The euro-dollar pair is trading without much enthusiasm at the beginning of the new trading week: the price fluctuated in a 20-pound range during the Asian session on Monday. Nevertheless, a fairly strong volatility is expected for the pair in the coming days. And if Nonfarm was the number one event last week, then there are much more informational reasons this week. That is why market participants are in no hurry with trading decisions - the fundamental picture may significantly change very soon, both for the dollar and the euro. Although the main "tests" have to go through the US currency.

At the forefront of events is trade negotiations between the United States and China. Perhaps this is the main event of October for the financial world, because markets hope to resolve the protracted conflict amid a slowdown in the global economy. Until recently (literally until last Friday), all the prerequisites for concluding a historic deal were - in late August, Donald Trump showed a "goodwill gesture" by delaying the introduction of additional tariffs on the import of Chinese goods until December 15 (instead of September 1), stating that Beijing has "serious intentions" that could lead to a deal. China, in turn, increased the volume of purchases of American agricultural products. Such mutual steps were conducive to constructive negotiations, so traders quite reasonably hoped for an end to the trade war.

But judging by recent events, this optimism was premature. In anticipation of key negotiations (to be held on October 10-12), the Chinese made a rather sharp maneuver, stating that the agenda of the meeting would be substantially changed. The market reacted minimally to this information, as it is unofficial in nature. The fact that China will narrow the agenda of trade negotiations, the news agency Bloomberg reported, citing its own sources. That is, on the one hand, these are just rumors, but on the other hand, there is definitely a certain logic in such behavior. Trump is still at the center of an ongoing political scandal. House committees continue to investigate impeachment by interviewing witnesses and examining relevant documents. According to many analysts, congressmen eventually still charged the US president with abuse of power by transferring an indictment to the Senate. Although the Upper House of Congress is controlled by Republicans, Trump's fate will depend on the gravity and soundness of the allegations.

In any case, the position of the US leader is now weakened, and, apparently, the Chinese decided to take advantage of the situation by excluding one of the main requirements of the White House from the agenda of the negotiations. During the next round of trade negotiations, they will not even discuss issues of reforming industrial policies and industrial subsidies. Earlier, Washington insisted on carrying out these reforms: even in the event of a deal, the United States wanted to retain the right to introduce new trade restrictions if China prolonged them.

But now Beijing is well aware that Trump needs a victory (at least of a nominal nature) in the trade war, and therefore has tightened his position in trade negotiations. Given the political situation of Trump, it is very interesting how he will react to such a Chinese maneuver. If the negotiations fail, anti-risk sentiment will increase substantially, and the dollar may be under strong pressure. Indeed, in this case, the Federal Reserve can continue to soften monetary policy, especially against the background of a weakening labor market and lower inflation rates.

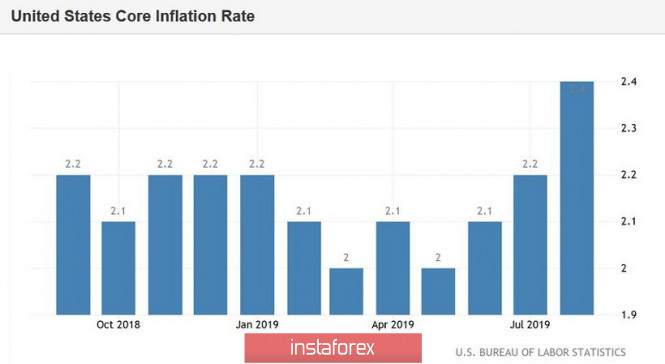

By the way, US inflation this week will also be in the spotlight for EUR/USD traders. The consumer price index for September will be published on Thursday, October 10. According to preliminary forecasts, in general, inflation will remain at the August level - overall inflation should slightly increase (in annual terms) - to 1.8%, and on a monthly basis remain at the same level (0.1%). Core inflation should completely repeat the trajectory of the month before last: 0.3% m/m, 2.4% y/y. For dollar bulls, it is important that these indicators come out at least at the forecast level: if the release is in the red zone, the greenback will again be under pressure, especially amid conflicting data on the labor market.

It is also worth noting that Fed Chairman Jerome Powell will speak three times this week, and on Wednesday the minutes of the September meeting of the Federal Reserve will be published. Let me remind you that members of the regulator did not demonstrate a monolithic position regarding the September rate cut and, in general, regarding the future prospects of monetary policy. The minutes of this meeting will help to understand what moods dominate in the Fed camp - "dovish" or "hawkish". And although many members of the Federal Reserve have already expressed their positions after this meeting, unexpected language may have an impact on the dollar. In turn, Jerome Powell, who will be speaking at various events for three days (at the premiere of the Marriner Eccles movie, at the Denver business forum and at the Fed hearings) can provide more relevant information on monetary policy prospects.

As for the European currency, it's just the report of the last meeting of the ECB. True, this report is published 4 weeks after the meeting itself, so the relevance of this document is dubious: after September 12, many (most) officials of the European Central Bank have already commented on the current situation.

Thus, this week the focus of the traders of the EUR/USD pair will be China, which decided to change the role of "slave" to the role of "leader". The results of the trade talks may overshadow all other fundamental factors, although the release of data on the growth of US inflation and the rhetoric of the head chief should also not be discounted. In general, the second week of October may be decisive for the US currency, especially if the upcoming US-Chinese talks will repeat the fate of the previous ones.

The material has been provided by InstaForex Company - www.instaforex.com