Forecast for July 31:

Analytical review of H1-scale currency pairs:

For the euro / dollar pair, the key levels on the H1 scale are: 1.1212, 1.1195, 1.1174, 1.1162, 1.1119, 1.1104 and 1.1073. Here, the price entered an equilibrium state. The continuation of the movement to the top is expected after the price passes the noise range 1.1162 - 1.1174. In this case, the goal is 1.1195, wherein price consolidation is near this level. For the potential value for the top, we consider the level of 1.1212.

Short-term downward movement is possible in the range of 1.1119 - 1.1104. The breakdown of the latter value will allow us to expect movement towards a potential target - 1.1073. From this level, we expect a rollback to the top.

The main trend is the local downward structure of July 18, the stage of correction.

Trading recommendations:

Buy 1.1175 Take profit: 1.1195

Buy 1.1197 Take profit: 1.1212

Sell: 1.1119 Take profit: 1.1105

Sell: 1.1103 Take profit: 1.1075

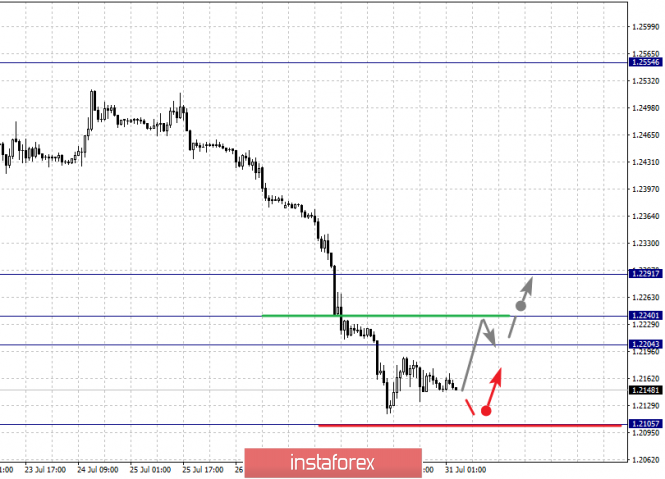

For the pound / dollar pair, the key levels on the H1 scale are: 1.2291, 1.2240, 1.2204 and 1.2105. Here, the price is near the limit value (1.2105) for the downward structure of July 19. Also, at the moment, we expect a correction movement with the subsequent formation of the initial conditions for the top. Short-term upward movement is possible in the range of 1.2204 - 1.2240. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 1.2291. Up to this level, we expect the top of the ascending structure to be formed.

The main trend is the downward cycle of July 19, we expect to go into correction.

Trading recommendations:

Buy: 1.2204 Take profit: 1.2240

Buy: 1.2242 Take profit: 1.2290

Sell: Take profit:

Sell: Take profit:

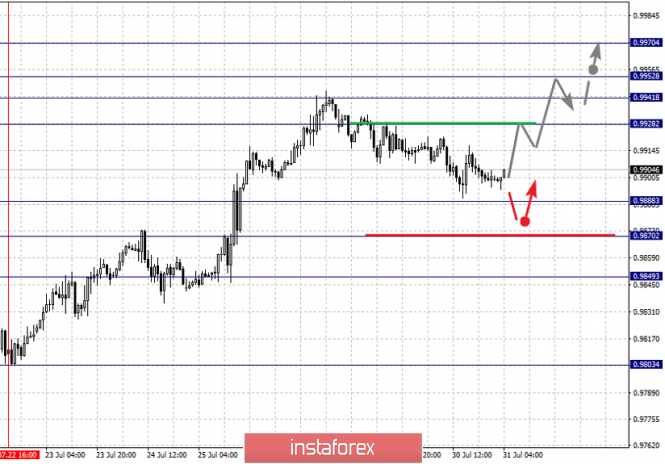

For the dollar / franc pair, the key levels on the H1 scale are: 0.9970, 0.9952, 0.9941, 0.9928, 0.9888, 0.9870 and 0.9849. Here, we are following the development of the ascending structure of July 22. At the moment, the price is in correction. The resumption of the upward trend is possible after the breakdown of the level of 0.9928. In this case, the target is 0.9941. Meanwhile, in the range of 0.9941 - 0.9952, there is a short-term upward movement, as well as consolidation. For the potential value for the top, we consider the level of 0.9970. After reaching which, we expect a rollback.

The level of 0.9888 is the key support for the upward trend. Its breakdown will lead to the development of a downward structure of July 26. In this case, the first target is 0.9870, wherein consolidation is near this level. For the potential value for the bottom, we consider the level of 0.9849. After reaching which, we expect a rollback to the top.

The main trend - the ascending structure of July 22, the stage of deep correction.

