Dear colleagues.

For the currency pair euro/dollar, we continue to monitor the local upward structure of June 5; the level of 1.1363 is the key resistance and the level of 1.1259 is the key support. For the currency pair pound/Dollar, the upward trend is expected after the breakdown of 1.2755. For the currency pair dollar/franc, the price is in equilibrium and the development of the upward structure is expected after the breakdown of 0.9961. For the currency pair dollar/yen, the price forms the potential for the top of June 7. For the currency pair euro/yen, the continuation of the upward movement is expected after the passage by the price of the range of 122.87 - 123.06. For the currency pair pound/yen, the continuation of the upward structure development on June 4 is expected after the breakdown of 138.20.

Forecast on June 12:

Analytical review of the currency pairs in H1 scale:

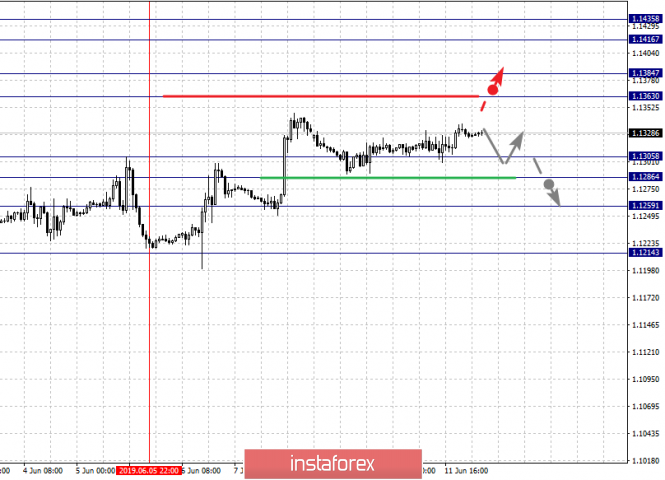

For the currency pair euro/dollar, the key levels on the H1 scale are 1.1435, 1.1416, 1.1384, 1.1363, 1.1305, 1.1286, 1.1259 and 1.1214. We continue to monitor the local upward structure from June 5. The short-term upward movement is possible in the area of 1.1363 – 1.1384 and the breakdown of the last value will lead to a pronounced movement. The goal is 1.1416. We consider the level of 1.1435 as a potential value for the top, upon reaching which, we expect consolidation in the area of 1.1416 – 1.1435, as well as a rollback to the correction.

The short-term downward movement is possible in the area of 1.1305 – 1.1286 and the breakdown of the last value will lead to a protracted correction. The goal is 1.1259 and this level is the key support for the upward structure. Its passage by the price will have to form the initial conditions for the downward cycle. The potential goal is 1.1214.

The main trend is the local structure for the top of June 5.

Trading recommendations:

Buy 1.1363 Take profit: 1.1382

Buy 1.1386 Take profit: 1.1416

Sell: 1.1305 Take profit: 1.1286

Sell: 1.1284 Take profit: 1.1262

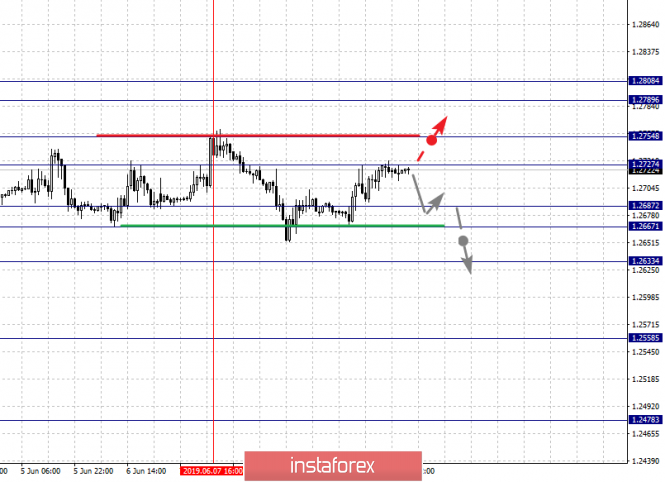

For the currency pair pound/dollar, the key levels on the H1 scale are 1.2808, 1.2789, 1.2754, 1.2727, 1.2687, 1.2667 and 1.2633. We continue to monitor the development of the upward cycle from May 31. At the moment, the price is in correction and forms the potential for a downward movement from June 7. We expect the continuation of the upward movement after the breakdown of 1.2727. In this case, the target is 1.2754 and near this level is the price consolidation. The breakdown of the level of 1.2755 should be accompanied by a strong upward movement. The target – 1.2808 and in the area of 1.2789 – 1.2808 is the consolidation rates and hence we expect a pullback to the bottom.

The short-term downward movement is possible in the area of 1.2687 – 1.2667 and the breakdown of the last value will lead to a protracted correction. The goal is 1.2633 and this level is the key support for the upward structure.

The main trend is the upward cycle from May 31, the stage of correction.

