USD/JPY managed to gain bullish momentum after the price was rejected off the 109.50 support area with a daily close. The pair is expected to tarde under upward pressure in the coming days. Ahead of US GDP report, USD/JPY is set to trade with higher volatility with USD responsible for price gains.

USD lost momentum in March because the Federal Reserve confirmed its intention to put interest rates steady this year. Besides, a stream of weak macroeconomic reports from the US derived the market sentiment away from the US currency. After the FED raised rates 4 times in 2018, the regulator softened its rhetoric. In early 2019, the US central bank was considering at least 3 rates hike this year. According to FED member Bostic, there are also chances of rate cuts in 2019. Such a scenario is certainly bearish for the US currency. Tomorrow, US GDP report is going to be published. The economy is expected to decrease to 2.4% from the previous value of 2.6%. If the actual figure meets the expectation, it will be a precursor of a severe downturn in the US economy. So, negative data could incease volatility in the market.

On the other hand, the Bank of Japan is currently facing mounting challenges as the officials are discussing a higher inflation target than 2%. Japan depends heavily on imports for its energy requirements. Thus, the core consumer price index is affected due to Japan's dependency on oil prices. On the back of the trade war between the US and China, Japan's overall exports have also been affected. Therefore, downbeat foreign trade caused weakness of the domestic economy. Recently BOJ Core CPI report was published with a decrease to 0.4% from the previous value of 0.5% and SPPI rose to 1.1% from the previous value of 1.0% but failed to meet the expectation of 1.2%. More important reports from Japan will follow in Friday such as Tokyo Core CPI and Unemployment Rate reports which is expected to be unchanged. So, JPY is expected to struggle further.

To sum it up, USD is expected to gain momentum while JPY is struggling for gains. JPY weakness was caused by downbeat economic reports. However, any negative reading in the US GDP report will increase volatility that might trigger a bullish counter-momentum in the coming days.

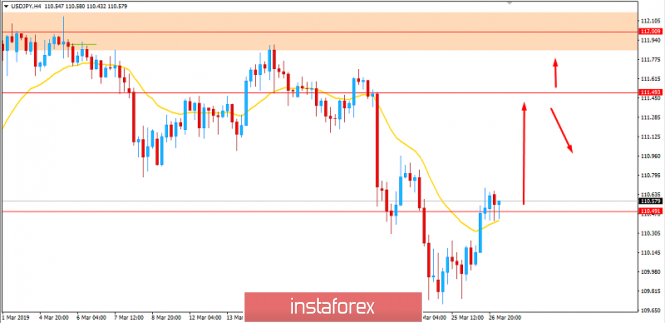

Now let us look at the technical view. The price is currently trading above 110.50 after retesting the level as support. Dynamic level of 20 EMA is holding the price higher. The price formed a Pin Bar formation from the same area. As the price remains above 110.00-50 support area, the bullish bias is expected to continue further with a target towards 111.50-112.00 resistance area, though higher volatility may be observed along the way.