Forecast for July 2:

Analytical review of H1-scale currency pairs:

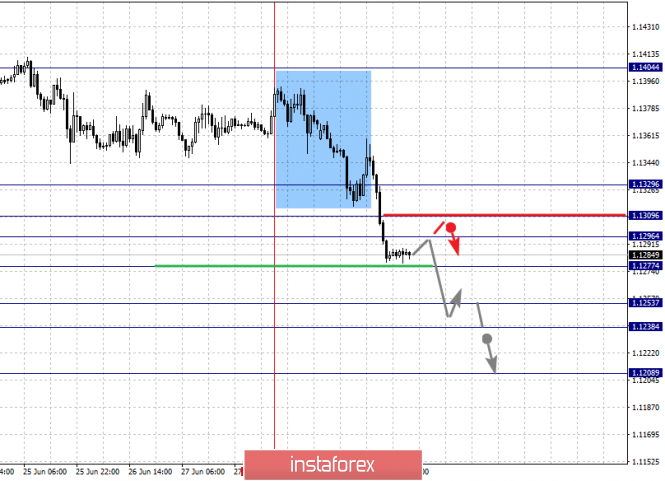

For the euro / dollar pair, the key levels are: 1.1329, 1.1309, 1.1296, 1.1277, 1.1253, 1.1238 and 1.1208. Here, the development of the downward trend is expected 1.1277. In this case, the target is 1.1253. Price consolidation is in the range of 1.1253 - 1.1238. For the bottom value, we consider the level of 1.1208. After the breakdown of the level of 1.1238.

Short-term upward movement, possible in the range 1.1296 - 1.1309. The breakdown of the latter will lead to in-depth correction. Here, the goal is 1.1329. This level is a key support for the downward structure.

The main trend is the downward trend from June 24.

Trading recommendations:

Buy 1.1296 Take profit: 1.1307

Buy 1.1310 Take profit: 1.1327

Sell: 1.1275 Take profit: 1.1255

Sell: 1.1236 Take profit: 1.1210

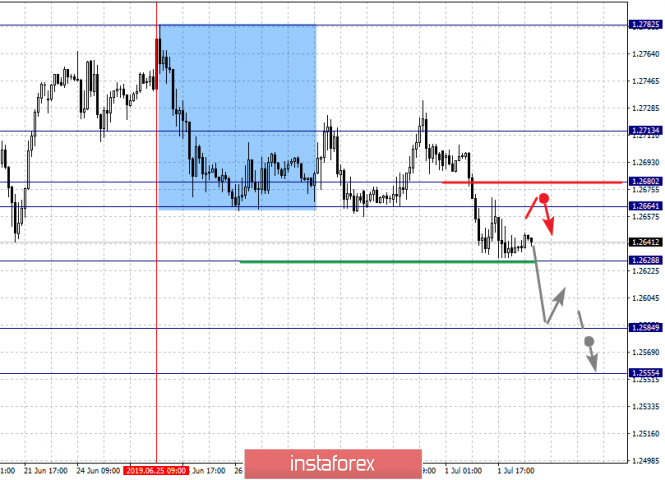

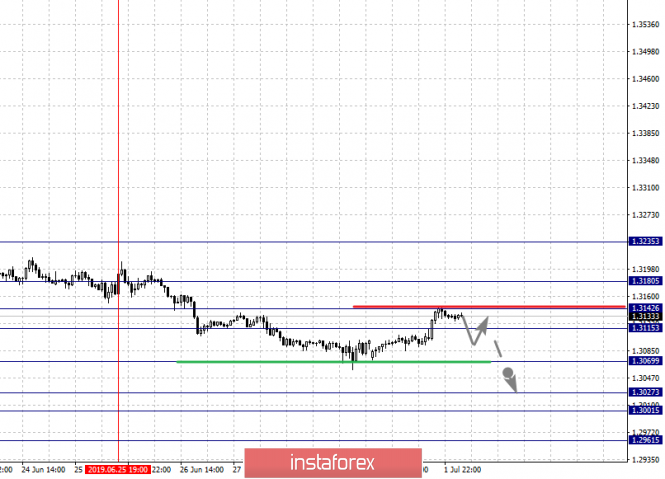

For the pound / dollar pair, key levels on the H1 scale are: 1.2713, 1.2680, 1.2664, 1.2628, 1.2584 and 1.2555. Here, we are following the development of the downward structure of June 25th. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2628. In this case, the goal is 1.2584, wherein consolidation is near this level. For the potential value for the bottom, we consider the level of 1.2555. After reaching which, we expect to go into a correction.