Trading recommendations:

Buy: 1.2728 Take profit: 1.2752

Buy: 1.2755 Take profit: 1.2787

Sell: 1.2686 Take profit: 1.2668

Sell: 1.2664 Take profit: 1.2638

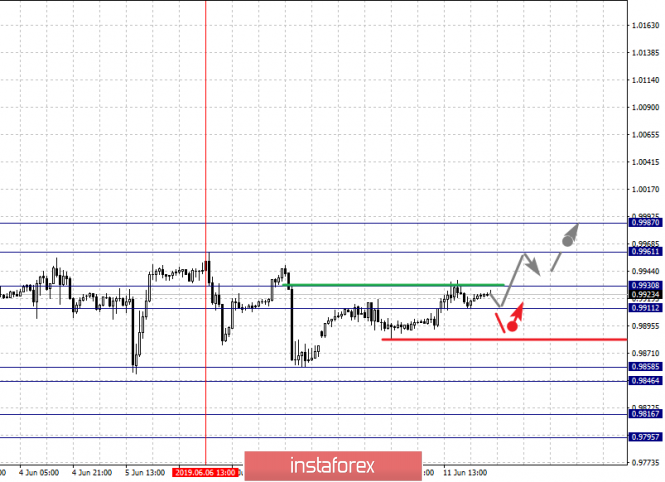

For the currency pair dollar/franc, the key levels in the H1 scale are 0.9987, 0.9961, 0.9930, 0.9911, 0.9858, 0.9846, 0.9816 and 0.9795. The price has entered an equilibrium state. The continuation of the downward movement is expected after the price passage of the range of 0.9858 – 0.9846. In this case, the goal is 0.9816. We consider the level of 0.9795 as a potential value for the bottom, near which we expect consolidation.

The consolidated movement is possible in the range of 0.9911 – 0.9930 and the breakdown of the last value will lead to the cancellation of the downward structure from June 6. In this case, the first potential target is 0.9961. We expect the initial conditions for the upward cycle to be formed at the level of 0.9987.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 0.9932 Take profit: 0.9960

Buy: 0.9963 Take profit: 0.9987

Sell: 0.9846 Take profit: 0.9816

Sell: 0.9814 Take profit: 0.9796

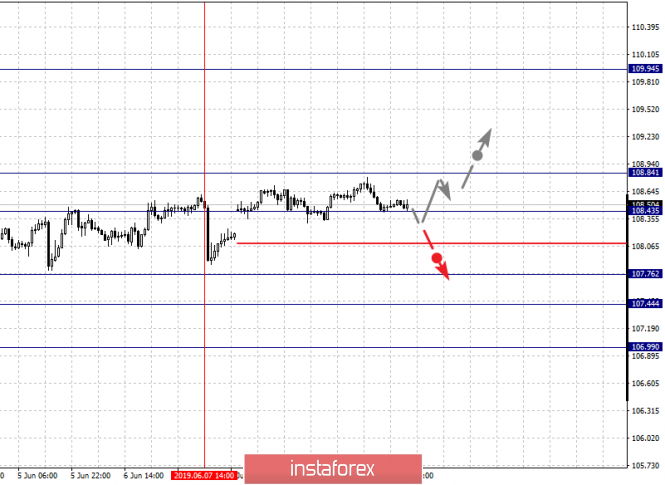

For the currency pair dollar/yen, the key levels in the scale of H1 are 108.84, 108.43, 107.76, 107.44 and 106.99. The price entered the equilibrium state: the downward trend of May 30 and the formation of the potential for the top of June 7. The short-term downward movement is expected in the area of 107.76 – 107.44 and the breakdown of the last value will lead to a movement to a potential target – 106.99, upon reaching this level, we expect a rollback to the top.

The short-term upward movement, as well as consolidation, is possible in the area of 108.45 – 108.84. The level of 108.84 is the key support for the downward structure. Its passage by the price will lead to the formation of the initial conditions for the upward cycle.

The main trend is the local structure for the bottom of May 30, the stage of correction.

Trading recommendations:

Buy: 108.45 Take profit: 108.82

Buy: Take profit:

Sell: 107.74 Take profit: 107.45

Sell: 107.42 Take profit: 107.00

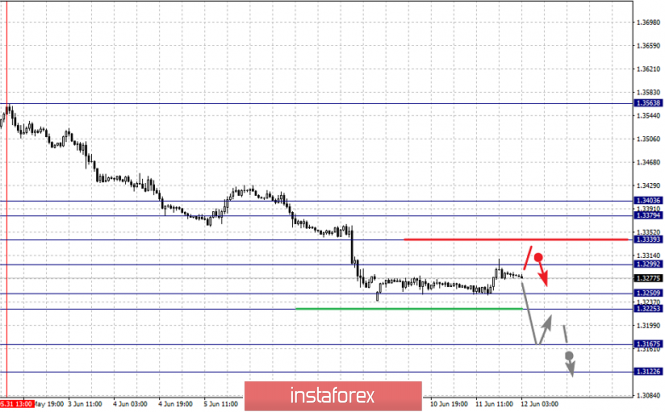

For the currency pair Canadian dollar/dollar, the key levels on the H1 scale are 1.3403, 1.3379, 1.3339, 1.3299, 1.3250, 1.3225, 1.3167 and 1.3122. We follow the development of the downward structure from May 31. We expect further development of the main trend after the price passes the range of 1.3250 – 1.3225. In this case, the target is 1.3167 and near this level is the consolidation. The potential value for the bottom is the level of 1.3122, from which we expect a rollback to the top.

