Forecast for November 13:

Analytical review of currency pairs on the scale of H1:

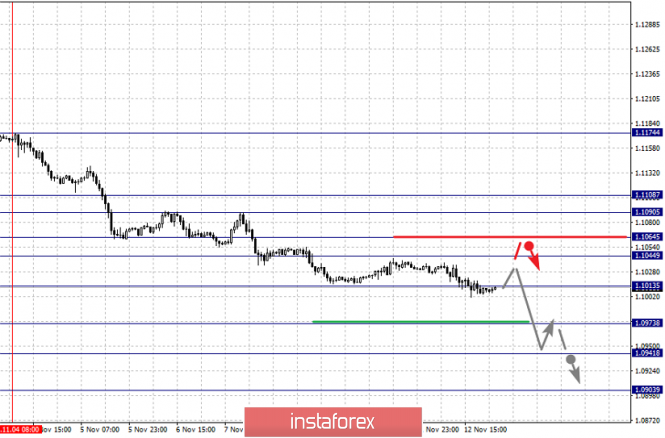

For the euro / dollar pair, the key levels on the H1 scale are: 1.1108, 1.1090, 1.1064, 1.1044, 1.1013, 1.0973 and 1.0941. Here, we are following the development of the downward cycle of November 4. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.1013. In this case, the target is 1.0973. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.0941. Upon reaching this value, we expect a rollback to the correction.

Short-term upward movement is expected in the range 1.1044 - 1.1064. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1090. The range 1.1090 - 1.1108 is a key support for the downward structure, before it, we expect the initial conditions for the upward cycle to be formed.

The main trend is the downward structure of November 4.

Trading recommendations:

Buy: 1.1045 Take profit: 1.1062

Buy: 1.1065 Take profit: 1.1090

Sell: 1.1012 Take profit: 1.0975

Sell: 1.0971 Take profit: 1.0941

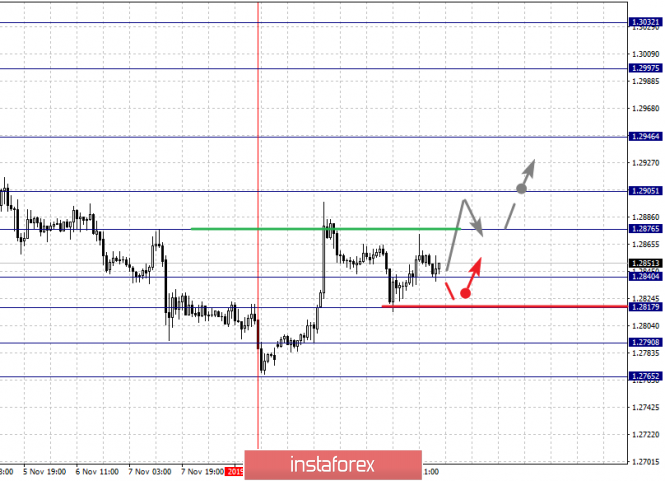

For the pound / dollar pair, the key levels on the H1 scale are: 1.3032, 1.2997, 1.2946, 1.2905, 1.2876, 1.2840, 1.2817, 1.2790 and 1.2765. Here, the price forms the expressed initial conditions for the top of November 8. Short-term upward movement is expected in the range 1.2876 - 1.2905. The breakdown of the latter value will lead to movement to the level of 1.2946. Price consolidation is near this level. The breakdown of the level of 1.2946 should be accompanied by a pronounced upward movement. Here, the target is 1.2997. We consider the level 1.3032 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom.

A short-term downward movement is possibly in the range of 1.2840 - 1.2817. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2790. This level is a key support for the top, its passage at the price will lead to the formation of a local descending structure. Here, the first goal is 1.2765.

The main trend is building potential for the top of November 8.

