Forecast for November 14:

Analytical review of currency pairs on the scale of H1:

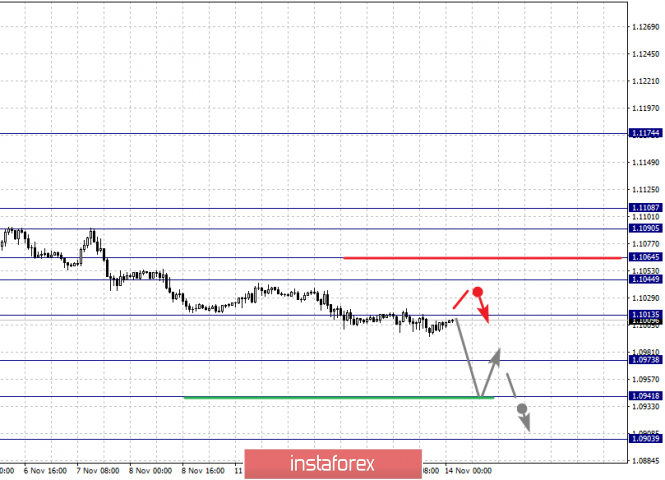

For the euro / dollar pair, the key levels on the H1 scale are: 1.1108, 1.1090, 1.1064, 1.1044, 1.1013, 1.0973, 1.0941 and 1.0903. Here, we are following the development of the downward cycle of November 4. At the moment, we expect a movement to the level of 1.0973. Price consolidation is near this level. Short-term downward movement, as well as consolidation is in the range of 1.0973 - 1.0941. For the potential value for the bottom, we consider the level of 1.0903. Upon reaching this value, we expect a rollback to the correction.

Short-term upward movement is expected in the range 1.1044 - 1.1064. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 1.1090. The range of 1.1090 - 1.1108 is a key support for the descending structure, before it, we expect the initial conditions for the upward cycle to be formed.

The main trend is the downward structure of November 4.

Trading recommendations:

Buy: 1.1045 Take profit: 1.1062

Buy: 1.1065 Take profit: 1.1090

Sell: 1.1012 Take profit: 1.0975

Sell: 1.0971 Take profit: 1.0941

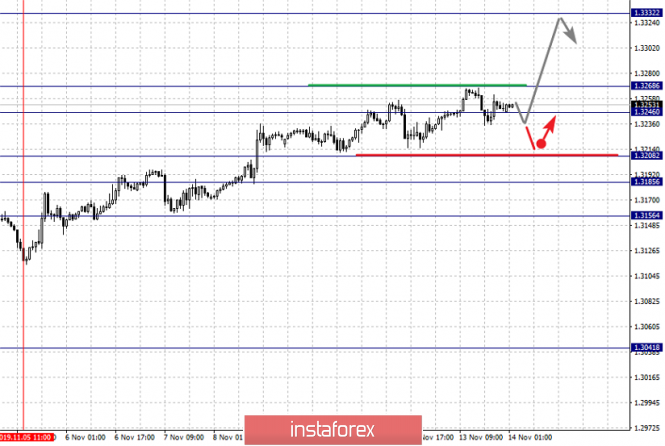

For the pound / dollar pair, the key levels on the H1 scale are: 1.3032, 1.2997, 1.2946, 1.2905, 1.2876, 1.2840, 1.2817, 1.2790 and 1.2765. Here, the price forms the expressed initial conditions for the top of November 8. Short-term upward movement is expected in the range 1.2876 - 1.2905. The breakdown of the latter value will lead to movement to the level of 1.2946. Price consolidation is near this level. The breakdown of the level of 1.2946 should be accompanied by a pronounced upward movement. Here, the target is 1.2997. We consider the level 1.3032 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom.

A short-term downward movement is possibly in the range of 1.2840 - 1.2817. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2790. This level is a key support for the top, its passage at the price will lead to the formation of a local descending structure. Here, the first goal is 1.2765.

The main trend is building potential for the top of November 8.

Trading recommendations:

Buy: 1.2876 Take profit: 1.2905

Buy: 1.2907 Take profit: 1.2944

Sell: 1.2840 Take profit: 1.2818

Sell: 1.2815 Take profit: 1.2792

For the dollar / franc pair, the key levels on the H1 scale are: 0.9930, 0.9913, 0.9900, 0.9881, 0.9863, 0.9853 and 0.9831. Here, we are following the development of the downward cycle of November 8. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9881. In this case, the target is 0.9863. Price consolidation is in the range of 0.9863 - 0.9853. For the potential value for the bottom, we consider the level of 0.9831. The expressed movement to which is expected after the breakdown of the level of 0.9851.

