The single European currency unexpectedly received support from data on housing prices. S&P/CaseShiller forecasts did not materialize, and housing prices did not accelerate from 2.1% to 2.2%, but slowed to 2.0%. At the same time, the previous data was revised upwards, up to 2.2%. In other words, the scale of the slowdown in housing price growth has been quite substantial. This was the reason for the weakening of the dollar on all fronts.

Today, the dollar can get an opportunity for revenge, due to data on the real estate market. It is expected that 660 thousand new homes were sold in August. This is 25 thousand more than in the previous month. or 3.9% more. In addition, the previous time, sales collapsed as much as 12.8%. So against the background of the previous collapse, the projected growth looks very impressive. Do not forget that tomorrow the final data on the GDP of the United States for the second quarter are published, so that the market situation is becoming more and more uncertain. This means that investors will be more responsive to emerging statistics.

New Home Sales (USA):

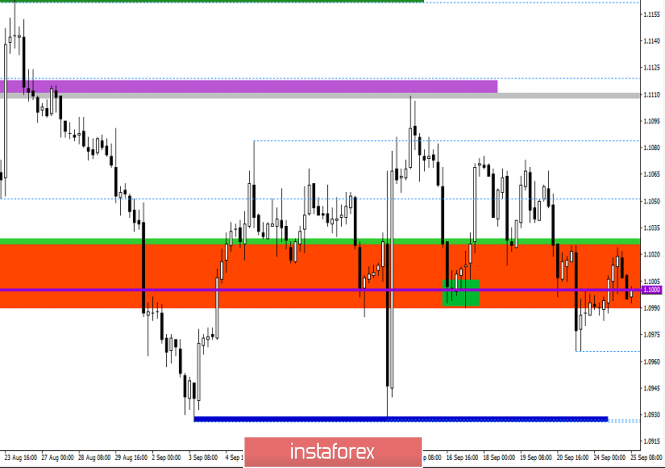

The EUR/USD pair in the pullback phase managed to rebound just above the psychological mark of 1.1000, where the recovery process started during the Pacific and Asian trading sessions, winning back a little more than 50% of the pullback. Considering what is happening in general terms, we see that relative to the corrective course, the recovery process is preserved, where the point of the main support is 1.0936, and the periodic support of the beginning of the week is 1.0966.

It is likely to assume that the quotation will again try to return to the area of the periodic support on Monday at 1.0966, where further actions will subsequently be considered.

Concretizing all of the above into trading signals:

• Long positions, if considered, in the event of price consolidation higher than 1.1025.

• We consider short positions as the main prospect, where an initial descent to the area of 1.0966/1.0980 is expected.

From the point of view of a comprehensive indicator analysis, we see that indicators in the short and medium term are prone to further decline. Hourly periods are neutral due to their versatile interest.