Trading recommendations:

Buy : 0.9928 Take profit: 0.9940

Buy : 0.9953 Take profit: 0.9970

Sell: 0.9888 Take profit: 0.9872

Sell: 0.9868 Take profit: 0.9850

For the dollar / yen pair, the key levels on the scale are : 109.86, 109.48, 109.29, 108.94, 108.54, 108.40, 108.16 and 107.92. Here, we are following the development of the ascending structure of July 18. The continuation of the movement to the top is expected after the breakdown of the level of 108.95. In this case, the goal is 109.29. Meanwhile, in the range of 109.29 - 109.48, there is a short-term upward movement, as well as consolidation. We consider the level of 109.48 to be a potential value for the top. Upon reaching this level, we expect consolidation as well as a rollback to the bottom.

Short-term downward movement is possible in the range of 108.54 - 108.40. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 108.16. This level is a key support for the upward structure. Its price passage will have to form the initial conditions for the downward cycle. Here, the potential target is 107.92.

The main trend: the ascending structure of July 18.

Trading recommendations:

Buy: 108.95 Take profit: 109.29

Buy : 109.30 Take profit: 109.46

Sell: 108.54 Take profit: 108.42

Sell: 108.38 Take profit: 108.16

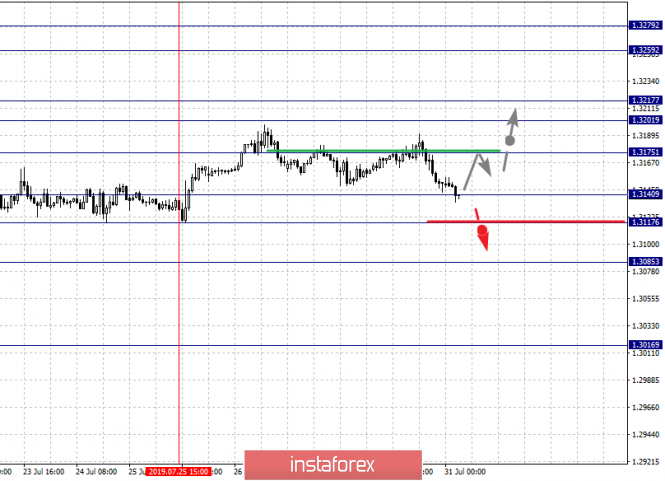

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3279, 1.3259, 1.3217, 1.3201, 1.3175, 1.3140, 1.3117 and 1.3085. Here, the continuation of the upward trend is possible after the breakdown of the level of 1.3175. In this case, the target is 1.3201. The passage at the cost of the noise range 1.3201 - 1.3217 must be accompanied by a pronounced upward movement. In this case, the target is 1.3259. For the potential value for the top, we consider the level of 1.3279. After reaching which, we expect consolidation, as well as a rollback to the bottom.

Short-term downward movement is possible in the range of 1.3140 - 1.3117. The breakdown of the latter value will lead to the development of a downward structure. Here, the potential target is 1.3085.

The main trend is the local ascending structure of July 25.

Trading recommendations:

Buy: 1.3175 Take profit: 1.3201

Buy : 1.3218 Take profit: 1.3257

Sell: 1.3138 Take profit: 1.3118

Sell: 1.3116 Take profit: 1.3087

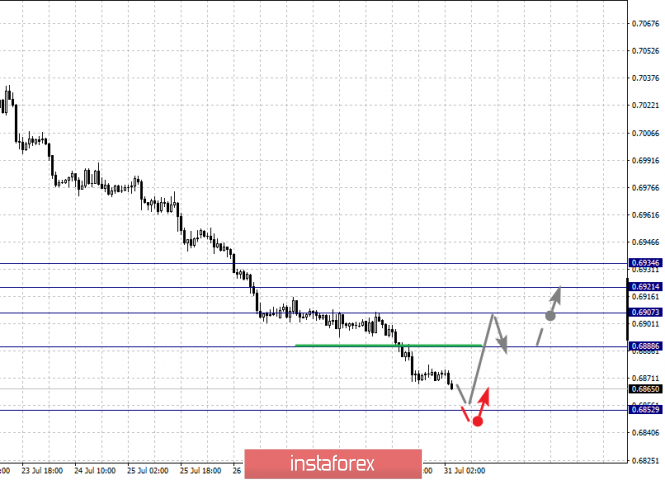

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6934, 0.6921, 0.6907, 0.6888 and 0.6852. Here, the price is near the limit values for the downward cycle of July 18, and we expect to go into a correction. The development of the ascending structure is possible after the breakdown of the level of 0.6888. In this case, the target is 0.6907. The breakdown of which, in turn, will allow us to count on the movement to the level of 0.6921. For the potential value for the top, we consider the level of 0.6934. Upon reaching which, we expect pronounced initial conditions for the upward cycle.

