EUR/JPY is currently trading higher after breaking below 125.00 with a daily close recently. The price is expected to make a correctional decline along the way. The eurozone is facing a slowdown which has been proved by recent downbeat economic reports. This is certainly bearish for EUR.

Citing Finance Minister Mario Centeno, a slowdown in the eurozone's economy is caused by political risks which the EU policymakers should bear in mind. Most countries in the eurozone have reported evidence of a slowdown in their domestic economies that dents the overall growth in the eurozone. Another headwind is the looming divorce of the UK with the EU. Moreover, ECB Vice President Luis De Guindos recently stated that the inflation will rise on the back of higher wages and ultra-loose monetary policy. Today, German Buba President Weidmann is going to speak on the eurozone's key interest rates and future monetary policies. His speech is unlikely to provide EUR with support. In case the policymaker expresses hawkish rhetoric, certain bullish momentum is expected in the pair in the coming days.

On the JPY side, today M2 Money Stock report was published unchanged as expected at 2.4% whereas Tertiary Industry Activity showed a slight increase to -0.3% from the previous value of -0.4% which failed to meet the expected value of -0.1% and Prelim Machinery Tools Orders showed a slight decrease to -18.8% from the previous value of -18.3% which affected the overall JPY growth, leading to certain EUR gains for a while. At present, JPY is a firmer currency in the pair on the back of stronger Japan's economy, while a slowdown in the eurozone's economy is affecting EUR strength.

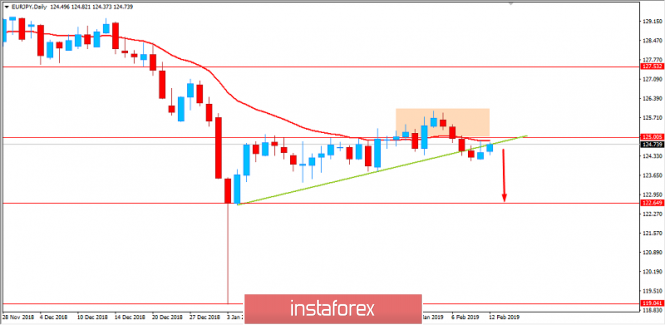

Now let us look at the technical view. The price has recently breached below 125.00 area and as well as the trendline support which is currently being retested. The price is currently expected to push lower towards 122.50 support area in the coming days as it remains below 126.00 area with a daily close.

SUPPORT: 122.50, 123.50

RESISTANCE: 125.00, 126.00

BIAS: BEARISH

MOMENTUM: VOLATILE