EUR managed to gain certain momentum over USD despite an economic slowdown in the eurozone. Besides, the Brexit deadline is just aorund the corner on March 29, 2019. Some of the ECB's hardliners are devising measures if the eurozone's economic slowdown gets much worse.

The eurozone's downturn was mainly caused by recession in Italy, stagnation in Germany, and a downgraded economic outlook for the 19-nation euro area. According to investors, EUR is currently is quite near to the weakest point which was recorded in mid-2017. The ECB's sentiment is quite nervous nowadays which might lead to certain wrong steps along the way. If the regulator provides a better solution than the latest one suggested by President Draghi, EUR might win back some of its losses, though its stength is likely to be short-lived. Economic indicators have revealed downbeat performance. Moreover, EUR is expected to extend broad-based weakness as analysts warn about more disappointing economic data to follow.

A disorderly BREXIT is also expected to impact the eurozone's economy. The eurozone is currently facing economic headwinds. France and Germany are currently working on the plans to reform EU competition rules to encourage positive changes through mergers of corporations.

On the other hand, USD is quite comfortable with unchanged interest rates despite the mixed economic reports from the US. USD could assert its strength, finding support from Fed's optimism. Recently FED's New York President John Williams stated that current interest rates are optimal and until the economic situation demands or inflation shifts, this steady rates are going to work fine towards progress. Recently NAHB Housing Market Index report was published with an increase to 62 from the previous figure of 58 which was expected to be at 59. Tomorrow, US Core Durable Goods Orders report is going to be published which is expected to increase to 0.2% from the previous value of -0.4% and Philly Fed Manufacturing Index is going to be published with a decrease to 15.6 from the previous figure of 17.0.

Moreover, the US and China are expected to make a trade deal by the deadline of March 1. Citing President Trump, the trade talks are going on well as planned. Tariffs on $200 billion worth of Chinese imports are schedule to rise 25% from 10% starting from March 1. If the parties are not ready to finalize the deal, it could be delayed.

Meanwhile, investors express confidence about the US - China trade deal that is bullish for USD. A slowdown in the eurozone's economy affects the overall EUR gains. Until the eurozone releases solid economic data and suggests sound solutions to spur economic growth, USD is going hold the upper hand in the short term.

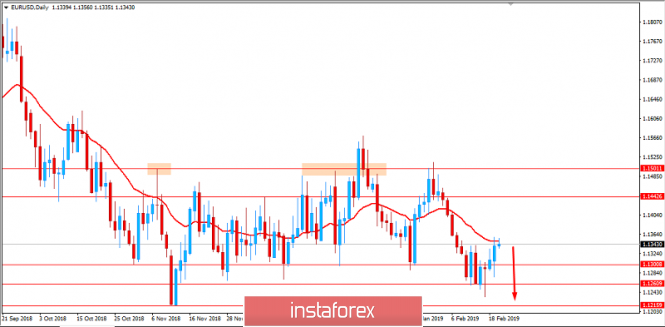

Now let us look at the technical view. The price is currently being held by the dynamic resistance of 20 EMA while residing below 1.1350 area which if perfectly held with a daily close below. In this case, further bearish pressure is expected in the pair which will lead the price towards 1.1200-50 support area in the coming days.