USD/CAD has been quite impulsive and non-volatile with the recent bearish momentum after bouncing off the 1.3650 resistance area with a daily close. Ahead of the Bank of Canada's Interest Rate decision, US FOMC minutes, and FED Chair Powell's speech, this pair is expected to be quite volatile and indecisive this week.

After the mixed employment reports published in the US recently, USD has been hurt by worse-than-expected data. So, USD lost ground in response. Recently US ISM Manufacturing PMI report was published with a decrease to 57.6 from the previous figure of 60.7 which was expected to be at 59.6 and JOLTS Job Opening also showed a decline 6.89M from the previous figure of 7.13M which was expected to be at 7.07M. Today ahead of FOMC Meeting Minutes, FOMC Members Evans and Rosengren are going to speak about the Fed's agenda for monetary tightening tat is expected to have a positive impact on USD. Besides, FED Chair Powell is going to speak tomorrow. His speech could be hawkish, leading to further gains of USD.

On the CAD side, recent positive economic reports like Ivery PMI showed an increase to 59.7 from the previous figure of 57.2 which was expected to be at 58.1 and Trade Balance posted a decrease to -2.1B as expected from the previous figure of -0.9B. Today the Bank of Canada Statement, Monetary Policy Report, and Overnight Rate decision are due later today. The benchmark interest rate is expected to be unchanged at 1.75%.

The Bank of Canada is uncertain about the recent economic status. Thus, the regulator is widely expected to put the key policy rate unchanged at 1.75%. As a result, CAD could lose certain grounds against USD in the coming days but the long-term bias is still on the side of CAD.

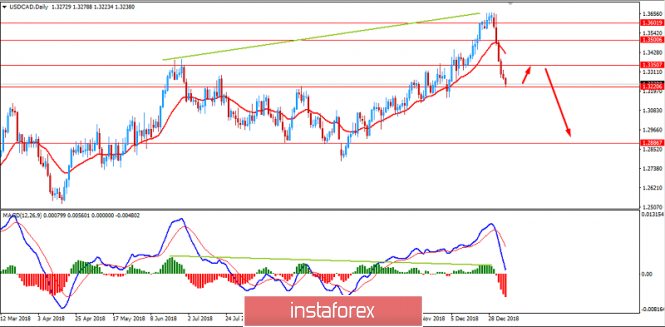

Now let us look at the technical view. After the Bearish Divergence was spotted, the price sank lower impulsively recently, leading the price to reside at the edge of 1.3200 area. On the grounds of the current price formation, the pair is expected to retrace higher towards 1.3350 area before moving lower with the trend with a target towards 1.3000 and later towards1.2850 support area. As the price remains below 1.3500 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 1.2850, 1.3000, 1.3200

RESISTANCE: 1.3350, 1.3500, 1.3600

BIAS: BEARISH

MOMENTUM: NON-VOLATILE