Short-term upward movement is possibly in the range of 0.9900 - 0.9913. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 0.9930. This level is a key support for the downward structure.

The main trend is the downward cycle of November 8.

Trading recommendations:

Buy : 0.9900 Take profit: 0.9911

Buy : 0.9914 Take profit: 0.9930

Sell: 0.9880 Take profit: 0.9865

Sell: 0.9852 Take profit: 0.9831

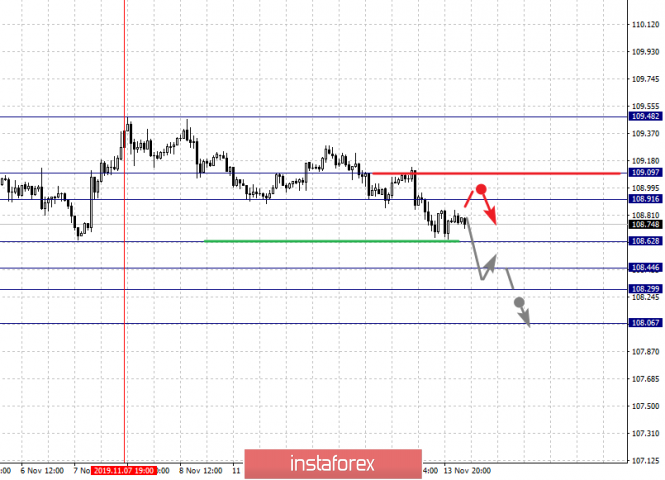

For the dollar / yen pair, the key levels on the scale are : 109.09, 108.91, 108.62, 108.44, 108.29 and 108.06. Here, the price has canceled the development of the local upward structure and at the moment, we are watching the downward potential of November 7. The continuation of the movement to the bottom is expected after the breakdown of the level of 108.62. In this case, the target is 108.44. Price consolidation is in the range of 108.44 - 108.29. We consider the level of 108.06 to be a potential value for the downward structure. Upon reaching which, we expect a pullback to the top.

Short-term upward movement is expected in the range of 108.91 - 109.09. The breakdown of the last value will have the formation of an ascending structure. In this case, the potential target is 109.48.

Main trend: The downward trend of November 7.

Trading recommendations:

Buy: 108.91 Take profit: 109.07

Buy : 109.11 Take profit: 109.45

Sell: 108.62 Take profit: 108.45

Sell: 108.28 Take profit: 108.06

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3332, 1.3268, 1.3246, 1.3208, 1.3185 and 1.3156. Here, we are following the medium-term upward structure from October 29, as well as the local structure for the top from November 5. Short-term movement to the top is expected in the range of 1.3246 - 1.3268. The breakdown of the last value will lead to a pronounced movement. Here, the potential target is 1.3332, and upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.3208 - 1.3185. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3156. This level is a key support for the upward structure.

The main trend is the medium-term initial conditions for the upward movement of November 29.

Trading recommendations:

Buy: 1.3246 Take profit: 1.3266

Buy : 1.3270 Take profit: 1.3332

Sell: 1.3208 Take profit: 1.3187

Sell: 1.3183 Take profit: 1.3156

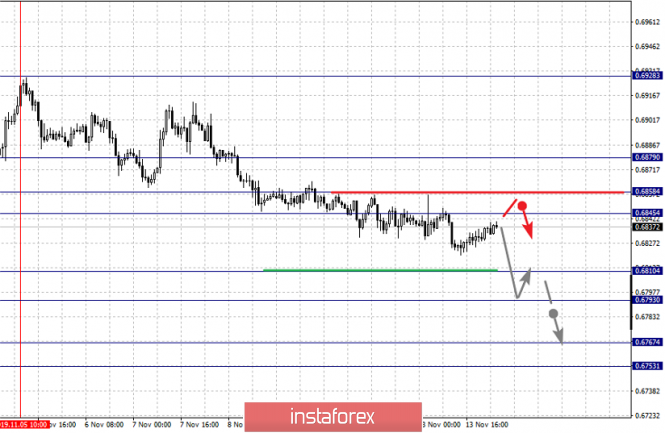

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6879, 0.6858, 0.6845, 0.6810, 0.6793, 0.6767, 0.6753 and 0.6722. Here, we are following the development of the downward cycle of November 5. Short-term downward movement is expected in the range of 0.6810 - 0.6793. The breakdown of the latter value should be accompanied by a pronounced downward movement to the level of 0.6767. Price consolidation is in the range of 0.6767 - 0.6753. For the potential value for the bottom, we consider the level of 0.6722, upon reaching this value, we expect a rollback to the top.

