The single European currency, at least until the opening of the American session, continued to confidently lose its position. The reason for this was, in the form of data on producer prices, the growth rate of which slowed down from 0.7% to 0.2%. Well, since producer prices refuse to increase, then inflation does not have to accelerate. Thus, the European Central Bank clearly has enough reasons to find ways to mitigate monetary policy. Moreover, there is not a zero probability that this will happen in the next two months, that is, exactly before Christine Lagarde succession to the post of head of the European Central Bank. Mario Draghi can throw such a similar trick as his farewell chord.

However, lately, the single European currency has been so oversold that at least some reason for local correction was necessary, and this was the cause of the American statistics. On the one hand, the final data on the index of business activity in the manufacturing sector of Markit showed its decline, but not from 50.4 to 49.9, but to 50.3, which by the way, greatly casts doubt on all shouts about the impending recession. Therefore, grabbing onto this one didn't succeed. On the other hand, the ISM index of business activity in the manufacturing sector came to the rescue, showing a decrease from 51.2 to 49.1. There was no limit to the joy of market participants, and they enthusiastically staged a sale of portraits of the dead American presidents.

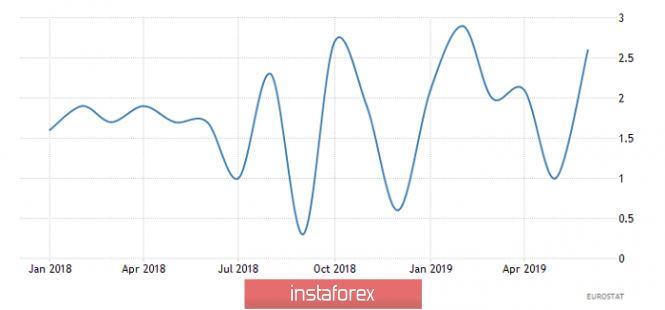

The dynamics of the index of business activity in the US manufacturing sector from Markit:

However, fundamentally, the situation on the market does not change. The European Central Bank is clearly looking for ways to ease monetary policy, and the Federal Reserve is in no hurry to make hasty decisions. So for now, everything contributes to the further strengthening of the dollar. Today, it is worth paying close attention to data on retail sales in Europe. The growth rate of which may slow down from 2.6% to 2.0%. Meanwhile, against the background of a slowdown in producer price growth, and steadily low inflation, a slowdown in retail sales clearly indicates a decrease in the profit of European companies, which means that the attractiveness of the single European currency will continue to decline.

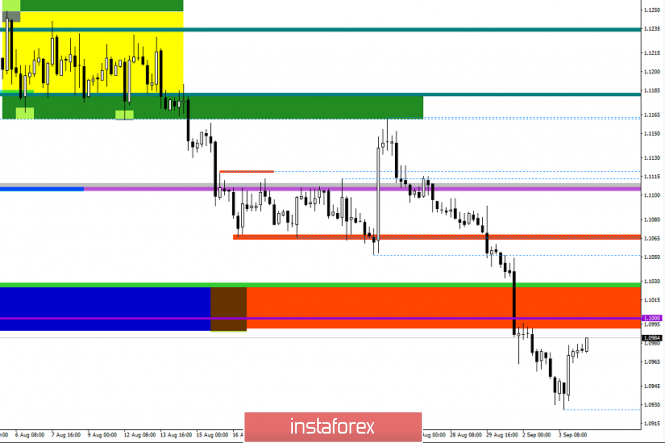

Dynamics of retail sales in Europe:

The pair EUR / USD, forming an inertial movement, was able not only to overcome a number of important values on its way, but also the quote was firmly consolidated below the psychological level of 1.1000. Considering everything that happens in general terms, we see that the downward trend continued its formation reaching the level of 1.0926, where, against the background of local overheating of the American currency, we felt a periodic support, forming a technical correction as a result.

It is likely to assume that the correction move will not last as long as many would like, and already within the range of 1.0990-1.1000, it is possible to expect a stop with the next return of short positions to the market.

Concretizing all of the above into trading signals:

- We consider long positions in terms of forming an oblong correction, but in this case, a clear fixation of the price above the level of 1.1000 is necessary.

- We consider short positions in terms of restoring the main move, where if the price is fixed lower than 1.0960, it is possible to consider the move to 1.0930.

From the point of view of a comprehensive indicator analysis, we see that indicators on the minute intervals signal the current correction, which cannot be said about intraday intervals where there is a characteristic uncertainty. Long-term periods, in turn, maintain a downward interest, reflecting the general market background.