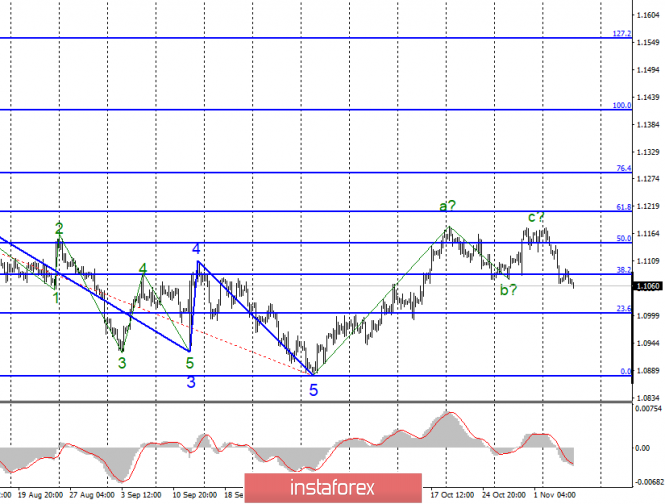

EUR / USD

November 6 ended for the pair EUR / USD with a decrease of another 10 basis points. Thus, the alleged first wave of the new downward trend continues its construction and has already gone beyond the minimum of the expected wave b, which indirectly indicates the willingness of the markets to further reduce quotes. If the current wave marking is correct, then the decline will continue at least to the area of the 9th figure.

Fundamental component:

On Wednesday, the news background for the euro-dollar instrument was extremely weak. For the whole day, markets could pay attention only to far from the most important reports from the eurozone, such as business activity in the service sector. In Italy, France, Germany and Spain, business activity in this area increased compared to the previous month. This is good news for the euro and for the EU economy as a whole. However, the European currency was still not in demand on November 6, so the effect of positive news from the EU turned out to be zero. Today, the situation for the instrument will be even less interesting, since nothing but industrial production in the EU is contained in the news calendar today. Even if the production report is better than the expectations of the market (that is, the reduction will be less than 2.9% y / y),

Purchase goals:

1.1208 - 61.8% Fibonacci

1.1286 - 76.4% Fibonacci

Sales goals:

1.0879 - 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend correction section. Since the attempt to break through the minimum of wave b turned out to be successful, I now recommend paying attention to the sale of the instrument with goals under the 10 figure. The instrument probably moved on to building a bearish trend section.

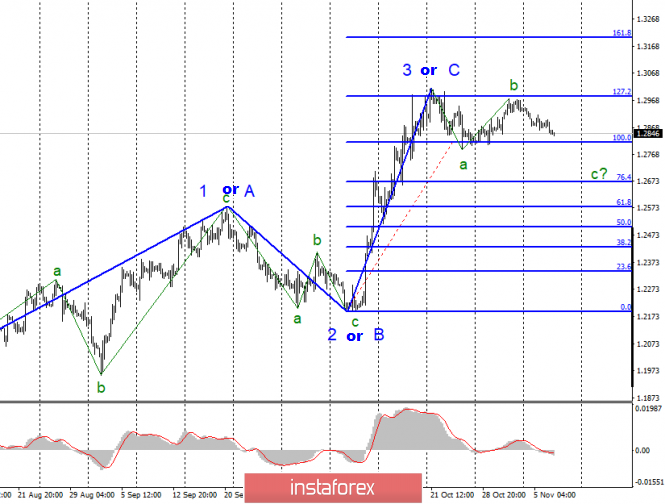

GBP / USD

On November 6, the GBP / USD pair lost about 30 basis points, which is fully consistent with the current wave marking, which suggests a further decrease in the instrument within the framework of the expected wave c. If this is true, then the minimum targets of this wave are located around 28th figure. A possible continuation of the increase in the pound-dollar pair will depend on the news background, which is currently absent. In any case, to determine the desire of the markets to buy the pound again, I recommend waiting for a successful attempt to break through the 127.2% Fibonacci level.

Fundamental component:

Yesterday, In the UK, no economic reports came out. From the Parliament, for obvious reasons, no messages were received either. Boris Johnson and Jeremy Corbyn "exchanged pleasantries" in the framework of the election campaign, which do not give traders any special food for thought. The only more or less significant news was the statement by an unknown British official that the country would not ask for an extension of the transition period that would begin after the Brexit agreement began to operate. However, we already heard something like this from Boris Johnson, when he stated that he would not ask the EU to postpone Brexit. Today, markets will follow the results of the meeting of the British Central Bank. However, no changes to monetary policy will be made this time. That is, the probability that the Bank of England will leave everything as is, 100%. In light of this information, more attention will be paid to the speech of the Chairman of the Bank, Mark Carney. The key question, of course, is when the Central Bank plans to lower or raise the key rate. However, the answer to this question is obvious, and, most likely, Carney will voice it: until the situation with Brexit is clarified, the Central Bank will not make any changes.

Sales goals:

1.2191 - 0.0% Fibonacci

Purchase goals:

1.2986 - 127.2% Fibonacci

1.3202 - 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of the alleged wave 3 or C and become the basis for new purchases of the instrument. Now, I recommend looking in the direction of sales after a successful attempt to break through the level of 1.2812 (100.0% Fibonacci).

The material has been provided by InstaForex Company - www.instaforex.com