The US labor market data released on Friday has failed to support the dollar. The greenback slightly weakened its position together with the euro but still remained within the 10th figure. Traders were in no hurry with trading decisions until Jerome Powell's speech, which took place 4 hours after the Nonfarm.

Expectations have largely justified themselves as the head of the Fed appreciated the published data and the state of the American economy as a whole. While Powell simultaneously predicted a slowdown in economic growth, he assured those present that the Fed was not expecting a recession. In general, his rhetoric was "positively cautious." In his opinion, the American labor market will continue to show strong growth and US GDP growth will be 2% - 2.5% this year, mainly due to an increase in consumer activity. At the same time, the head of the Federal Reserve again recalled the consequences of the trade war. He noted that growing uncertainty is putting strong pressure on business investment. This factor, according to Powell, forces companies to "postpone investment decisions."

As for the prospects of monetary policy, here the head of the Fed did not go into any details. Again, he repeated the phrase that the regulator "will act adequately to the current situation using monetary policy tools to support the country's economy." This is a vague wording that can be interpreted in different ways - both in favor of a wait-and-see attitude and in favor of decisive action. Nevertheless, Jerome Powell and his other colleagues who spoke last week on the eve of the 10-day "silence regime" made it clear that the Fed's next steps will depend mainly on the dynamics of the US-China trade war and on the dynamics of key macroeconomic indicators.

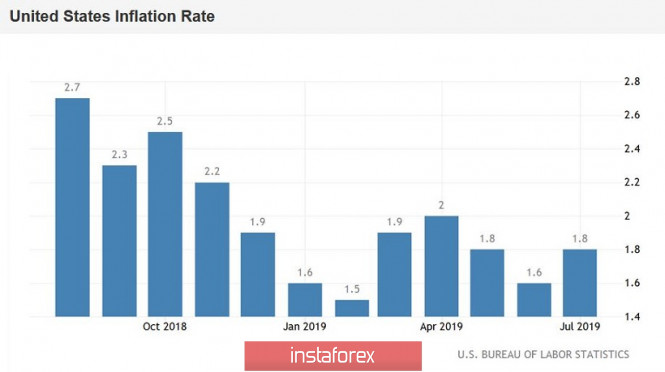

In this context, the most important day of the week for the EUR/USD pair is Thursday on September 12th. We will find out the basic data on the growth of American inflation in August. According to preliminary forecasts, the general consumer price index will show a negative trend: it will drop to 0.1% in monthly terms and to 1.7% in annual terms. The core index, excluding food and energy prices, should also drop to 0.2% on a monthly basis but grow a little to 2.3% in annual terms. As you can see, experts predict a rather contradictory picture. If all the indicators come out at the indicated levels, the dollar will undoubtedly remain under the background pressure in anticipation of the September meeting of the Fed, which will take place next week, September 18.

It is noteworthy that another important event, a meeting of the European Central Bank, for the EUR/USD pair will take place this Thursday. Without exaggeration, we can say that the fate of the euro in the medium term (and possibly long term) depends on this meeting of members of the European regulator. Over the past few weeks, there has not been a debate among experts regarding further action by the ECB. According to the general opinion of analysts, the Central Bank will reduce the deposit rate by either 0.1 or 0.2 percentage points, starting to acquire assets at the same time by 30-40 billion euros per month. However, according to the latest rumors, a serious split occurred in the ranks of the ECB, which could hinder the implementation of the above scenario. According to the opponents of the "dovish" ECB, a further reduction in the rate will have serious side effects for the banking system in Europe.

As the CEO of Deutsche Bank noted last week at current rates, Europeans annually lose more than 160 billion euros in their savings. Further steps of the Central Bank in this direction will only aggravate the situation, provoking a "greater split in society." By and large, they have been talking about this for a long time. Mario Draghi himself has repeatedly focused on the side effects of low rates. And at the beginning of this year, German bankers sent an open appeal to the ECB, in which they urged the European Central Bank to introduce a differentiated rate on deposits. The option of lowering the rate further to the negative area of speech was not even discussed then.

In other words, the September intrigue is still intact. If the ECB unexpectedly maintains a wait and see position, the euro will receive strong support throughout the market, including paired with the dollar.

In addition, preliminary consultations between the US-China negotiation groups will begin this week. Members of the working group will set the stage for the 13th round of high-level negotiations, which is due to take place in early October. News "from the field" of the negotiation process can have a fairly strong impact on the dollar. Also, the foreign exchange market will monitor the situation with Brexit. The House of Lords of the British Parliament approved the bill of the House of Commons on Friday night, which obliges Boris Johnson to ask Brussels for another postponement. But there is another problem,according to the French Foreign Minister, the European Union may not agree to transfer Brexit. According to him, Brussels "is not going to do this every three months, while the British Parliament does not support the draft deal and does not support a "tough" scenario. " At the same time, he threatened London to veto the postponement of Brexit if the rest of the EU countries support this idea. Thus, now the "ball is on the side of Europe", and the European currency will be keenly responsive to the dynamics of the current situation.

From a technical point of view, the situation remained the same: at the end of the week, EUR/USD traders will either be able to "pull out" the price above the 11th figure (in the range of 1.1090-1.1210), or the downward trend will continue to the ninth figure with the prospect of a decrease to the middle of the seventh figure. This is where most powerful support level is 1.0750, which was the lower line of the Bollinger Bands indicator on the monthly chart.

The material has been provided by InstaForex Company - www.instaforex.com