Trading recommendations:

Buy: 1.2876 Take profit: 1.2905

Buy: 1.2907 Take profit: 1.2944

Sell: 1.2840 Take profit: 1.2818

Sell: 1.2815 Take profit: 1.2792

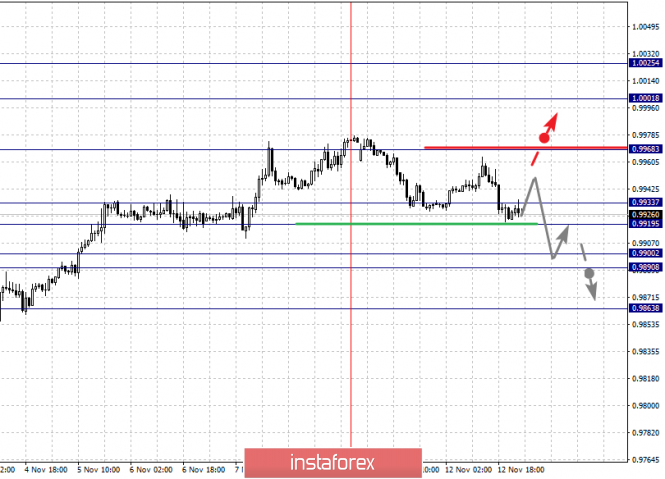

For the dollar / franc pair, the key levels on the H1 scale are: 1.0025, 1.0001, 0.9968, 0.9933, 0.9919, 0.9900, 0.9890 and 0.9865. Here, we are following the medium-term upward structure from November 1. At the moment, the price is in correction and forms the potential for the bottom from November 8. The continuation of the movement to the top is expected after the breakdown of the level of 0.9968. In this case, the target is 1.0001. Price consolidation is near this level. We consider the level 1.0025 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9933 - 0.9919. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9900. The range of 0.9900 - 0.9890 is the key support. Its price passage will allow you to expect movement to a potential target - 0.9863.

The main trend is the medium-term upward structure from November 1, the correction stage

Trading recommendations:

Buy : 0.9970 Take profit: 1.0000

Buy : 1.0002 Take profit: 1.0025

Sell: 0.9917 Take profit: 0.9900

Sell: 0.9890 Take profit: 0.9865

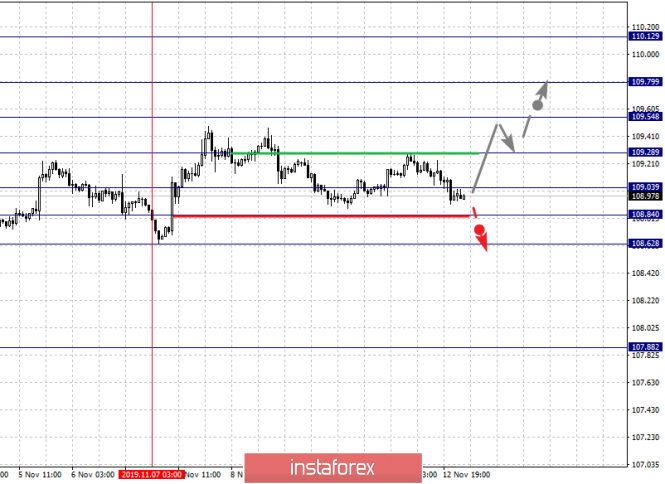

For the dollar / yen pair, the key levels on the scale are : 110.12, 109.79, 109.54, 109.28, 109.03, 108.84 and 108.62. Here, the price is in the correction zone from the local ascending structure on November 7. The continuation of the movement to the top is expected after the breakdown of the level of 109.28. Here, the first goal is 109.54. The breakdown of which, in turn, will allow you to count on moving to 109.79. Price consolidation is near this level. For the potential value for the top, we consider the level of 110.12.

Consolidated movement is expected in the range of 109.03 - 108.84. The breakdown of the last value will lead to the cancellation of the local ascending structure from November 7. Here, the first goal is 108.62.

The main trend: the upward cycle of November 1, the local structure of November 7.