Short-term upward movement is expected in the range of 1.2664 - 1.2680. The breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2713. This level is a key support for the downward structure.

The main trend - the downward structure of June 25.

Trading recommendations:

Buy: 1.2664 Take profit: 1.2680

Buy: 1.2682 Take profit: 1.2710

Sell: 1.2626 Take profit: 1.2586

Sell: 1.2582 Take profit: 1.2557

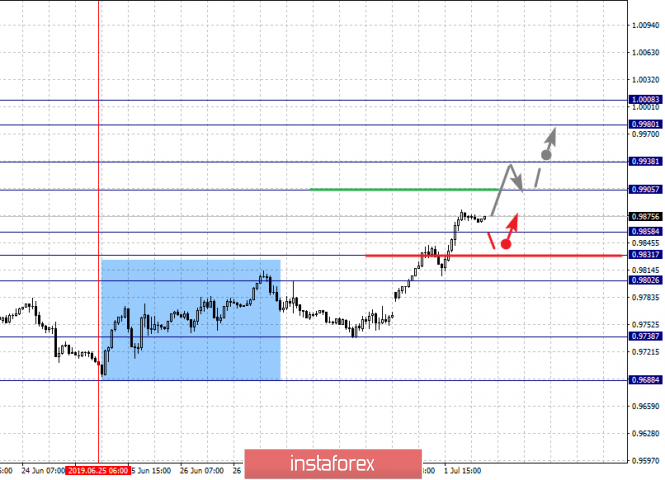

For the dollar / franc pair, the key levels on the H1 scale are: 1.0008, 0.9980, 0.9938, 0.9905, 0.9858, 0.9831 and 0.9802. Here, we continue to follow the development of the ascending cycle of June 25. The continuation of the movement to the top is expected after the breakdown of the level of 0.9905. In this case, the target is 0.9938, and near this level is a price consolidation. The breakdown of the level of 0.9938 should be accompanied by a pronounced upward movement. Here, the target is 0.9980. For the potential value for the top, we consider the level of 1.0008. After reaching which, we expect consolidation, as well as a rollback to the correction.

Short-term downward movement is possible in the range of 0.9858 - 0.9831. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 0.9802. This level is a key support for the top. Its price will lead to the development of the downward structure. Here, the potential goal is 0.9738.

The main trend is the ascending cycle of June 25.

Trading recommendations:

Buy : 0.9905 Take profit: 0.9936

Buy : 0.9939 Take profit: 0.9980

Sell: 0.9858 Take profit: 0.9832

Sell: 0.9829 Take profit: 0.9802

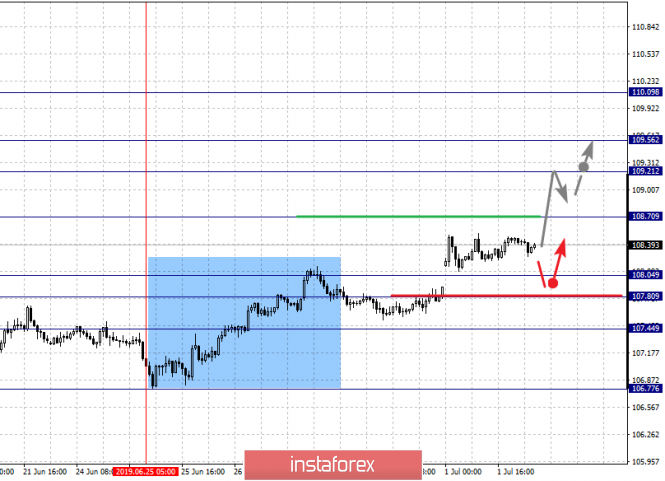

For the dollar / yen pair, the key levels on the scale are : 110.09, 109.56, 109.21, 108.70, 108.04, 107.80 and 107.44. Here, we continue to follow the development of the ascending structure of June 25. The continuation of the movement to the top is expected after the breakdown of the level of 108.70. In this case, the goal is 109.21. Short-term upward movement, as well as consolidation is in the range of 109.21 - 109.56. For the potential value for the top, we consider the level of 110.09. The movement to which, is expected after the breakdown of the level of 109.56.

