Dear colleagues,

For the Euro / Dollar pair, we mainly expect a downward movement, which should occur after the breakdown of 1.1360. For the pair Pound / Dollar, the price is in deep correction and forms the potential from the bottom of February 27. The pair Dollar / Franc price forms the initial conditions for the top of February 28. The development of which is expected after the breakdown of 1.0022. The pair Dollar / Yen is following the development of the upward cycle of February 27. The development of the impulse is expected after the breakdown 112.23. For the Euro / Yen pair, we follow the upward cycle from February 22. We expect further uptrend after the breakdown of 127.61. On the Pound / Yen pair, the main development of the upward trend from February 22 is expected after the passage of the noise range 147.75 - 148.21, the level 146.80 key support.

For at Forecast March 4:

Analytical review of H1-scale currency pairs:

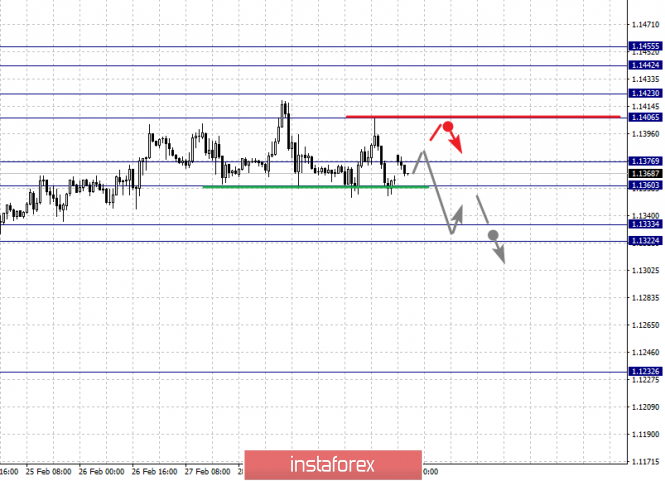

The for Euro / Dollar pair, the key a levels on the H1 scale are: 1.1455, 1.1442, 1.1423, 1.1406, 1.1376, 1.1360, 1.1333 and 1.1322. Here the price is in equilibrium. Short-term upward movement is expected in the corridor 1.1406 - 1.1423. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1442. The potential value for the top is considered the level of 1.1455, after reaching this level which we expect consolidation, as well as a rollback to the correction.

Short-term downward movement is possible in the corridor 1.1376 - 1.1360. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.1333. The range 1.1333 - 1.1322 is a key support for the upward structure.

The main trend is the equilibrium state.

Trading recommendations:

Buy 1.1406 Take profit: 1.1421

Buy 1.1424 Take profit: 1.1441

Sell: 1.1374 Take profit: 1.1361

Sell: 1.1358 Take profit: 1.1335

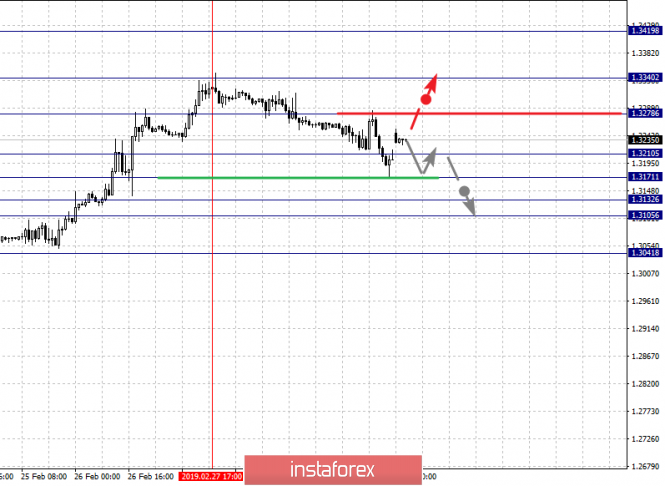

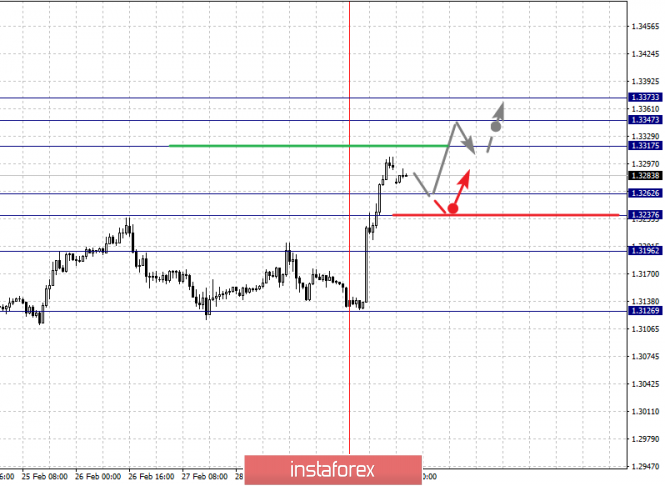

The for Pound / Dollar pair, the key a levels on the H1 scale are 1.3419, 1.3340, 1.3278, 1.3210, 1.3171, 1.3132, 1.3105 and 1.3041. Here, the price is in deep correction with the uptrend and forms the potential from the bottom of February 27. Short-term downward movement is expected in the corridor 1.3210 - 1.3171. The breakdown of the latter value will allow us to expect to move to level 1.3132, in the corridor 1.3132 - 1.3105 consolidation. The potential value for the bottom is considered the level of 1.3041. After reaching this level, we expect a rollback to the top.

Level 1.3278 is a key support for the downward structure of February 27. Its price passage will have to form a local ascending structure. In this case, the first target is 1.3340. As a potential value for the top, we consider the level 1.3419.

The main trend is the upward cycle of February 14, the stage of deep correction.

Trading recommendations:

Buy: 1.3278 Take profit: 1.3340

Buy: 1.3342 Take profit: 1.3417

Sell: 1.3210 Take profit: 1.3172

Sell: 1.3169 Take profit: 1.3132

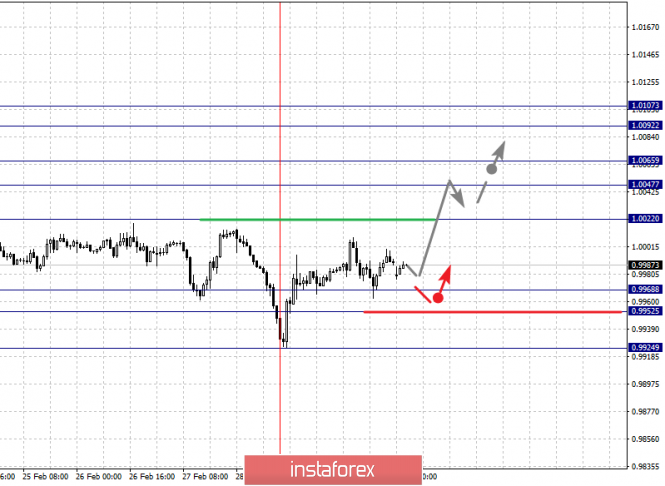

The for Dollar / by Frank pair, the key a levels on the H1 scale are: 1.0107, 1.0092, 1.0065, 1.0047, 1.0022, 0.9968, 0.9952 and 0.9924. Here, we follow the formation of the initial conditions for the top of February 28. The continuation of the upward movement we expect after the breakdown 1.0022. In this case, the target is 1.0047. In the corridor 1.0047 - 1.0065, a short-term upward movement is shown, as well as consolidation. The breakdown of the level of 1.0065 should be accompanied by a pronounced upward movement. Here the goal is 1.0092. The potential value for the top is considered the level of 1.0107, upon reaching which we expect consolidation, as well as a rollback to the top.

Short-term downward movement is possible in the corridor 0.9968 - 0.9952. The breakdown of the latter value will lead to movement to the first potential target - 0.9924.

The main trend - the formation of the ascending structure of February 28.

Trading recommendations:

