The EUR/CAD pair has been trading between 1.50 and 1.51 recently. It is likely to consolidate around this area. Meanwhile, the Canadian currency supported by today's BOC statement may regain momentum in the coming days.

The loonie has been struggling to resist the single currency lately as the weak Employment reports affected the economy and discouraged the CAD buyers. The Bank of Canada is expected to hold policy steady for the rest of this year, with calls for the next hike in early 2020 resting on a knife's edge, a Reuters poll showed, the latest dulling of rate expectations for a major central bank. The Canadian economy has taken a hit from the mandatory production cut of oil – its biggest export – a slowdown in the housing market and wilting business sentiment over worries surrounding the US-China trade war. All economists polled said the BoC will hold rates at 1.75 percent at its meeting today and about 60 percent of them say they will stay there through to the end of this year.

On the other hand, Europe is facing an economic slowdown as well as Brexit. Germany's ZEW economic sentiment survey, a key gauge of investor confidence, showed an increase last week. The reading had been in negative territory for the past 12 months and climbed into positive territory in April 2019. The Eurozone's ZEW indicator also improved to 4.5 from -2.5. It is also a positive sign. During the last meeting, the ECB mentioned that its focus would be to ensure the continued sustained conjunction of inflation close to 2% over the medium term. The leading indicator is important for traders and investors to measure market sentiment. The euro area's real Gross Domestic Product rose by 0.2% in the fourth quarter of 2018, following an increase of 0.1% in the Q3.

Last Week, the Consumer Price Index remained unchanged of 1.4% along with the Core CPI at 0.8%. The French Flash Service PMI rose from 49.1 to 50.5, while the German Flash Manufacturing PMI came out at 44.5 undershooting the forecast of 45.2. The Spanish Unemployment rate is in the spotlight this week. It is anticipated to remain unchanged at 14.5%.

As of the current scenario, CAD will have more chances to gain momentum over EUR if the upcoming economic reports and events turn out to be positive for the Canadian economy.

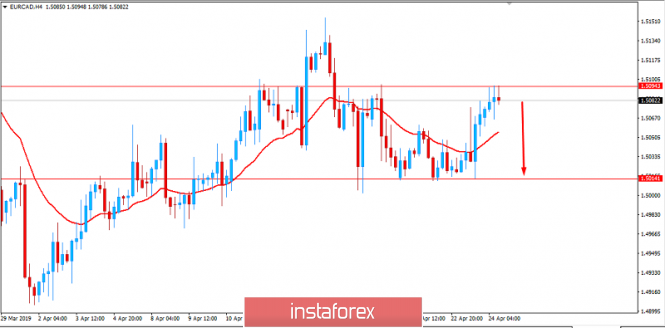

Now, let us look at the technical view. The price is currently retreating from the 1.5100 resistance area with a strong bearish momentum which is expected to lead the price lower towards 1.50 support area in the coming days. Though the price has been quite volatile earlier, breaking below 1.50 will trigger strong bearish bias or even a long-lasting bearish trend. As far as the price remains below the 1.51 area with a daily close, the bearish bias is forecast to continue.