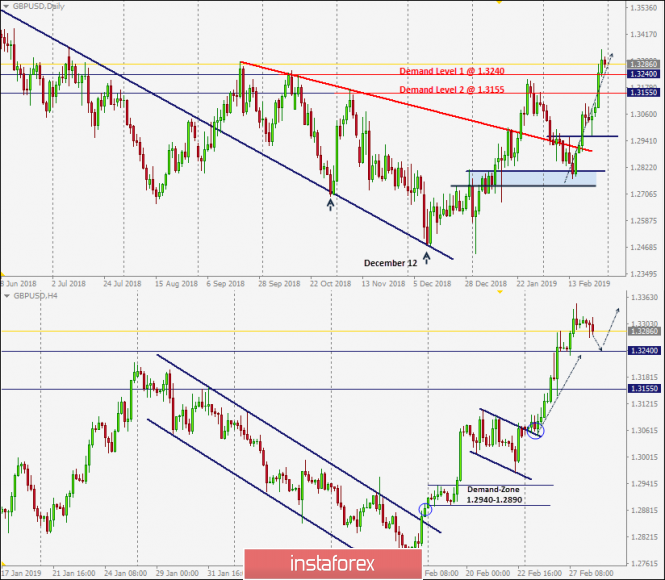

On December 12, the previously-dominating bearish momentum came to an end when the GBP/USD pair visited the price levels of 1.2500 where the backside of the broken daily uptrend was located.

Since then, the current bullish swing has been taking place until January 28 when the GBP/USD pair was almost approaching the supply level of 1.3240 where the recent bearish pullback was initiated.

Shortly after, the GBP/USD pair lost its bullish persistence above 1.3155. Hence, the short-term scenario turned bearish towards 1.2920 (38.2% Fibonacci) then 1.2820-1.2800 (50% Fibonacci level) within the depicted H4 bearish channel.

On February 15, significant bullish recovery was demonstrated around 1.2800-1.2820 (Fibonacci 50% level) resulting in a Bullish Engulfing daily candlestick.

This initiated the current bullish breakout above the depicted H4 bearish channel. Quick bullish movement was demonstrated towards 1.3155, 1.3240 and 1.3300.

Early signs of bearish reversal/retracement were demonstrated around the price level of 1.3317. Bearish pullback is expected to extend down towards 1.3240 and 1.3200 where price action should be watched cautiously.

Bullish persistence above the newly-established depicted demand-zone (1.3240-1.3155) is mandatory to allow further bullish advancement.

Any bearish breakdown below 1.3240 invalidates the short-term bullish scenario allowing a quick bearish movement to occur towards 1.3150 (lower limit of the demand zone).

Trade Recommendations :

Conservative traders should wait for a bearish pullback towards 1.3240 for a valid BUY entry. S/L to be located below 1.3190. T/P levels to be located around 1.3290, 1.1330 and 1.3360.

The material has been provided by InstaForex Company - www.instaforex.com