The loonie is very confident on the eve of the October meeting of the Bank of Canada. As a result of tomorrow's meeting between members of the Canadian regulator, the USD/CAD pair can either break through the support level of 1.3000 or return to the first resistance level of 1.3200 (the middle line of Bollinger Bands, which coincides with the lower boundary of the Kumo cloud on the daily chart). Judging by the dynamics of key macroeconomic indicators, there are all the prerequisites for the loonie to continue to strengthen towards the greenback, especially if the Fed will disappoint dollar bulls with a softer position tomorrow.

According to the general opinion of the market, the Canadian central bank will leave all the parameters of monetary policy unchanged tomorrow. Unlike the US regulator, whose members (most likely) will again lower their interest rates by 25 basis points - the third time this year. Such a correlation plays in favor of the loonie, however, both the Fed's rate cut and the Bank of Canada's wait-and-see attitude are already included in current prices. Further dynamics of the USD/CAD pair will depend on the further steps of these regulators.

As I mentioned above, Bank of Canada officials have every reason to maintain a wait-and-see attitude. In particular, the latest inflation data turned out to be quite good, although in some parameters the indicators went below forecast levels. The consumer price index increased by 1.9% in September (on an annualized basis): the indicator also showed a similar result in August. The core index, excluding gas prices, grew by 2.4% - at this level it comes out for the third straight month. Considering the structure of the general indicator, we can conclude that oil became the "anchor" of inflation growth - the price of gasoline fell by ten percent YOY, against the background of continued weak demand for "black gold". It also summed up the index of tuition fees - it fell by 3.6% due to the introduction of a special program at the level of Ontario, due to which the cost of education in this province decreased.

For other parameters, inflation indicators showed a positive trend. For example, for the seventh consecutive month, the index of purchases of cars is growing - in September it increased by 3.4% in annual terms. Food prices climbed (by 3.7% (year on year), for housing, transportation costs also grew. The index of cost of mortgage loans in September also increased significantly - by 7.5%.

According to some experts, the September inflation rate in Canada (+1.9%) is moderate. On the one hand, this is indeed so - many analysts on the eve of the release predicted stronger numbers. But on the other hand, it is worth recalling that the Bank of Canada itself expected a more modest dynamics of inflation growth - by 1.6%. Therefore, in this case, the published figures should be viewed through the prism of the prospects for monetary policy of the central bank.

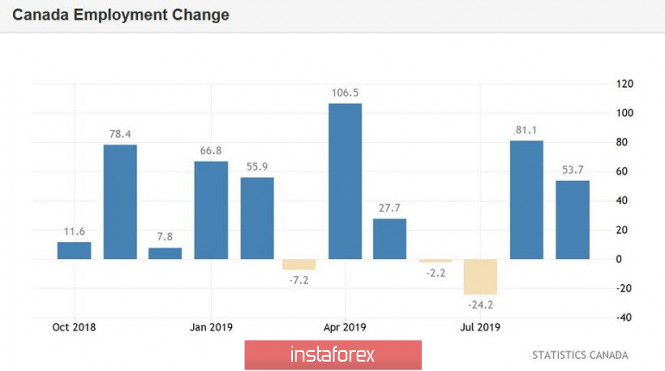

As for the remaining key macro indicators, the situation here is controversial. In particular, the dynamics of GDP growth disappointed, but the latest data on the Canadian labor market were surprisingly strong. Contrary to neutral forecasts, the unemployment rate fell to 5.5%, and the number of employees grew by five times (!) Exceeded the forecast values, reaching 53 thousand instead of the forecasted 11 thousand. It should be noted here that this increase was mainly due to the growth in the number of full-time employees (+70 thousand), while part-time employment decreased by 16 thousand. This is a positive signal, including for inflation indicators, since regular positions require a higher level of salaries and a level of social protection. Wage growth rates accelerated to 4.3% from the previous value of 3.8%, signaling a strengthening of the wage scale.

But the data on Canadian GDP growth, which were published in early October, made USD/CAD traders nervous. The indicator came out in the red zone, not justifying the forecasts of most analysts: on a monthly basis, the indicator was at zero level (with a weak forecast of growth to 0.1%), while in annual terms it dropped to 1.3% (with the forecast growth up to 1.4%).

Thus, in my opinion, the members of the Canadian regulator have every reason to maintain a wait-and-see attitude tomorrow, especially considering the results of the last round of US-Chinese negotiations. The updated economic forecast for 2020 is likely to reflect the negative effects of the global trade conflict, and the accompanying statement will focus on global prospects and trade uncertainty. But in general, the Bank of Canada is unlikely to deviate from the position announced in September. This fact may support the Canadian currency in tandem with the US dollar. But short positions should be opened for the pair only after the announcement of the results of the October meeting of the Fed: if they are not in favor of the greenback, the downward impulse of USD/CAD may increase. But otherwise, the pair will correct at least to around 1.3200.

The material has been provided by InstaForex Company - www.instaforex.com