Short-term upward movement is possibly in the range of 0.6845 - 0.6858. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6879. This level is a key support for the downward structure of November 5.

The main trend is the downward structure of November 5.

Trading recommendations:

Buy: 0.6845 Take profit: 0.6856

Buy: 0.6859 Take profit: 0.6877

Sell : 0.6808 Take profit : 0.6793

Sell: 0.6790 Take profit: 0.6768

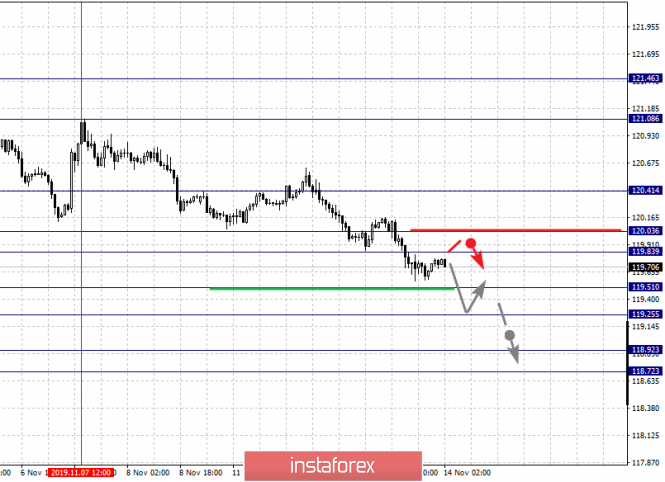

For the euro / yen pair, the key levels on the H1 scale are: 120.41, 120.03, 119.83, 119.51, 119.25, 118.92 and 118.72. Here, the subsequent targets for the downward movement is determined from the local structure on November 7. Short-term downward movement is expected in the range of 119.51 - 119.25. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the potential target is 118.72, and upon reaching this level, we expect a consolidated movement in the range of 118.92 - 118.72.

Short-term upward movement is expected in the range of 119.83 - 120.03. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 120.41. This level is a key support for the downward trend.

The main trend is the local structure for the bottom of November 7.

Trading recommendations:

Buy: 119.83 Take profit: 120.01

Buy: 120.06 Take profit: 120.40

Sell: 119.50 Take profit: 119.27

Sell: 119.24 Take profit: 118.92

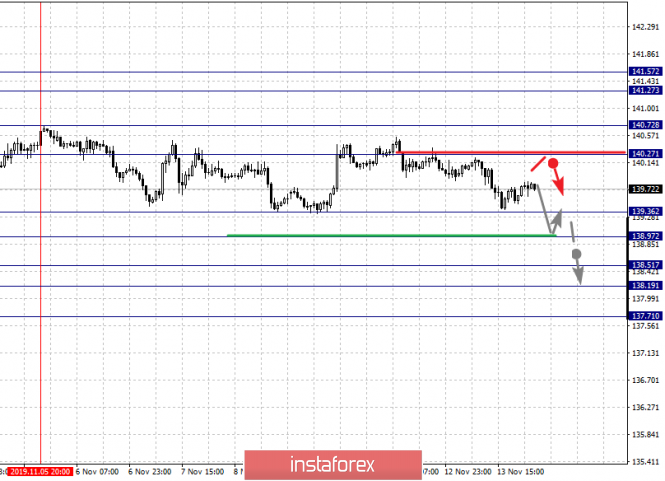

For the pound / yen pair, the key levels on the H1 scale are :141.57, 141.27, 140.72, 140.27, 139.36, 138.97, 138.51, 138.19 and 137.71. Here, we consider the descending of November 5 as the main structure. Short-term downward movement is expected in the range 139.36 - 138.97. The breakdown of the last value will lead to a pronounced movement to the level of 138.51. Price consolidation is in the range of 138.51 - 138.19. For the potential value for the bottom, we consider the level of 137.71. Upon reaching which, we expect a pullback in the correction.

Short-term upward movement is possibly in the range of 140.27 - 140.72. The level of 140.72 is a key support for the initial conditions of November 5. Its passage at a price will lead to the development of the upward structure of November 11. Here, the first potential target is 141.27. Price consolidation is in the range of 141.27 - 141.57.

The main trend is the downward structure of November 5.

Trading recommendations:

Buy: 140.72 Take profit: 141.27

Buy: 140.27 Take profit: 140.70

Sell: 139.36 Take profit: 138.98

Sell: 138.95 Take profit: 138.51

The material has been provided by InstaForex Company - www.instaforex.com