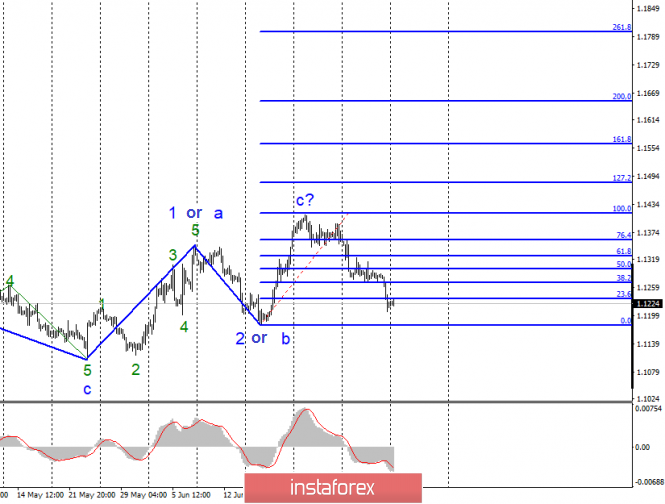

EUR / USD

On Friday, July 5, trading ended for EUR / USD with a decrease of 60 basis points. The main hopes of the Eurocurrency were associated with weak data on new jobs in the agricultural sector, unemployment and wages this June in America. However, the number of new jobs amounting in 224,000, is nearly 80,000 higher than the forecast. This data was enough for the bears to continue selling the tool. Thus, the current wave marking still remains in force, but the maximum of June 25 is likely to be the maximum of the three-wave ascending structure. Thus, if this assumption is true, then from June 25, it is also possible for a new downward trend or horizontal section to begin. It will depend on the news background coming from the United States and the European Union, as well as on the decisions of the Central Banks in the meetings to come.

Purchase goals:

1.1417 - 100.0% Fibonacci

1.1480 - 127.2% Fibonacci

Sales targets:

1.1180 - 0.0% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair presumably remains within the upward segment of the trend. I recommend buying euros with targets located near the estimated marks of 1.1417 and 1.1480, which equates to 100.0% and 127.2% Fibonacci, if the pair does not go below the level of 0.0%. However, moving the tool below the level of 0.0% will result in adjustments to the current markup.

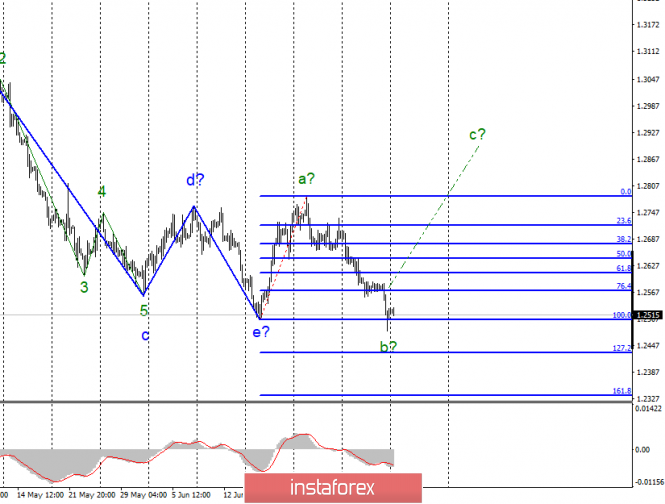

GBP / USD

The GBP / USD pair lost 55 basis points on Friday and broke through the low of the wave e. Thus, in the best case for the pound, the pound-dollar tool must move in a horizontal trend segment. This is supported by an unsuccessful attempt to break through the 100.0% Fibonacci level. However, the market can push this level on the second or third attempt, which would mean almost a sentence for the UK currency. So far, there are ghostly chances for quotes to move away from the lows reached with the construction of wave c, with targets around 28 figures. However, the news background remains extremely negative for the pound sterling. British political circles are increasingly inclined to believe that Boris Johnson is right in his desires to leave the EU as soon as possible. Thus, the probability of a "hard" version of Brexit grows with the likelihood of a new blow to the UK economy is growing, which will invariably affect the pound rate, for which the last three years have been extremely unsuccessful. Thus, it is best to count for pounds at 1.2800 barriers.

Sales targets:

1.2431 - 127.2% Fibonacci

1.2334 - 161.8% Fibonacci

Purchase goals:

1.2783 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument involves the construction of an upward wave c, but only in the case of an unsuccessful attempt to break through the 100.0% Fibonacci level. Thus, I recommend very small purchases of a pair with targets located around 28 figures and an order limiting losses under the level of 100.0%. Breaking through the 1.2506 mark will allow the instrument upon building a downward trend.

The material has been provided by InstaForex Company - www.instaforex.com