Trading recommendations:

Buy: 109.28 Take profit: 109.52

Buy : 109.55 Take profit: 109.77

Sell: Take profit:

Sell: 108.82 Take profit: 108.62

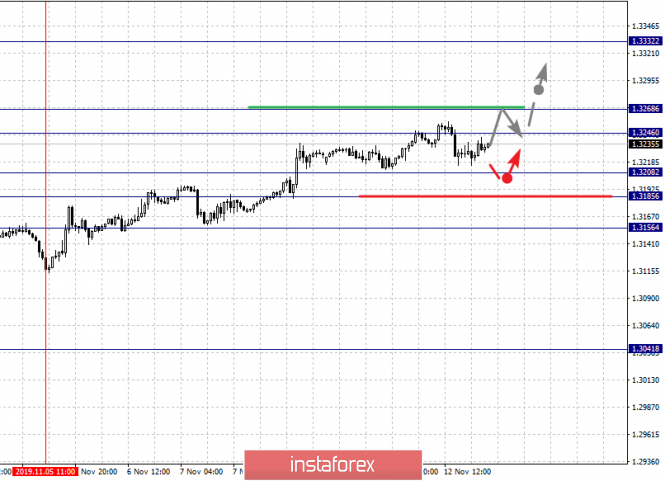

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3332, 1.3268, 1.3246, 1.3208, 1.3185 and 1.3156. Here, we are following the medium-term upward structure from October 29, as well as the local structure for the top from November 5. Short-term movement to the top is expected in the range of 1.3246 - 1.3268. The breakdown of the last value will lead to a pronounced movement. Here, the potential target is 1.3332, when this level is reached, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.3208 - 1.3185. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3156. This level is a key support for the upward structure.

The main trend is the medium-term initial conditions for the upward movement of November 29.

Trading recommendations:

Buy: 1.3246 Take profit: 1.3266

Buy : 1.3270 Take profit: 1.3332

Sell: 1.3208 Take profit: 1.3187

Sell: 1.3183 Take profit: 1.3156

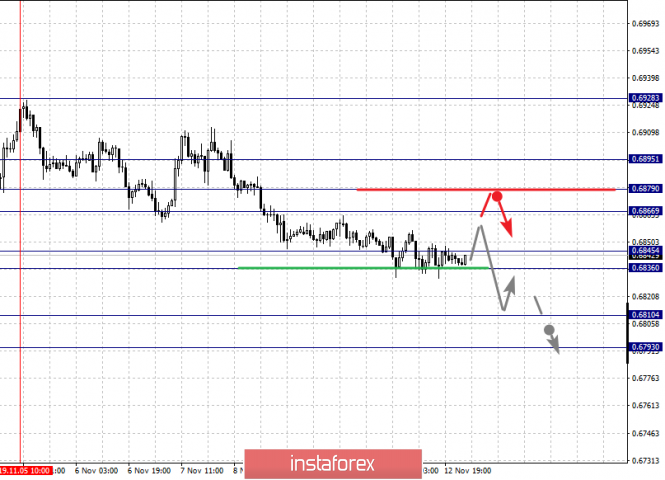

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6895, 0.6879, 0.6866, 0.6845, 0.6836, 0.6810 and 0.6793. Here, we are following the development of the downward cycle of November 5. The continuation of the movement to the bottom is expected after the price passes the noise range 0.6854 - 0.6836. In this case, the target is 0.6810. For the potential value for the bottom, we consider the level of 0.6793, upon reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is possibly in the range of 0.6866 - 0.6879. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6895. This level is a key support for the downward structure from November 5.

The main trend is the downward structure of November 5.

