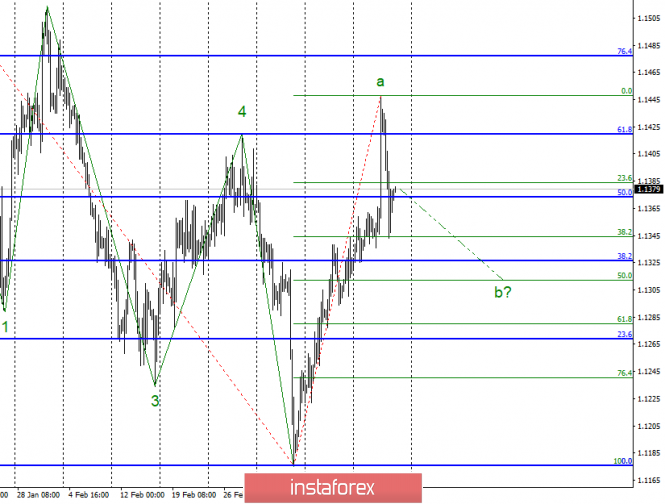

Wave counting analysis:

On Thursday, March 21, trading ended for EUR / USD by 50 bp lower. Thus, the assumption about the completion of the construction of the proposed wave a now looks convincing. If this is indeed the case, the decline in instrument quotes will continue with targets located near 38.2% and 50.0% Fibonacci levels. After the completion of the construction of this wave, the resumption of the upward trend plot construction is expected. The news background remains neutral for the pair, as the Fed's decision to abandon the rate hike in 2019, although it can support the Eurocurrency, but the policy of the ECB also remains a "pigeon".

Sales targets:

1.1344 - 38.2% Fibonacci (small grid)

1.1311 - 50.0% Fibonacci (small grid)

Purchase goals:

1.1477 - 76.4% Fibonacci

General conclusions and trading recommendations:

The pair allegedly completed the construction of wave a. Now I recommend short-term sales with targets located around 1.1344 and 1.1311, which corresponds to 38.2% and 50.0% Fibonacci, based on the construction of wave b. Around the levels that suggest the completion of this wave, I recommend to re-prepare to buy a pair with targets above the mark of 1.1450.

The material has been provided by InstaForex Company - www.instaforex.com