Buy: 1.0022 Take profit: 1.0047

Buy: 1.0065 Take profit: 1.0090

Sell: 0.9968 Take profit: 0.9953

Sell: 0.9950 Take profit: 0.9925

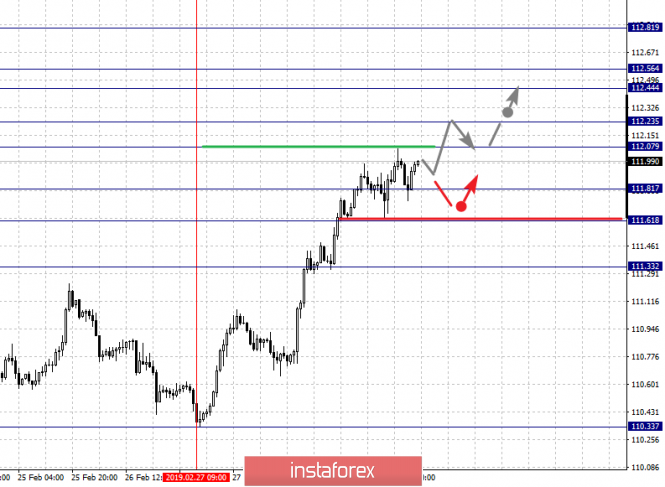

The for Dollar / to Yen pair, the key on the scale a levels are: 112.81, 112.56, 112.44, 112.23, 112.07, 111.81, 111.61 and 111.33. Here, we continue to monitor the ascending structure of February 27. Short-term upward movement is expected in the range of 112.07 - 112.23. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the goal is 112.44 in the corridor 112.44 - 112.56 consolidation of the price. The potential value for the top is considered the level of 112.81. After reaching this level, we expect a departure to a correction.

Short-term downward movement is possible in the corridor 111.81 - 111.61. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 111.33. This level is a key support for the upward structure of February 27.

The main trend: the upward cycle of February 27.

Trading recommendations:

Buy: 112.07 Take profit: 112.21

Buy: 112.25 Take profit: 112.44

Sell: 111.80 Take profit: 111.63

Sell: 111.58 Take profit: 111.35

For the Canadian dollar / Dollar pair, the key a levels on the H1 scale are: 1.3373, 1.3347, 1.3317, 1.3262, 1.3237 and 1.3196. Here, after the cancellation of the potential for downward movement, we are following the formation of the initial conditions for the top of March 1. Movement up is expected after breakdown 1.3317. In this case, the goal is 1.3347. The potential value for the uptrend for now is considered the level of 1.3373. Before which, we expect the registration of the expressed initial conditions.

Short-term downward movement is possible in the corridor 1.3262 - 1.3237. The breakdown of the latter value will lead to in-depth correction. Here, the goal is 1.3196. This level is a key support for the top.

The main trend is the formation of the initial conditions for the ascending cycle of March 1.

Trading recommendations:

Buy: 1.3317 Take profit: 1.3345

Buy: 1.3347 Take profit: 1.3372

Sell: 1.3261 Take profit: 1.3238

Sell: 1.3235 Take profit: 1.3198

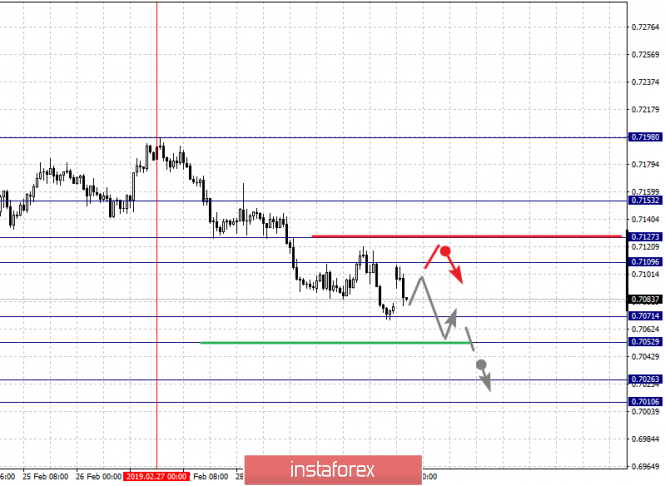

The for the Australian dollar / dollar pair, the key a levels on the H1 scale are : 0.7153, 0.7127, 0.7109, 0.7071, 0.7052, 0.7026 and 0.7010. Here, we are following the development of the downward cycle of February 27. Short-term downward movement is expected in the corridor 0.7071 - 0.7052. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the goal is 0.7026. The potential value for the bottom is considered the level of 0.7010, upon reaching which we expect a rollback to the top.

Short-term upward movement is possible in the corridor 0.7109 - 0.7127. The breakdown of the latter value will lead to a deep correction. Here, the target is 0.7153. This level is a key support for the downward structure.

The main trend is the downward cycle of February 27.