Short-term downward movement, perhaps in the range of 108.04 - 107.80. The breakdown of the latter value will lead to in-depth correction. Here, the goal is 107.44. This level is a key support for the top.

The main trend: the ascending structure of June 25.

Trading recommendations:

Buy: 108.70 Take profit: 109.20

Buy : 109.24 Take profit: 109.53

Sell: 108.04 Take profit: 107.82

Sell: 107.78 Take profit: 107.46

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3180, 1.3142, 1.3115, 1.3069, 1.3027, 1.3001 and 1.2961. Here, we continue to monitor the local downward structure of June 25. At the moment, the price is in the correction zone. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3069. In this case, the goal is 1.3027. Price consolidation is in the range of 1.3027 - 1.3001. For the potential value for the bottom, we consider the level of 1.2961. After reaching which, we expect a rollback to the top.

Consolidated movement is possible in the range of 1.3115 - 1.3142. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3180. This level is a key resistance for the development of the ascending structure. Its breakdown will make it possible to count on movement towards the potential target - 1.3235.

The main trend is a local downward structure from June 25.

Trading recommendations:

Buy: 1.3143 Take profit: 1.3180

Buy : 1.3182 Take profit: 1.3230

Sell: 1.3067 Take profit: 1.3027

Sell: 1.3001 Take profit: 1.2961

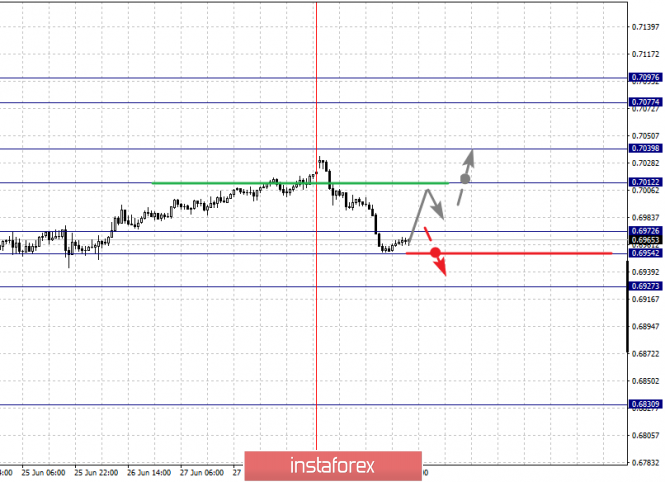

For the pair Australian dollar / US dollar, the key levels on the H1 scale are : 0.7097, 0.7077, 0.7039, 0.7012, 0.6972, 0.6954 and 0.6927. Here, we are following the development of the ascending structure of June 18. At the moment, the price is in correction and forms the potential for the downward movement of June 28. The continuation of the movement to the top is expected after the breakdown of the level of 0.7012. In this case, the goal is 0.7039, and near this level is a price consolidation. The breakdown of the level of 0.7040 must be accompanied by a pronounced upward movement. Here, the goal is 0.7077. For the potential value for the top, we consider the level of 0.7097. Upon reaching this level, we expect a consolidated movement in the range of 0.7077 - 0.7097, as well as a rollback to the bottom.

Consolidated movement is possible in the range of 0.6972 - 0.6954. The breakdown of the last value will lead to a prolonged correction. Here, the target is 0.6927. This level is a key support for the top.

The main trend is the upward structure on June 18, the correction stage is the formation of potential for the bottom of June 28.

