The environment was clearly unsuccessful for the dollar. None of the published macroeconomic indicators added optimism to the bulls. The trade balance deficit increased from 51.2 billion to 55.5 billion in May, which is not surprising given the avalanche-like growth of problems in the manufacturing sector. The volume of production orders decreased by 0.7% in May and the trend is becoming threatening.

The ISM report on business activity in the services sector is worse than forecast and the growth rate of the sector is obviously slowing down to 55.1p in May, which is the minimum value for 22 months.

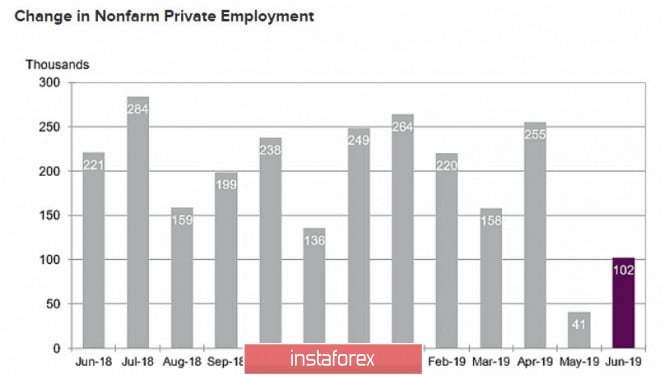

The ADP report on employment in the private sector showed an increase in new jobs by only 102 thousand, which after it failed to 41 thousand a month earlier indicates saturation of the labor market.

The weak ADP report reinforces the likelihood that nonpharma will also come out worse than expected on Friday and this is perhaps the most important conclusion on the prospects for the dollar. So far, there is no reason why the Fed can postpone a quarter-percent rate cut at a meeting on July 31. Moreover, if the trend towards a slowdown in the US economy is developing and this is what we are seeing, then the decline can be immediately by 0.5%. Such a probability makes the dollar an outsider in the foreign exchange market in the medium term.

Today is a national holiday in the USA and banks are closed. The volatility will be low and one should not expect strong movements.

USD/CAD pair

The decision of OPEC + to extend the agreement on the reduction of oil production for 9 months had a positive impact on oil prices, which together with the declared truce on the trade war between the United States and China strengthened both stock markets and commodity currencies.

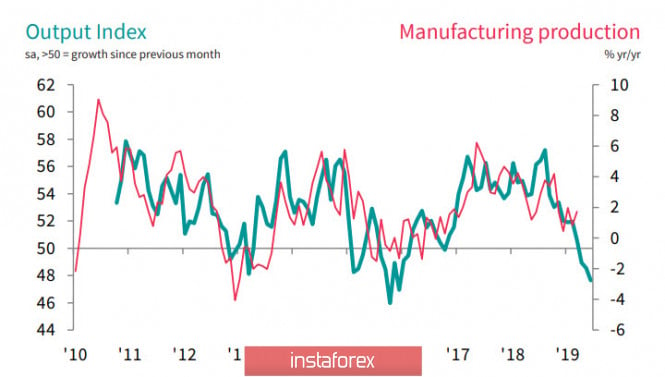

Despite the oil optimism that supports the loonie against the dollar, the problems in the Canadian economy are much the same as in the United States. The manufacturing sector is at its lows for 3.5 years and the PMI index is below 50 p. For the third month in a row, which is consistently reflected in such important components of economic health given the rapid growth of work in progress (at least since October 2010), negative dynamics of new orders, stagnation on new jobs and the sharpest drop in consumer activity since December 2015.

According to Markit, the reason for the slowdown is obvious, which is the trade war between China and the United States that holds back development. Low trade volumes or weak export growth do not save even high oil prices.

Nevertheless, the current situation must still be considered in favor of the Canadian. First of all, the reason for this is noticeably higher inflation than in the United States. The base index was 2.1% in May, which allows the Bank of Canada not to hurry with a decrease in the rate. If the Canada labor market report is satisfactory tomorrow, the Bank of Canada at its meeting on July 10 will most likely leave the rate unchanged, which will increase the yield spread.

Technically, a Canadian looks overbought but the momentum has not yet worked out. The repeated test of support at 1.3066 can be successful, which will open the way to 1.2950.

USD/JPY pair

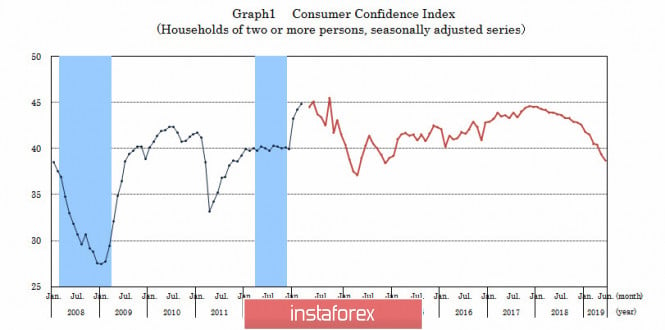

The business indices in the manufacturing and services sectors were worse than expected in June. Also, the consumer confidence index fell to 5-year lows at 38.7p.

At the same time, the Tankan indices for Q2 are stable and did not add additional concern.

A member of the Board of Directors of the Bank of Japan, Funo, has directly pointed out that there is no need to immediately respond to the growing difficulties in the economy with monetary measures. Apparently, BoJ will adhere to the previously announced strategy to keep rates at the current level until the spring of 2020, which inevitably makes the yen a favorite against the dollar and during this time, it will be under pressure from the Fed.

The political component for the yen also remains bullish. There is no reason to believe that the "truce" will lead to a deal between the United States and China. Moreover, it could push Trump to intensify against the EU and Japan in areas such as cars and agriculture. According to Trump, the yen's rate is too low that makes the potential for reducing the USD/JPY pair still remains. The yen will retest the recent low of 106.76 with an eye to 105.90/106.10.

The material has been provided by InstaForex Company - www.instaforex.com