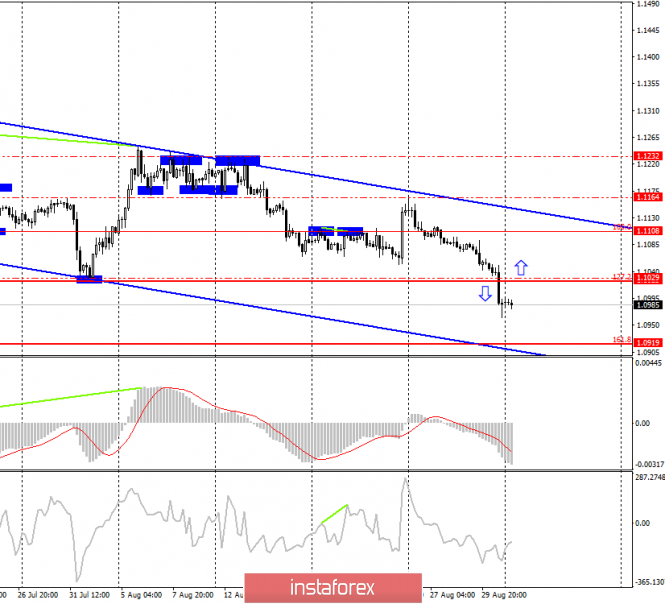

EUR / USD - 4H.

The EUR / USD pair on the 4-hour chart continues the fall process, in the direction of the correction level of 161.8% - 1.0919. A signal for a new fall of the euro-dollar pair was received on Friday, August 30, by closing quotes below the Fibo level of 127.2% - 1.1024. This signal is already in operation. An equidistant channel unambiguously indicates which direction the current trend has. From the latest news, I note the speech of Christine Lagarde, the future chairman of the ECB, who will succeed Mario Draghi at the end of October 2019. Ms. Lagarde noted that the European Central Bank should be ready for action against the backdrop of a difficult economic situation. Also, according to Ms. Lagarde, "the ECB has the opportunity to cut rates, even if it negatively affects financial stability and the banking sector."

What to expect from a currency pair on Monday?

On September 2, I expect a further decline in the euro-dollar pair in the direction of the level of 1.0919, since I do not see any obstacles and barriers to the implementation of this scenario. Typically, traders take profits at the end of the week or month. This did not happen on Friday. Accordingly, traders are ready to maintain sales. Accordingly, today I look forward to continued decline. The information background is also unlikely to be on the side of the euro, as business activity in Germany and the European Union is likely to remain at low levels, indicating a decline in industry. Below the level of 1.1024, I only consider sales. One can think about the growth of the European currency after the pair consolidates above the Fibo level of 127.2%. Upcoming divergence is not observed today in any indicator.

The Fibo grid was built at the extremes of May 23, 2019 and June 25, 2019.

Forecast on EUR / USD and recommendations to traders:

I recommend selling the pair with the target of 1.0919, as the pair completed consolidation under the correction level of 127.2%. Stop Loss - Over 1.1029.

You can buy a pair after closing above the level of 1.1029 with the target of 1.1108. In this case, the pair will still remain inside the downward trend.

GBP / USD - 4H.

So far, the correction equidistant channel indicates the preservation of the rising mood for the pair GBP / USD. Quotations rebound from the bottom line of this channel allows traders to expect some growth in the direction of the level of 1.2308 (peak of August 27). At the same time, the upper line of the trend equidistant channel, which continues to support the long-term downward trend, may become an insurmountable obstacle to this level. Based on this, I believe that the pair has a better chance of closing under the correction channel. In this case, the path to the levels of 1.2014 (low of August 12) and 1.1854 (Fibo level of 161.8%) will be open and accessible without barriers. Given the background and the events that will take place in the UK tomorrow, I believe that this scenario is highly likely. Today, traders can only pay attention to UK business activity in the industrial sector, which is likely to remain around 48.0. That is, it is unlikely to force traders to buy pound sterling. But tomorrow, British parliamentarians will leave the vacation, and war will begin in parliament. The war between Prime Minister Boris Johnson, who at the weekend had already announced that he would expel from the party all who would impede Brexit's "No Deal" and Brexit's opposing deputies on October 31. Accordingly, it is tomorrow that we will learn how the story will develop with the suspension of parliament by Boris Johnson. and war will begin in parliament. The war between Prime Minister Boris Johnson, who at the weekend had already announced that he would expel from the party all who would impede Brexit's "No Deal" and Brexit's opposing deputies on October 31. Accordingly, it is tomorrow that we will learn how the story will develop with the suspension of parliament by Boris Johnson. and war will begin in parliament. The war between Prime Minister Boris Johnson, who at the weekend had already announced that he would expel from the party all who would impede Brexit's "No Deal" and Brexit's opposing deputies on October 31. Accordingly, it is tomorrow that we will learn how the story will develop with the suspension of parliament by Boris Johnson.

What to expect from a currency pair on Monday?

The main obstacle for a new fall of the pound is now the bottom line of the correction channel. Accordingly, I look forward to overcoming this line, which will allow traders to expect the pair to fall in the direction of levels 1,2014 and 1,1854. I do not expect news today from the UK, but in America today is Labor Day - a national holiday. I do not expect the growth of the British currency, since there is practically no reason for this. Moreover, I think that on August 27 the trend segment ended when the pound grew. Now you just have to wait for confirmation of this assumption.

The Fibo grid was built at the extremes of January 3, 2019 and March 13, 2019.

GBP / USD Forecast and recommendations for traders:

I recommend buying the pair very carefully (or not buying at all) with the target of 1.2437, if closing is performed above the upper line of the trend channel (downward). Shopping near the top line inside the channel is dangerous.

I recommend selling a pair with targets 1.2014 and 1.1854 and with a Stop Loss level above 127.2% - 1.2180 if closing is performed under the lower line of the correction channel.

The material has been provided by InstaForex Company - www.instaforex.com