GBP/USD has been quite impulsive amid the bearish momentum recently which is currently leading the price towards 1.30 price area. USD has been quite stronger than GBP in light of robust US nonfarm payrolls. On the other hand, USD growth is capped by dovish Fed's rhetoric on monetary policy and the recent government shutdown.

GBP has been struggling for gains due to downbeat economic reports and the unsettled Brexit deal ahead of March 29, 2019. Brexit developments have been the main driving force for GBP, whereas the downbeat economic data added to the drawdown even more. Negotiations are being held between the UK and the EU. There is a growing likelihood that the UK could leave the EU without any deal on tough conditions. In case of a hard Brexit, custom checks may be eased for at least three months in Britain for the goods arriving from Europe. A no deal BREXIT is expected to hamper not only the UK economy but also a large number of big companies in the world that might trigger extreme volatility in global financial markets. Recently, UK Construction PMI report was published with a decrease to 50.6 from the previous figure of 52.8 which was expected to be at 52.6 and today Services PMI report was published with a decrease to 50.1 from the previous figure of 51.2 which was expected to be at 51.1. The market-moving events this week are a BOE Inflation report, MPC Official Bank Rate Vote, Monetary Policy Summary, and an Official Bank Rate report which is expected to be unchanged at 0.75%.

On the USD side, the US Federal Reserve kept the official funds rate in December. The Labor Department released mixed employment data, being optimistic with the overall economic growth. As a result, USD is likely to extend strength this week. The Federal Reserve is currently quite patient with the interest rate decisions. Citing Cleveland FED President Mester, it is the best approach under the current situation. However, to boost the US sustainable economic growth, further rate hikes are needed. Today US ISM Non-Manufacturing PMI report is going to be published which is expected to decrease to 57.2 from the previous value of 57.6 and later President Donald Trump is also going to speak about the US-Mexico deal which is expected to contribute to USD gains.

Meanwhile, USD is expected to gain further momentum over GBP but certain spikes and volatility may be observed along the way which might lead to certain throwbacks along the way. Nevertheless, the long-term market sentiment is expected to be against GBP.

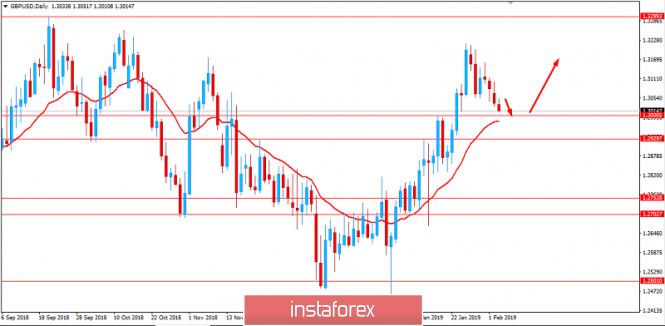

Now let us look at the technical view. The price is currently falling deeper towards 1.30 area which is expected to climb higher after retesting off the area with a daily close if any strong bullish momentum is observed with a daily close above the area. As the price remains above 1.30 area with a daily close, further bullish pressure is expected in this pair.

SUPPORT: 1.2930, 1.30

RESISTANCE: 1.3200, 1.3300

BIAS: BULLISH

MOMENTUM: VOLATILE