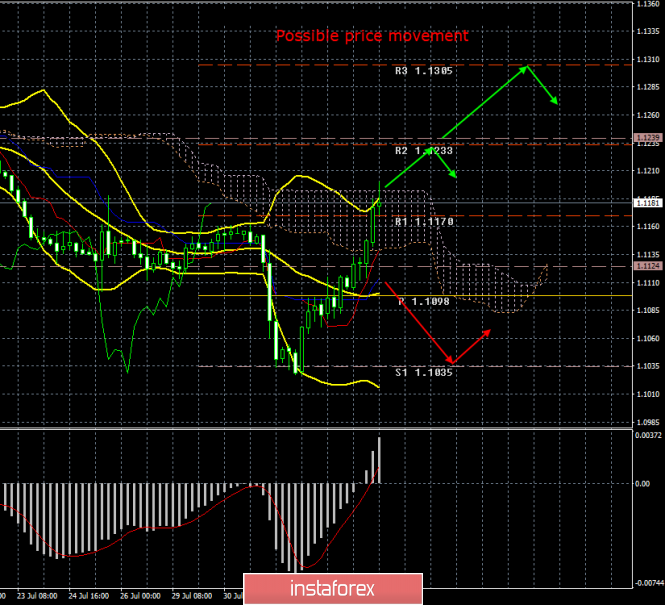

4-hour timeframe

Amplitude of the last 5 days (high-low): 38p - 29p - 102p - 69p - 46p.

Average amplitude over the last 5 days: 57p (55p).

After today, it is safe to say that the euro bears are sated and are now taking profits in short positions, which leads to the strengthening of the euro/dollar pair. Particularly important news was not available to traders during the day. Indexes of business activity in the services sector and composite in the eurozone were almost neutral. Two out of three similar US indices turned out to be higher than forecasts, but the most significant index of business activity in the ISM services sector turned out to be worse than the expectations of the Forex market. However, at the same time, all three US business activity indexes are confidently staying above 50.0, so there is no talk of a decline at the moment, at most, about a slight slowdown. However, the euro began to grow exactly when trade opened on Monday, August 5, and continuously increased all day. It is this factor that speaks of the technical nature of this movement. Meanwhile, China struck back against Donald Trump. The Chinese government ordered its companies to suspend the purchase of agricultural products in America, and also let the yuan go free float. For the first time in 11 years, the rate went above 7 yuan per dollar. This is also planned, or at least a deliberate step by Beijing to offset the damage from a trade war with the United States. Donald Trump, however, remains to escalate the conflict with China even more, as the parties failed to go along the peaceful path. China frankly expects that a trade war with it will harm Washington itself, and this will be enough to prevent Trump from being re-elected for a second term. And with the new president, perhaps, it will be easier to agree. In this case, what remains with Trump when frankly his plan did not work? It's right to continue to introduce further duties on Chinese imports, increase duties that are already imposed, exert any other pressure on Beijing, impose sanctions and, of course, declare in all media that China "does not want to conclude a trade deal and unfairly treats America. "

Trading recommendations:

EUR/USD continues to move up. Thus, it is now recommended to buy the euro currency in small lots with a target of 1.1233. A price rebound from the Senkou Span B line or a MACD indicator turn down will indicate a round of correction.

It will be possible to sell the euro/dollar pair with the goal of a support level of 1.1035, when bears take the initiative back into their own hands, and the rate consolidates below the critical line.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

The material has been provided by InstaForex Company - www.instaforex.com