JPY has been stronger against CAD since the bounce off 84.50 level which pushed the price lower by more than 100 pips. However, the Canadian currency managed to offset losses as the Bank of Canada provided an optimistic outlook for the upcoming development. The loonie is expected to maintain gains in the coming days.

The Bank of Canada has raised the interest rate five times since July 2017, although it kept the dovish stance on the back of the global trade concerns, slumping oil sector and a weaker housing sector. These factors dented the Canadian economic growth. According to BOC Governor Stephen Poloz, the economic slowdown caused by external effects is expected to be temporary and the worst-case scenario has already become invalid. Now its time to proceed forward, he said. According to the Bank of Canada's estimates, the neutral range for the interest rate is between 2.25 and 3.25 percent. The overnight interest rate is currently at 1.75 percent.

During this week's monetary policy meeting, the BOC decided to keep the interest rate unchanged at 1.75%. The corresponding statement was dovish. The BOC outlined that the global economic growth slowed more than anticipated. The bank expected the growth to pick up from the second quarter of 2019 while the housing activity and employment income were expected to be stabilized. The bank's forecast of the real GDP growth is 1.2% in 2019 and around 2% in 2020 and 2021. The core inflation expectations are just close to 2% are likely to be unchanged. According to the BOC, the labor market seems to be healthy amid wage increases.

On the JPY side, the BOJ intends to maintain the current extremely low levels of short- and long-term interest rates for an extended period of time. The bank decided to keep the interest rate unchanged and planned to purchase the Japanese government bonds (JGBs) in order to ensure that 10-year JGB yields remain at around 0%. The BOJ once again projected a moderate economic expansion with weaker exports due to global economic slowdown. The labor market is expected to be stronger while the inflation rate is likely to remain unchanged in the long run. The ultimate target for CPI is seen at 2%. The Core Consumer Price Index was published last week. It showed a better than expected result of 0.8%. Furthermore, the revised industrial production dropped from 1.4% to 0.7% while the All Industry Activity index dropped to -0.6%. At the same time, the unemployment rate missed the expectation this week while the retail sales increased to 1.0%. On the positive side, the trade balance came in at -0.18T, whereas the forecast was -30T. However, the last month's reading was revised lower to 0.03T. The mixed data from Japan is making the market volatile and corrective.

As of the current scenario, JPY is expected to lose momentum against CAD, but any positive economic reports from Japan can lead to certain volatility and indecision in the process.

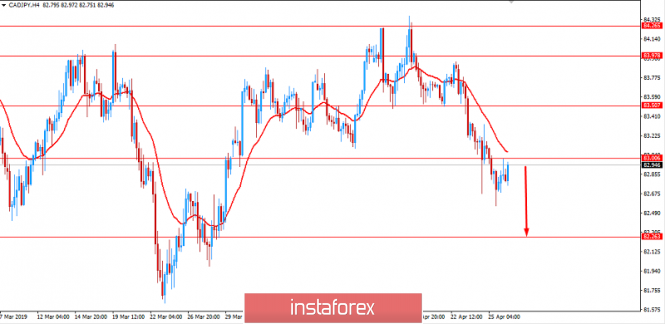

Now let us look at the technical view. After a break below 83.00 area with a daily close, the price is currently quite corrective and volatile. The pair is set to retest the resistance at 83.00 before progressing lower with the target at 82.00 and 80.00 which is the support area. As the price remains below 85.00 area with a daily close, the bearish bias is expected to continue further.