Trading recommendations:

Buy: 0.6866 Take profit: 0.6877

Buy: 0.6880 Take profit: 0.6895

Sell : 0.6836 Take profit : 0.6812

Sell: 0.6808 Take profit: 0.6793

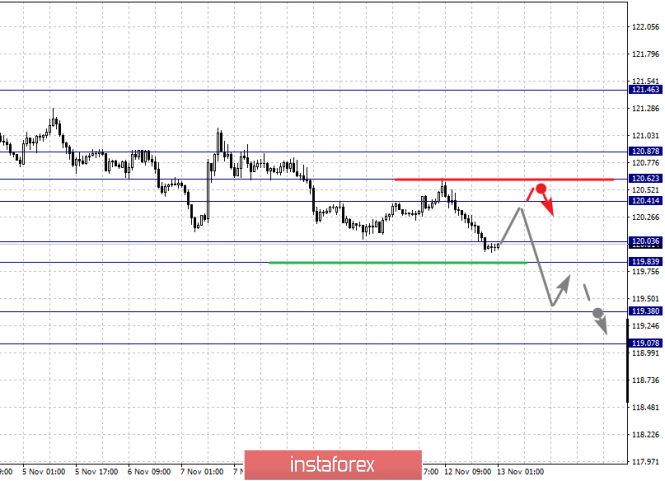

For the euro / yen pair, the key levels on the H1 scale are: 120.87, 120.62, 120.41, 120.03, 119.83, 119.38 and 119.07. Here, we are following the development of the downward cycle of October 30. Short-term downward movement is expected in the range of 120.03 - 119.83. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 119.38. For the potential value for the bottom, we consider the level of 119.07. Upon reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is expected in the range of 120.41 - 120.62. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 120.87. This level is a key support for the downward trend.

The main trend is the downward cycle of October 30.

Trading recommendations:

Buy: 120.41 Take profit: 120.62

Buy: 120.64 Take profit: 120.87

Sell: 120.03 Take profit: 119.85

Sell: 119.80 Take profit: 119.38

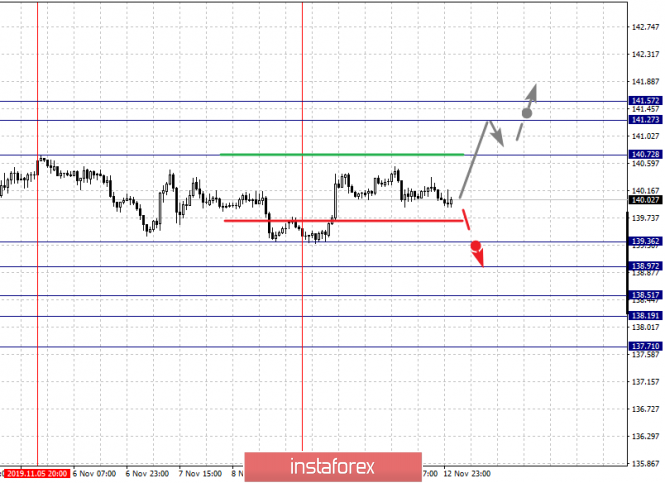

For the pound / yen pair, the key levels on the H1 scale are : 141.57, 141.27, 140.72, 139.36, 138.97, 138.51, 138.19 and 137.71. Here, as the main structure, we consider the downward trend of November 5, and the price has also formed the potential for the top of November 11. The level of 140.72 is the key support for the initial conditions of November 5. Its passage at the price will lead to the development of the ascending structure of November 11. Here, the first potential target is 141.27. Price consolidation is in the range of 141.27 - 141.57. Short-term downward movement is expected in the range 139.36 - 138.97.

The breakdown of the last value will lead to a pronounced movement to the level of 138.51. Price consolidation is in the range of 138.51 - 138.19. For the potential value for the bottom, we consider the level of 137.71. Upon reaching which, we expect a pullback in the correction.

The main trend is the descending structure of November 5, the potential for the top of November 11.

Trading recommendations:

Buy: 140.72 Take profit: 141.27

Buy: Take profit:

Sell: 139.36 Take profit: 138.98

Sell: 138.95 Take profit: 138.51

The material has been provided by InstaForex Company - www.instaforex.com