Recently, EUR/AUD has been quite corrective and indecisive after breaking above 1.60 area with a daily close. The volatile phase is still not over as no impulsive bullish pressure was observed at a daily close which indicates further correction is coming.

The weak growth in the eurozone and mixed economic reports resulted in further indecision in the euro upward trend. According to the European Commission economic forecast, the euro is expected to continue suffering during 2019 with the hope of rebound in 2020. The GDP growth is anticipated to be at 1.2% comparing to 1.9% in 2018. At the same time, the unemployment rate will stay at 7.7% according to the forecast. This figure is better than previous ones but not the best. Summary budget deficit in the eurozone is expected to rise to 0.9% of GDP. Although debt of the eurozone is likely to decrease, it would be not enough to boost the euro. Moreover, the ongoing trade wars lead to weakness in emerging markets, especially in China. Additionally, Brexit that is constantly prolonged may end with a no-deal at all.

Today, German trade balance report was published with an increase to 20.0B from the previous figure of 18.7B which was expected to be at 19.4B. The French industrial production decreased to -0.9% from the previous value of 0.1% while the French preliminary private payrolls remained unchanged at 0.3% which was expected to decrease to 0.2%. Additionally, Italian retail sales report is yet to be published which is expected to increase to 0.3% from the previous value of 0.1%.

Today, the RBA Monetary Policy Statement was published where the central bank sharply downgraded outlook for growth and inflation. The bank indicated it would consider lowering interest rates unless unemployment falls further which would be a major step toward the first policy easing since 2016. The RBA predicted underlying inflation would remain below the mid-point of its 2-3% target band through mid-2021 while the wage growth is expected to be slower. The economy is seen slowing sharply to 1.75% in June from a year earlier, before picking up to 2.75% through to mid-2021. According to RBA governor Phillip Lowe, the board "concluded that the ongoing subdued rate of inflation suggests that a lower rate of unemployment is achievable while also having inflation consistent with the target."

As of the current scenario, the possibility of Australia's rate cut is expected to derive the market sentiment away from the Australian economy whereas positive economic reports from the euro zone can provide support to the euro. However, certain correction and volatility may be observed in the process.

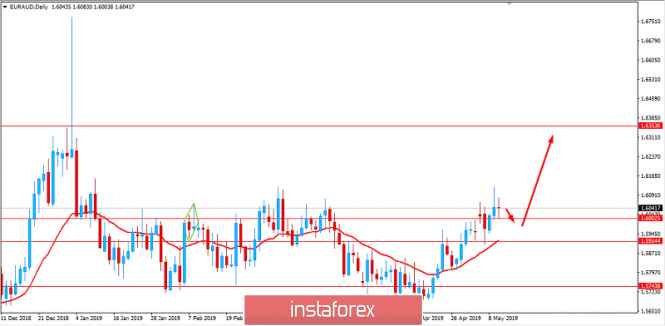

Now let us look at the technical view. The price is currently quite indecisive at the edge of 1.60 area from where the price is expected to throw back towards 1.5900 support area before pushing higher with target towards 1.6350 resistance area. As the price remains above 1.5900 area with a daily close, continuation of the bullish trend is expected in the coming days.