USD / JPY pair

In the latest review on the yen, we wrote the following: "If there are any other disturbing geopolitical news, then we can work out a bearish goal of 107.22. There may also be some price reduction without fixing it on a day-long scale." That's how it happened - on the news of Donald Trump's upcoming impeachment, the price pierced the green-channel support, and then on the day after, yesterday, it increased by 70 points. We cited this reference to the previous forecast in order to confirm our commitment to the rising scenario as the main one.

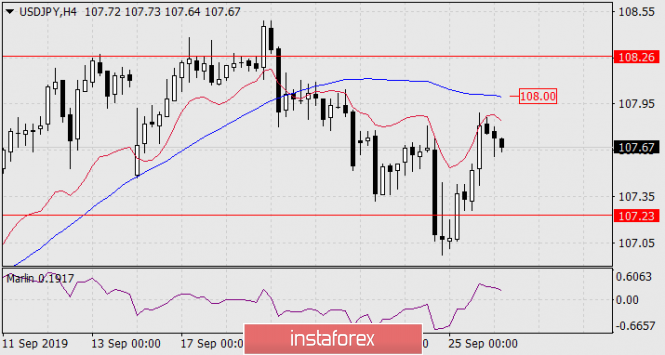

On the daily chart, the signal line of the Marlin oscillator turned upward almost from the border with the growth territory. This dividing line (0.00) is the support/resistance of the indicator with the immediate target open to 108.26. Overcoming the red line of the price channel at 108.26 opens the second target on the next line to 109.10.

On a four-hour scale, the price is still below the balance lines (indicator red) and MACD (blue), while Marlin is already in the growth zone, which increases the likelihood of the price going over the resistance on the indicator. But until the price actually fixes above the MACD line of 108.00, there is still the possibility of another price attack to break through the green line of the price channel and further decline to the MACD line on the daily chart towards the price of 106.50.

The material has been provided by InstaForex Company - www.instaforex.com