On Tuesday, the published economic statistics in the US collapsed the local stock market, significantly brought the probability of not only continuing to reduce interest rates by the Federal Reserve, but also the possibility of a large-scale easing of monetary policy

Also, yesterday, nothing foreshadowed the negative development of events on trading floors in the USA and a sharp weakening of the US dollar. First, the published values of the index of business activity in the manufacturing sector (PMI) pleased the market participants, adding up to 51.1 points from 50.3 points, while it was expected to increase to 51.0 points. Moreover, trading in the US stock market began on a positive note. Major stock indexes also opened with gaps. Yields on US Treasury bonds went up too, and the US dollar received some support. However, as it turned out - the main news, and with it the negative ones, was yet to come.

Later at 3 p.m. London time, the industrial activity indicator for the USA (PMI) for September was released, together with an index from the American Institute for Supply Management (ISM). Unfortunately, it just showed a negative trend. According to the data presented, the index fell sharply to 47.8 points from 49.1 points, while it was expected to increase to 50.4 points. The decline of the indicator below the key level of 50 points indicates a decrease in economic growth.

Against the background of these values, the situation in the markets has changed dramatically. The stock market in the United States went down, as the Treasury yields did. Meanwhile, protective assets — gold and safe haven currencies — began to be in demand. The dollar, in turn, came under pressure in the wake of a sharp increase in expectations of another cut in interest rates by the US Federal Reserve.

In our opinion, our forecast that the American economy will have a high probability of failure in the recession pit will most likely come true by the end of this year. The slowdown in economic growth will have to force the Federal Reserve to not only lower rates by 0.25% once again, limiting itself to supporting local financial markets only by repurchase transactions, but also to begin larger-scale incentives for the market dubbed QE4 following the September performance by J. Powell.

Today and Friday, updated data on employment in the States will be presented. Today, these are values from ADP, and on Friday, from the Ministry of Labor. We assume that if they turn out to be worse, especially the expectations for Friday's values, this will be an incentive for the continuation of a limited decline in the US stock market, growth in demand for defensive assets and a weakening dollar. In our opinion, their negativity will only increase pressure on the Fed, which will have to take urgent measures to correct the situation in the economy. Therefore, this could be a prologue to new measures to ease monetary policy and stimulate the economy. By the way, all these difficulties occur against the background of the impeachment procedure of President D. Trump, initiated by the "democrats" in the United States, which can only aggravate the chaos in world markets.

Forecast of the day:

EUR/USD is trading below 1.0940 on a wave of negative news for the dollar. We believe that if the employment data from ADP turns out to be weaker than the forecast, this will lead to the continuation of a local price increase to 1.1000, but for this to happen, it is necessary to first overcome the level of 1.0940. At the same time, if the statistics are positive, we should expect the pair to turn down and decrease to 1.0880.

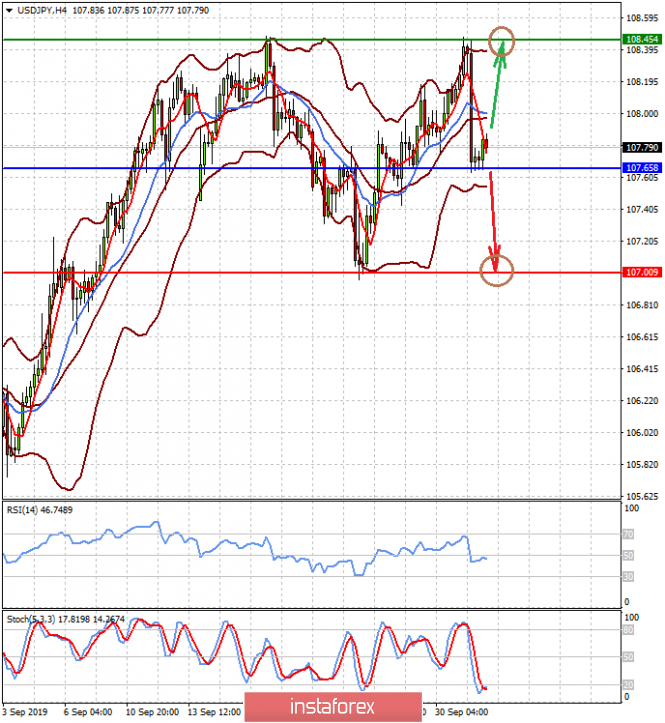

USD/JPY is trading above 107.65. We believe that the pair will also move based on US statistics. Negative values from ADP can also lead to a breakthrough of the level of 107.65 and a decline in the price to 107.00. Positive values, on the contrary, will lead to a local increase to 108.45.