The breakdown of the level of 0.6852 will be accompanied by an unstable downward movement, and here, we do not consider subsequent targets until the correction is made.

The main trend - the downward structure of July 18.

Trading recommendations:

Buy: 0.6888 Take profit: 0.6907

Buy: 0.6908 Take profit: 0.6920

Sell : Take profit :

Sell: Take profit:

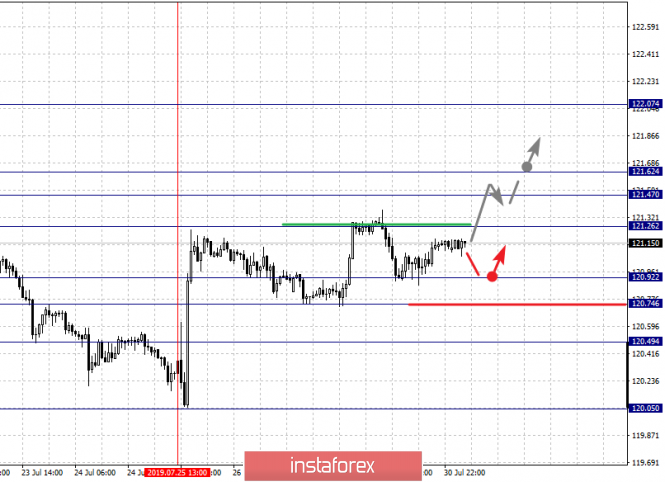

For the euro / yen pair, the key levels on the H1 scale are: 122.07, 121.62, 121.47, 121.26, 120.92, 120.74 and 120.49. Here, we are following the formation of the ascending structure of July 25. The continuation of the movement to the top is expected after the breakdown of the level of 121.26. In this case, the first target is 121.47. Meanwhile, we expect the formation of a pronounced structure of the initial conditions for the ascending cycle to the level of 121.62. For the potential value for the top, we consider the level of 122.07. The movement to which is expected after the breakdown of the level of 121.62.

Short-term downward movement is possible in the range of 120.92 - 120.74. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 120.49. This level is a key support for the top.

The main trend is the formation of the initial conditions for the upward cycle of July 25.

Trading recommendations:

Buy: 121.26 Take profit: 121.45

Buy: 121.64 Take profit: 122.05

Sell: 120.72 Take profit: 120.54

Sell: 120.45 Take profit: 120.10

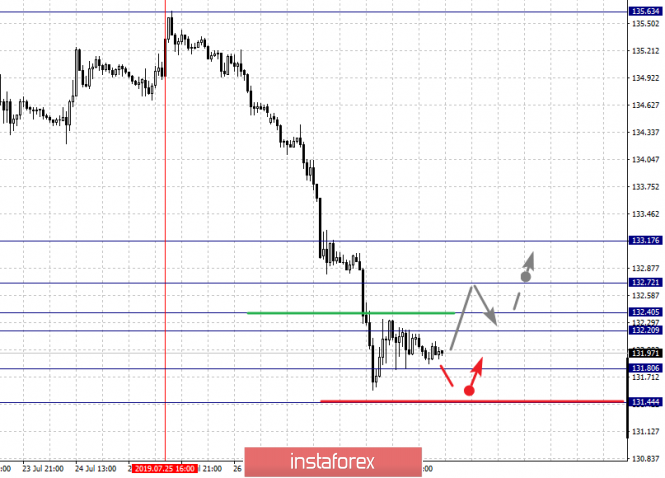

For the pound / yen pair, the key levels on the H1 scale are : 133.17, 132.72, 132.40, 132.20, 131.80 and 131.44. Here, the price is the will of the limit values for the downward structure of July 25, and therefore, we expect movement in the correction zone. The development of an upward trend is possible after the passage of the price to the noise range 132.20 - 132.40. Here, the goal is 132.72. For the potential value for the top, we consider the level of 133.17, to which, we expect the registration of a pronounced structure of the initial conditions.

Short-term downward movement is possible in the range of 131.80-113.44. From here, we expect a key reversal to the top. The breakdown of the level of 131.44 will be accompanied by an unstable development of the trend, and so far, we do not set further goals for the downward structure.

The main trend - the downward structure of July 25.

Trading recommendations:

Buy: 132.40 Take profit: 132.70

Buy: 132.74 Take profit: 133.15

Sell: 131.76 Take profit: 131.50

The material has been provided by InstaForex Company - www.instaforex.com