Once upon a time in the market they seriously believed that oil prices could change if the prince of Saudi Arabia sneezed. It seems that old times are returning. Despite the fact that the new Minister of Energy, Prince Abdulaziz bin Salman, claims that nothing will change in Riyadh's policy and the country will continue long-term cooperation with Russia and other producers, prices are rising at a dash. Brent quotes reached a 6-week peak simply because Saudi Arabia violated its principle of not appointing members of the Royal Family. The situation seems to be critical, and in anticipation of the important IPO Saudi Aramco, the Saudis need oil at a higher price than the current one.

In previous articles, we talked about how the fall of Brent stalled the economy of Saudi Arabia. To balance the budget, it needs a North Sea grade of $80 per barrel. Yes, the new Minister of Energy argues that there will be no fundamental changes in Riyadh's policy, but the very fact that the Saudis keep their desire to stabilize the market pushes futures quotes higher. Rumors are actively circulating in the market that OPEC may prolong the Vienna agreement to reduce production by 1.2 million bpd for a longer period.

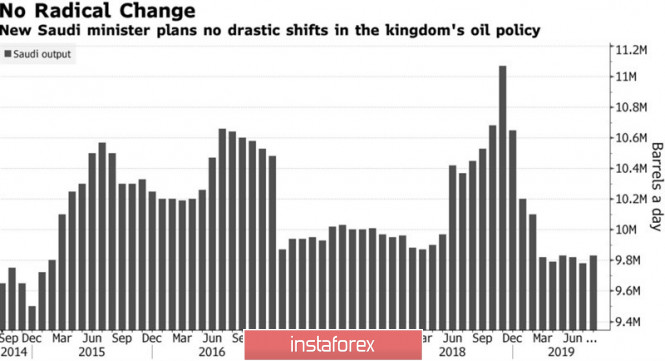

The dynamics of oil production by Saudi Arabia

In addition, Prince Abdulaziz bin Salman, in his first speech as Minister of Energy, dealt a blow to the main trump card of the Bears - Brent and WTI - global demand. In his opinion, the fall in prices is speculative. Investors fear a recession in the global economy, but in reality there will be no recession. The trade war between the US and China will soon end, and the black gold market will improve. It should be recognized that it was the factor of reduction in world demand that pulled down futures quotes, while the factor of growth in production in the US was offset by its reduction from OPEC and other producing countries. So, Citi claims that the loss of global demand since March 2018 amounted to 800 thousand bpd. The indicator will grow by 940 thousand bpd in 2019, and if trade frictions in Washington and Beijing keep going for another six months - by 600-700 thousand bpd. In such circumstances, it will be difficult for bulls on oil to push quotes higher.

However, if Prince Abdulaziz bin Salman is right, then the situation is fundamentally changing. Investors sincerely hope that opponents will take a step towards each other in October, and we can talk about a de-escalation of the conflict. Moreover, according to the US Treasury Secretary Steve Mnuchin, the Americans are ready for negotiations, and substantial progress is taking place in relations between the United States and China. Stock indices react to this news with growth, which indicates an increase in global risk appetite and favorably affects both grades of black gold.

Technically, as expected, a breakthrough of the upper limit of the consolidation range of $57.45-61.35 per barrel activated the Shark pattern and increased the risks of its target by 88.6%. In addition, Wolfe waves were formed on the Brent daily chart, so the growth of quotes can continue up to $68.2 and higher.

The material has been provided by InstaForex Company - www.instaforex.com