Reserve Bank of Australia's Governor Phillip Lowe today spoke quite optimistically about the growth of the economy. The hawkish statement from the RBA Governor helped AUD to regain momentum over USD after impulsive bearish pressure with a daily close.

Recently Australia's Wage Price Index report was published with a decrease to 0.5% which was expected to be unchanged at 0.6%. The worse economic report weakened the currency earlier. However, today AUD gained momentum after positive statements from RBA Governor Lowe.

Australian GDP is expected to be around 3% by 2019 and 2.75% by 2020. If achieved, stronger AUD is going to hold the upper hand in pair. Governor Lowe expressed good confidence about no rate hikes this year which is still variable as situation demands. The interest rate decision is very much depended on the inflation rate whereas any fluctuation on the inflation will lead to further variations.

Recently the US FED unveiled a shift in stance on the balance sheet that aroused criticism from some media sources. The Federal Reserve is currently thinking of stopping the unwind of $4 trillion balance sheet later this year that is strongly disliked by market watchers as they think it will be a terrible mistake. According to the FED, balance sheet reduction is going on for a year and it has not made a significant impact on the economy and financial markets yet, though the economy is expected to benefit from normalization of the balance sheet. Additionally, JP Morgan recently downgraded US Q1 GDP growth outlook to 1.5% from the previous forecast of 1.75%. There are several reasons, but the dongraded forecast is clearly leading the market to indecision and volatility.

Yesterday US Core Durable Goods Orders report was published with a minor increase to 0.1% from the previous value of -0.4% but it failed to meet the expected value of 0.3% and Philly FED Manufacturing Index was published with a decrease to -4.1 from the previous figure of 17.0 which was expected to be at 14.1. Another market moving event today is FED's Monetary Policy report. Besides, FOMC Members Williams and Clarida are due to speak later in the global trading day. These events are likely to inject volatility in the market.

Meanwhile, certain gains on the USD side may be observed in the coming days but AUD supported by the long-term optimistic view on the economy is expected to lead to certain bullish pressure in the pair in future.

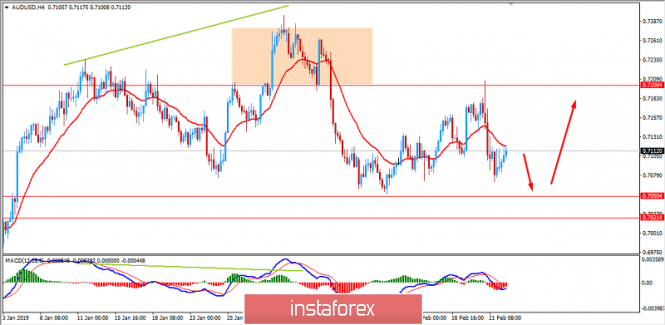

Now let us look at the technical view. The price is currently climbing higher after an impulsive bearish pressure. If bulls are rejected by strong bearish pressure, further downward momentum is expected in this pair for a certain period. As the price is heading towards 0.7000-50 support area, there will be certain probability for bullish intervention in future.