Trading recommendations:

Buy: 0.7012 Take profit: 0.7037

Buy: 0.7041 Take profit: 0.7077

Sell : Take profit :

Sell: 0.6952 Take profit: 0.6930

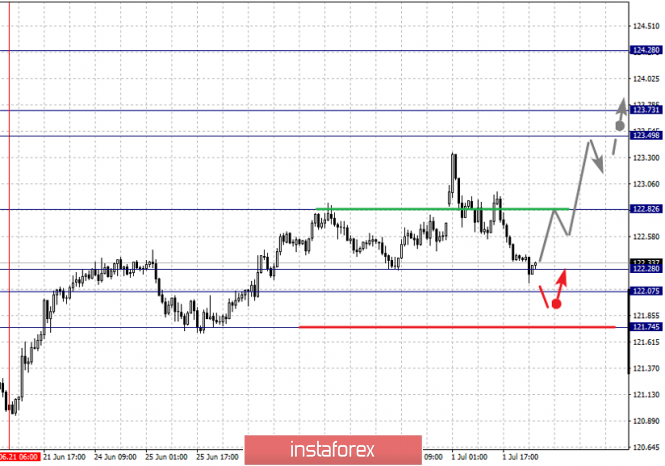

For the euro / yen pair, the key levels on the H1 scale are: 124.28, 123.73, 123.49, 122.82, 122.28, 122.07 and 121.74. Here, we are following the development of the ascending structure of June 21. The continuation of the upward movement is expected after the breakdown of the level of 122.82. In this case, the first target is 123.49. A short-term upward movement, as well as consolidation is in the range of 123.49 - 123.73. The breakdown of the level of 123.73 should be accompanied by a pronounced upward movement to the potential target - 124.28.

Short-term downward movement is expected in the range of 122.28 - 122.07. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 121.74. This level is a key support for the upward structure.

The main trend is the upward structure of June 21, the stage of correction.

Trading recommendations:

Buy: 122.82 Take profit: 123.49

Buy: 123.50 Take profit: 123.72

Sell: 122.28 Take profit: 122.08

Sell: 122.05 Take profit: 121.75

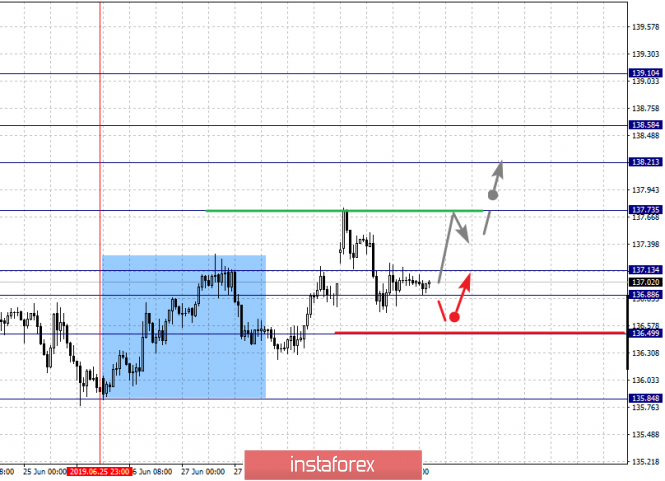

For the pound / yen pair, the key levels on the H1 scale are : 139.10, 138.58, 138.21, 137.73, 137.13, 136.88 and 136.49. Here, we continue to monitor the ascending structure of June 25. The continuation of the movement to the top is expected after the breakdown of the level of 137.73. In this case, the target is 138.21. A short-term upward movement, as well as consolidation is in the range of 138.21 - 138.58. For the potential value for the top, we consider the level of 139.10. The movement to which, is expected after the breakdown of the level of 138.58.

Short-term downward movement is possible in the range 137.13 - 136.88. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 136.49. This level is a key support for the top.

The main trend is the local rising structure of June 25.

Trading recommendations:

Buy: 137.75 Take profit: 138.20

Buy: 138.25 Take profit: 138.55

Sell: 137.13 Take profit: 136.90

Sell: 136.85 Take profit: 136.50

The material has been provided by InstaForex Company - www.instaforex.com