4-hour timeframe

Amplitude of the last 5 days (high-low): 51p - 76p - 28p - 56p - 38p.

Average volatility over the past 5 days: 50p (average).

The last trading day of the current week was all in the same downward movement that was observed all week. We have repeatedly said that the bears do not particularly and currently need macroeconomic statistics, loud statements by Mario Draghi or Jerome Powell. The euro, like many other currencies, again fell against the greenback just because the US economy is much stronger and does not experience such firm pressure due to a slowdown in the global economy. That is, very roughly, the US economy is slowing more slowly than, for example, the European one. Now, if you look at the picture from the side of traders and investors, questions arise: in which economy is it better to invest? What currency is more appropriate to buy if it is a matter of making a profit on the basis of exchange rate differences? What currency should be purchased in order to invest in an economy that is showing a slower pace of slowdown? The answer is obvious: US dollar. After all, the movements of a currency pair do not depend only on currency traders. The demand for currency is also formed at the expense of large players who buy or sell currency for major international transactions, for the purchase of government securities of a country, form government reserves using currencies that are most stable. All this again leads to an increase in the US currency. That is why Friday, during which one single macroeconomic report was published - the consumer confidence index from the University of Michigan - ended in favor of the dollar. And if we take into account purely technical factors ... the attempt to overcome the level of 1.1175 failed twice, the bulls showed their weakness, the pair turned down and is ready to form a new downward trend. It turns out that, in principle, all factors now speak in favor of the US currency.

One of the most significant factors determining the demand for a particular currency is the policy of the central bank. In the case of the EUR/USD pair - the policy of the ECB and the Fed. We have already written several times that even despite three successive cuts in the key rate of the Federal Reserve, the balance of power between the monetary policies of the European Union and the United States has not changed much. America still has a much higher refinancing rate, which not only speaks of the strength of the US economy at this time, but also of much greater opportunities for maneuverability in the future of the Fed. This factor alone is enough to consider buying the dollar in the medium term. In addition, the rhetoric of the central banks, their attitude, forecasts of the main economic indicators are of no small importance. Here we state a confident draw. If you look at the speeches of the heads of central banks in recent years, then all of their points are reduced to the same thing:

- threat of protectionism policy

- high risks of global economic slowdown

- trade wars hinder economic growth

This is regularly mentioned by Mario Draghi, Mark Carney and even Jerome Powell. Thus, these factors affect the economies of all developed countries, but judging by macroeconomic statistics, the European Union, which also has an unresolved Brexit, suffers the most with the UK.

Thus, we stick with our opinion: in order for the euro to begin to grow in the long run, the US economy must begin to slow down faster, the Fed must lower its key rate to 0.0%. We intentionally do not say that the European economy should begin to accelerate, because there is practically no chance of it now. The EU has just resumed the quantitative stimulus program, it will provide results, but not as fast as we would like, and at best, it will be the results from the category "We stopped the slowdown in economic growth". That is, about any acceleration and acceleration of the European economy is now not even a question. Therefore, the euro's "hope" is for the United States and Donald Trump, whose trade wars could hypothetically have a greater negative impact on the US economy.

From a technical point of view, a new downward trend continues to be formed, therefore, it is recommended to remain bearish. Ichimoku indicator and the Bollinger Bands confidently signal a downward trend. Volatility is now not too high, no more than 50 points per day, but it is this kind of weak systematic decrease that is most dangerous for the euro, as it can last a very long time.

Trading recommendations:

EUR/USD continues to move down. Thus, it is now recommended to sell the currency pair with targets at 1.0997 and 1.0970. Turning the MACD indicator up may indicate another round of correction, but a strong correction is still not expected. It is recommended to return to purchases of the euro currency no earlier than when the bulls break the critical Kijun-sen line, which is not expected in the near future.

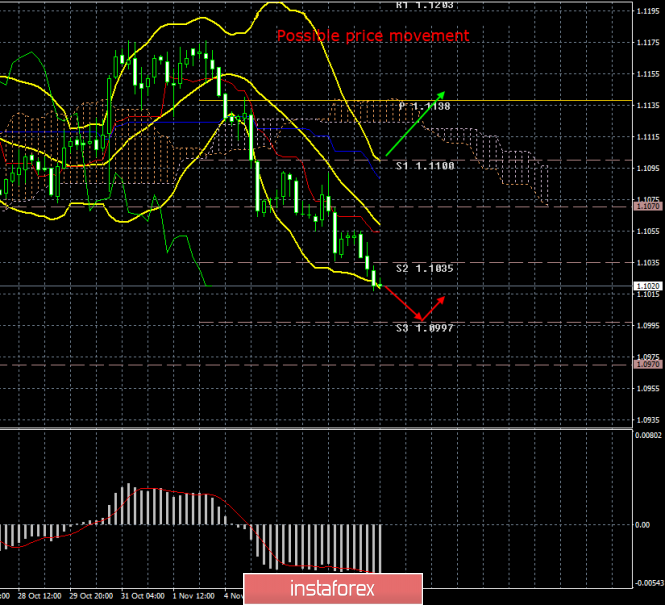

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com