The short-term upward movement is possible in the area of 1.3299 – 1.3339 and the breakdown of the last value will lead to a protracted correction. The goal is 1.3379 and the range of 1.3379 – 1.3403. Before it, we expect the expressed initial conditions for the upward cycle.

The main trend is the downward structure of May 31.

Trading recommendations:

Buy: 1.3300 Take profit: 1.3337

Buy: 1.3342 Take profit: 1.3379

Sell: 1.3225 Take profit: 1.3170

Sell: 1.3165 Take profit: 1.3124

For the currency pair Australian dollar/dollar, the key levels on the H1 scale are 0.6990, 0.6974, 0.6964, 0.6944, 0.6933, 0.6911 and 0.6893. We follow the formation of the capacity for the bottom of June 7. The short-term downward movement is expected in the range of 0.6944 – 0.6933 and the breakdown of the last value should be accompanied by a pronounced downward movement. The target is 0.6911. We consider the level of 0.6893 as a potential value for the bottom, upon reaching which, we expect a rollback to the top.

The short-term upward movement is possible in the area of 0.6964 – 0.6974 and the breakdown of the last value will lead to a protracted correction. The goal is 0.6990 and this level is the key support for the downward structure. Its passage by the price will have to form the initial conditions for the top. In this case, the potential target is 0.7021.

The main trend is the formation of capacity for the bottom of June 7.

Trading recommendations:

Buy: 0.6975 Take profit: 0.6990

Buy: 0.6995 Take profit: 0.7010

Sell: 0.6933 Take profit: 0.6913

Sell: 0.6909 Take profit: 0.6895

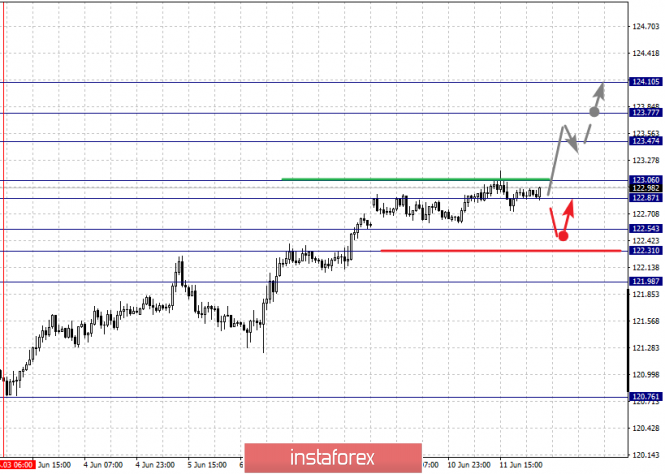

For the currency pair euro/yen, the key levels on the H1 scale are 124.10, 123.77, 123.47, 123.06, 122.87, 122.54, 122.31 and 121.98. We continue to follow the upward structure of June 3. The continuation of the upward movement is expected after the passage of the price of the range of 122.87 – 123.06. In this case, the goal is 123.47 and in the area of 123.47 – 123.77 is the price consolidation. We consider the level of 124.10 as a potential value for the top, upon reaching which, we expect a correction.

The short-term downward movement is expected in the area of 122.54 – 122.31 and the breakdown of the last value will lead to a protracted correction. The goal is 121.98 and this level is the key support for the top.

The main trend is the upward cycle of June 3.

Trading recommendations:

Buy: 123.06 Take profit: 123.45

Buy: 123.48 Take profit: 123.75

Sell: 122.54 Take profit: 122.33

Sell: 122.25 Take profit: 122.00

For the currency pair pound/yen, the key levels on the H1 scale are 139.44, 138.98, 138.67, 138.19, 137.47, 137.25, 136.97 and 136.52. We follow the development of the upward structure from June 4. We expect the continuation of the movement to the top after the breakdown of 138.20. In this case, the target is 138.67 and in the area of 138.67 – 138.98 is the short-term upward movement, as well as consolidation. We consider the level of 139.44 as a potential value for the top, upon reaching which, we expect a rollback to the bottom.

The short-term downward movement is expected in the area of 137.47 – 137.25 and the breakdown of the last value will lead to a protracted correction. The goal is 136.97 and this level is the key support for the top.

The main trend is the upward structure of June 4.

Trading recommendations:

Buy: 138.20 Take profit: 138.65

Buy: 138.69 Take profit: 138.96

Sell: 137.47 Take profit: 137.27

Sell: 137.20 Take profit: 136.98

The material has been provided by InstaForex Company - www.instaforex.com