NZD gained impulsive momentum with an opening gap today against USD. More macroeconomic reports and events will follow later this week.

Today New Zealand Retail Sales report was published with a notable climb to 1.7% from the previous value of 0.3% which was expected to be at 0.5% and Core Retail Sales also jumped to 2.0% from the previous value of 0.7% which was expected to be at 0.8%. Ahead of Trade Balance and ANZ Business Confidence, NZD is expected to be quite volatile due to weak expectations, but if any positive outcome from the events occur then further gain on the NZD side is expected in the future. As ANZ Business Confidence has been pushing harder to regain optimism by crawling towards 0.0 since August 2018, any positive figure from upcoming ANZ Business Confidence is expected to provide impulsive pressure for the NZD gains.

On the USD side, the domestic economy has been underperforming in certain sectors that pulled back the currency from further growth. Though there are certain headwinds which affected the overall growth of the economy, but the government shutdown is still taken as the main catalyst. Recently the Federal Reserve stated in a report of economic scorecard that Trump's Administration undershot a little to ensure its 3% annual GDP target for 2018. As per verdict, the elements which affected economic growth are the impact of tax cuts and other policies warning, wider Federal Reserve's deficit, and trade protectionism. On the other hand, during this period the only thing which was in uptrend was employment growth. Ahead of FED Chairman Powell's Testimony this week, USD is expected to be trade with higher volatility and may lose certain momentum until any the US provides upbeat economic data.

Meanwhile, NZD managed to gain certain momentum. But the question is still open how sustainable and reliable the upcoming move will be. Though there is a greater likelihood of volatility as high impact economic events on both currencies are yet to be published this week. If investors remain optimistic about the upcoming economic reports, then further gains on the NZD side is expected.

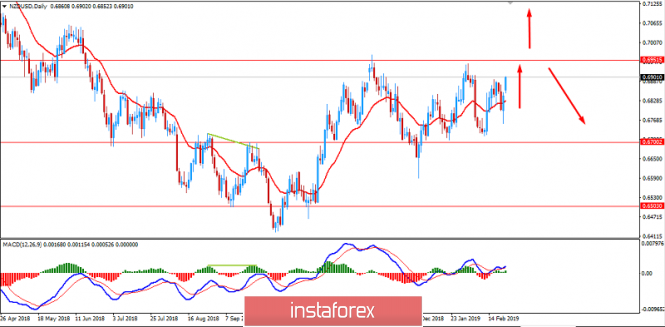

Now let us look at the technical view. The price is currently proceeding towards 0.6950-0.70 resistance area from where the price has certain possibility to push lower with a target towards 0.6700 area. On the other hand, a daily close above 0.70 is expected to lead to continuation of the bullish momentum with target towards 0.7150 resistance area in future. As the price remains above 0.6700 area with a daily close, the bullish bias is expected to continue.