Trading recommendations:

Buy: 0.7109 Take profit: 0.7125

Buy: 0.7128 Take profit: 0.7152

Sell: 0.7070 Take profit: 0.7054

Sell: 0.7051 Take profit: 0.7026

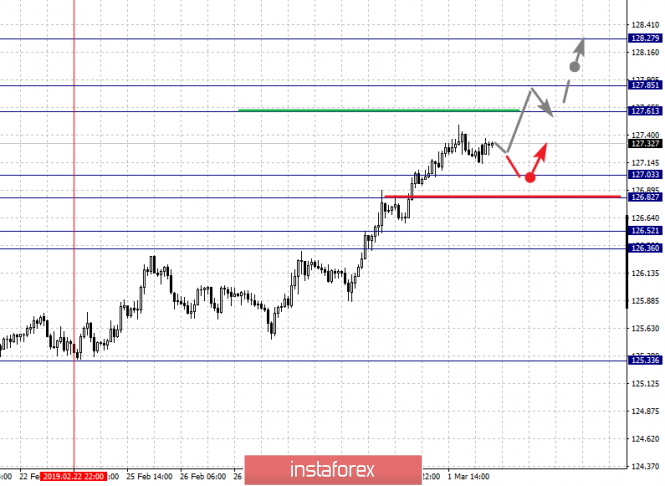

The for Euro / to Yen pair, the key a levels on the H1 scale are: 128.27, 127.85, 127.61, 127.03, 126.82, 126.52 and 126.36. Here, we continue to monitor the local ascending structure of February 22. A short-term upward movement is expected in the corridor 127.61 - 127.85. The breakdown of the last value will allow us to count on the movement towards a potential target - 128.27. From this level, we expect a departure to the correction.

Short-term downward movement is expected in the corridor 127.03 - 126.82. The breakdown of the latter value will lead to in-depth movement. Here, the target is 126.52 with Range 126.52 - 126.36 noise, to 126.36. We expect the initial conditions for the downward cycle.

The main trend is the local structure for the top of February 22.

Trading recommendations:

Buy: 127.61 Take profit: 127.82

Buy: 127.87 Take profit: 128.25

Sell: 127.03 Take profit: 126.84

Sell: 126.80 Take profit: 126.55

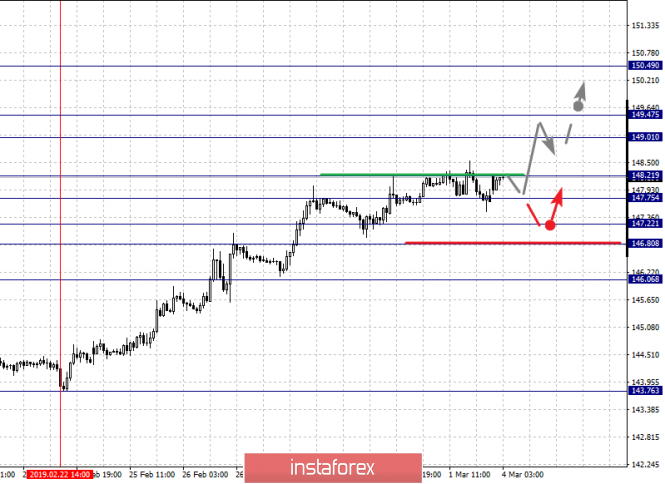

The for Pound / to Yen pair, the key a levels on the H1 scale are: 150.49, 149.47, 149.01, 148.21, 147.75, 147.22, 146.80 and 146.06. Here, we continue to monitor the ascending structure of February 22. Short-term upward movement is expected in the corridor 147.75 - 148.21. The breakdown of the latter value should be accompanied by a pronounced upward movement. Here, the target is 149.01 in the corridor 149.01 - 149.47 short-term upward movement, as well as consolidation. The potential value for the top is considered the level of 150.49, upon reaching which we expect a rollback downwards.

Short-term downward movement is possible in the corridor 147.22 - 146.80. The breakdown of the latter value will lead to in-depth correction. Here, the target is 146.06. This level is a key support for the top.

The main trend is the local structure for the top of February 22.

Trading recommendations:

Buy: 147.77 Take profit: 148.20

Buy: 148.25 Take profit: 149.00

Sell: 147.22 Take profit: 146.82

Sell: 146.78 Take profit: 146.10

The material has been provided by InstaForex Company - www.instaforex.com