Markets continue to play the outcome of the US Federal Reserve meeting. The S&P 500 updated its record high on Thursday, reaching 2958.38, gold futures went into an 18-month high zone, the yields of 10-year Treasures returned to November 2016 levels.

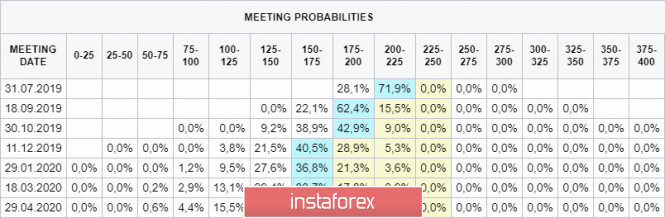

The change in the Fed's policy direction led to a re-evaluation of the rate forecasts. According to the CME futures market, a two-fold rate cut before the end of the current year is considered to be a decided matter, and the third reduction is quite probable. Such a market consensus leaves traders no choice, since it indicates a guaranteed weakening of the dollar in the second half of the year.

The question is not whether the dollar will fall, the question is only in the depth of the decline, because in addition to a drop in yields, panic from the rapidly approaching recession can be added at any time. The Fed assures that the US economy shows "moderate growth" and still expects the labor market to remain strong, and inflation will be pulled up to target 2%.

EURUSD

Consumer confidence, according to the European Commission, is down to -7.2p in June, which is slightly worse than forecast, and trust has been in negative territory for 7 months in a row, showing no signs of slowing down. The results of the study are in complete agreement with the slightly earlier published ZEW index, which noted a sharp decline in sentiment in the business environment.

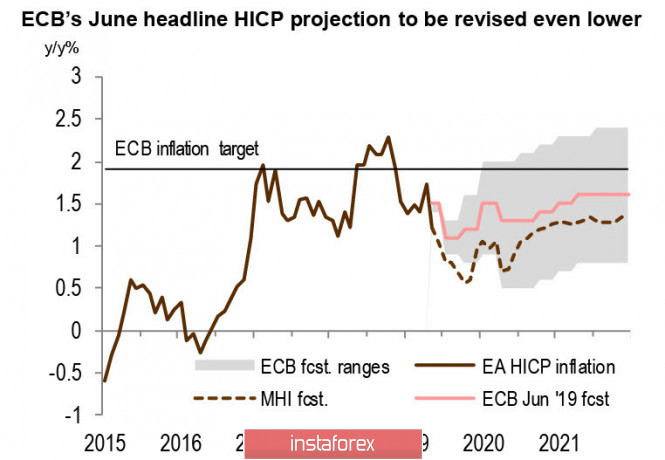

The point is that at the July meeting, the ECB will be ready to lower its inflation forecast, which will automatically entail a whole chain of consequences. A sharp decline in oil prices at the end of May raises the likelihood of the inflation forecast being lowered for 2020, and this year the markets may well see a decline in growth rates to 0.6% in the fall - a number of large banks, in particular Nordea and Mizuho, are inclined to these figures.

Accordingly, a decrease in inflationary expectations will be accompanied by a softening of monetary policy, which means that the planned beginning of the TLTRO3 may not be the ECB's main action in the coming months - it is quite possible to reduce the deposit rate. A recent study by the ECB of the effect of negative rates on macroeconomic indicators, contrary to the prevailing market opinion, focuses on a number of advantages for investors who are forced to reduce the amount of free cash and invest in large assets, which effectively stimulate the economy.

Reduced forecasts at the Fed rate triggered dollar sales across the entire spectrum of the foreign exchange market, but an overly strong euro is also a big problem for the ECB. While the threat of the eurozone economy falling into recession is small, there are no drastic steps for the ECB to take, so in the short term, the euro may well strengthen against the dollar for a couple of figures without any special consequences.

The 1.1130/35 target, designated as probable in the previous review, is canceled - the Fed has launched the dollar easing cycle. The euro may continue to grow, the nearest target is 1.1335/47, passing the resistance will make the euro's technical picture appear more bullish and will open the way to 1.1447.

GBPUSD

The Bank of England expectedly kept the interest rate unchanged at 0.75%, the decision was made unanimously in full accordance with the forecasts, the asset repurchase program was left unchanged.

Despite the fact that the Bank of England has confirmed its intention to start raising interest rates in the coming years, there are no objective reasons for such steps to be seen on the horizon. Zero growth is expected in the second quarter, which is quite logical given the deterioration in basic macroeconomic indicators. The volume of industrial orders, according to CBI, fell to -15p in June, which corresponds to three-year lows, growth in retail sales slowed down, inflationary expectations are falling before our eyes, therefore, the wishes of Committee members look utopian at the moment.

The chances of a deal with the EU before October 31 remain unclear as the country has entered a political crisis, and markets are increasingly skeptical about the likelihood of a successful conclusion to the Brexit saga.

The pound has updated its low, having reached 1.2504, however, a reversal of the Fed policy provides the opportunity to develop a correctional growth, a resistance test of 1.2760 is possible for today.

The material has been provided by InstaForex Company - www.instaforex.com