On Tuesday, API reported a more significant than expected reduction in oil reserves, which allowed Brent to rise above $60 per barrel. As concerns about the approaching recession increase, raw materials usually lose value, as the recession is always accompanied by a decline in demand, so markets do not expect strong numbers from the EIA today, and support for commodity currencies after yesterday's publication will be short-lived.

Much more important is the answer to the question of where the Fed will move. The recession is still not considered inevitable if the Fed does not wait for official confirmation and will take measures to stimulate the US economy immediately. Trump insists on this – on Tuesday, he said that the Fed should lower the rate by 1%, which will give a "huge explosion of growth." In turn, Trump is ready to carry out additional tax cuts to stimulate the economy, explaining this possibility by the fact that problems are accumulating around the world and the US can improve its economic situation through additional incentives.

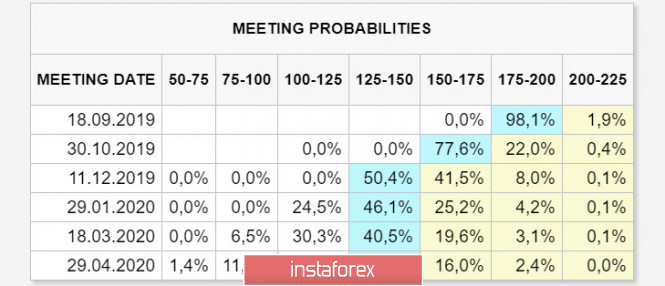

On Wednesday morning, investors are confident of a quarter percent rate cut in September and at least one more cut before the end of the year. This is less than Trump wants, but more than expected 3 months ago.

As usual, there is no good solution. The Fed's preventive actions may provoke additional panic, as consumer sentiment will deteriorate sharply, that is, the markets will react based on historical experience, which says that a reduction in rates is tantamount to a movement towards recession. Accordingly, the reverse option, in which the Fed will pull to the last, will maintain the illusion of stability, but next year, it can lead to the rapid development of the crisis, and the collapse will be deeper than if the Fed began to act in advance.

There is no consensus in the markets, not even a rough understanding of what scenario will be chosen. In this regard, J. Powell's speech at the Jackson Hole symposium on Friday could have the most serious consequences if the head of the Fed decides to outline the immediate strategy.

Until Friday, the markets will be in a state of expectation, volatility is expected to be low, and trade will go mainly in the range.

USDCAD

The Canadian dollar is based on the still stable oil, the absence of falling demand in the US and good domestic demand supporting inflation. For all key indicators, the Bank of Canada is enough to keep abreast, there is no need for urgent intervention, but the latest data show that Canada will not remain aloof from a possible recession.

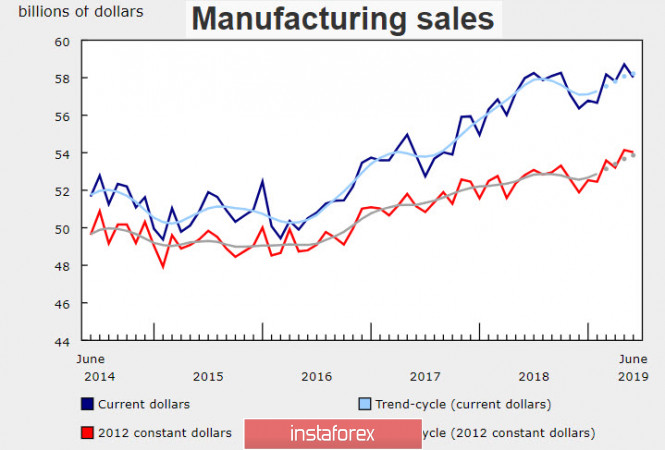

Sales in the manufacturing industry in Canada fell in June by 1.2% after rising 1.6% a month earlier, the largest drop in petroleum and coal industry, the decreased utilization rate of production capacity by 0.9%.

Today, the Bureau of Statistics will publish data on consumer inflation for July, a decrease is expected from 2.0% to 1.7%, which is below the target of the Central Bank of Canada. The expected decline caused primarily by a decrease in the prices of petroleum products, however, if the drop will affect core inflation, the growth of the USDCAD can be accelerated.

The resistance of 1.3343/45 is still holding, but this is only until the first negative data. The chances of staying in the range are declining, the support has moved to the border of the channel of 1.3280, any pair decline is more logical to use for purchases and wait for a breakthrough of resistance with a target of 1.3564.

USDJPY

The yen is fiercely resisting the strengthening, but its fate is largely beyond the capabilities of the Central Bank of Japan. The Central Bank, through its head Kuroda, has repeatedly voiced its determination to introduce a new package of stimulus measures if necessary, but this is rather a psychological method, since rates in Japan are already in negative territory, and demand for the yen can increase sharply in the event of a fall in commodity prices or stable signs of approaching recession.

Until Friday, the yen is likely to remain in the range of 106.15-106.96, the probability of a break down will remain higher under any scenario after the speech of J.Powell.

The material has been provided by InstaForex Company - www.instaforex.com