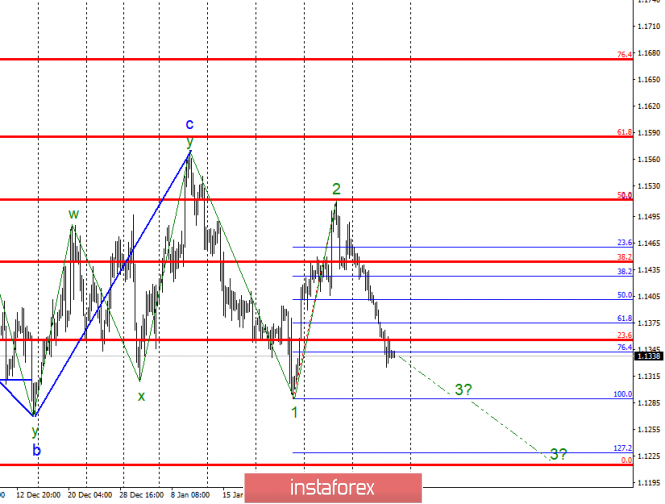

Wave counting analysis:

On Thursday, February 7, trading ended with a decline by another 40 basis points. Thus, the main option continues to be worked out, involving the construction of a downward wave 3 with targets located near the minimum of wave 1 and below. Wave 3 in its internal wave structure still does not look complete. After reducing to a minimum of wave 1, it will be necessary to understand whether the tool is ready to further reduce and build the impulse part of the trend, or the segment originating on January 10 is transformed into a three-wave structure with its completion around 13 or slightly lower. The development of a further trading strategy will depend on this.

Sales targets:

1,1289 - 100.0% Fibonacci

1.1215 - 0.0% Fibonacci

Shopping goals:

1.1444 - 38.2% Fibonacci

1.1514 - 50.0% Fibonacci

General conclusions and trading recommendations:

The pair continues to build a downward wave of 3. So now I still recommend selling the EUR / USD instrument with targets located near the levels of 1.1289 and 1.1215, which corresponds to 100.0% and 0.0% Fibonacci. There are no prerequisites for changing the working version and the need to complement the current wave marking.

The material has been provided by InstaForex Company - www.instaforex.com