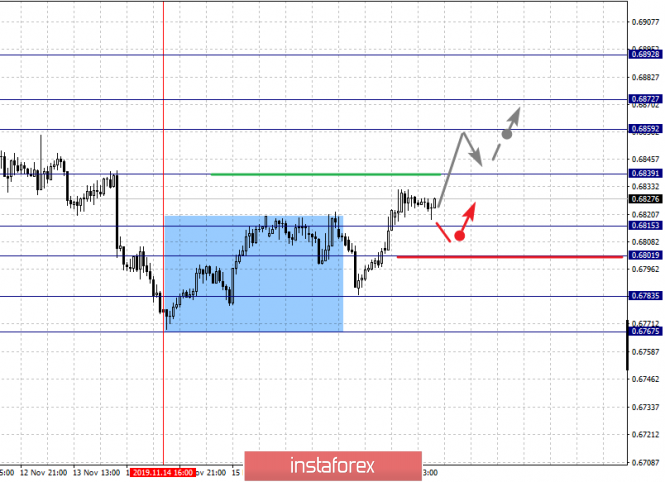

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6892, 0.6872, 0.6859, 0.6839, 0.6815, 0.6801 and 0.6783. Here, we are following the development of the ascending structure of November 14. The continuation of the movement to the top is expected after the breakdown of the level of 0.6840. In this case, the target is 0.6859. Short-term upward movement, as well as consolidation is in the range of 0.6859 - 0.6872. For the potential value for the top, we consider the level of 0.6892. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is expected in the range of 0.6815 - 0.6801. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6783. This level is the key support for the ascending structure of November 14.

The main trend is the upward structure of November 14.

Trading recommendations:

Buy: 0.6840 Take profit: 0.6857

Buy: 0.6860 Take profit: 0.6870

Sell : 0.6815 Take profit : 0.6803

Sell: 0.6800 Take profit: 0.6785

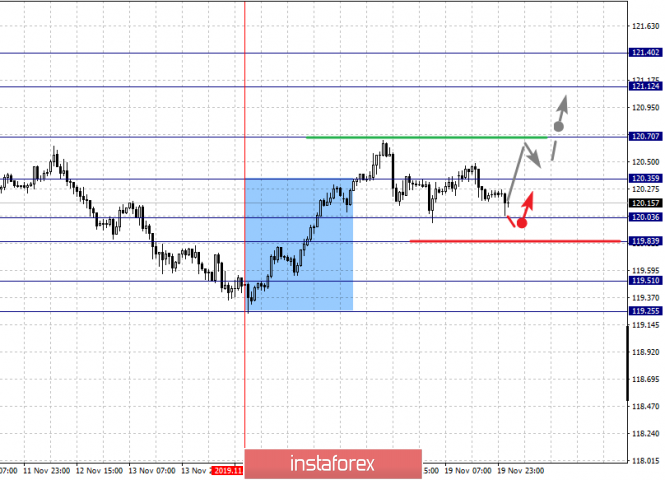

For the euro / yen pair, the key levels on the H1 scale are: 121.40, 121.12, 120.70, 120.35, 120.03, 119.83, 119.51 and 119.25. Here, we are following the ascending structure of November 14. The continuation of the movement to the top is expected after the breakdown of the level of 120.35. Here, the goal is 120.70. Price consolidation is near this level. The breakdown of the level of 120.70 should be accompanied by a pronounced upward movement. Here, the goal is 121.12. For the potential value for the top, we consider the level of 121.40. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is expected in the range of 120.03 - 119.83. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.51. This level is a key support for the upward structure.

The main trend is the upward structure of November 14.

Trading recommendations:

Buy: 120.35 Take profit: 120.68

Buy: 120.72 Take profit: 121.10

Sell: 120.03 Take profit: 119.83

Sell: 119.80 Take profit: 119.51

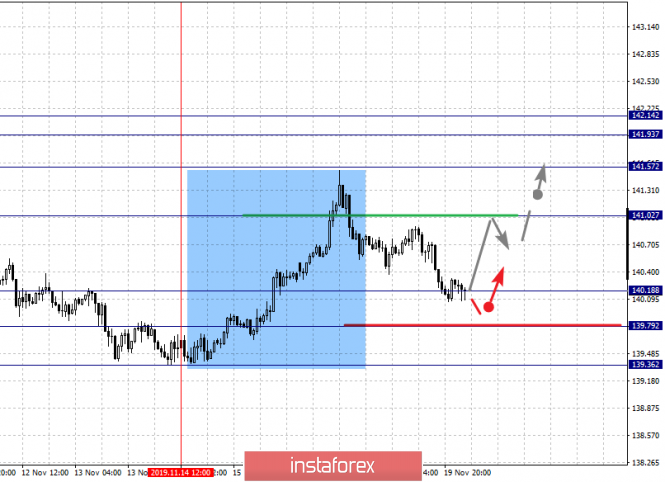

For the pound / yen pair, the key levels on the H1 scale are : 142.14, 141.93, 141.57, 141.02, 140.49, 140.18 and 139.79. Here, we are following the development of the ascending structure of November 14. At the moment, the price is in deep correction. The continuation of the movement to the top is expected after the breakdown of the level of 141.02. In this case, the first goal is 141.57. The breakdown of which will allow us to count on movement to the level of 142.14. Upon reaching this value, we expect consolidation in the range of 141.93 - 142.14.

Short-term downward movement is possibly in the range 140.18 - 139.79. The breakdown of the latter value will lead to the cancellation of the ascending structure of November 14. In this case, the first target is 139.36.

The main trend is the rising structure of November 14, the stage of deep correction.

Trading recommendations:

Buy: 141.02 Take profit: 141.55

Buy: 141.58 Take profit: 141.93

Sell: 140.16 Take profit: 139.84

Sell: 139.76 Take profit: 139.38

The material has been provided by InstaForex Company - www.instaforex.com