GBP/USD has been quite impulsive with the bullish momentum recently which led the price to break above the 1.30 area with a daily close. Ahead of Brexit, certain gain on the GBP side did create sudden surprise in the market, but having partial government shutdown for the last 35 days, it can be understood form a certain point of view.

Britain is working hard for the Brexit deal, but the fact whether it will be in line with the plan is still undecided. Today, the Parliament will vote on an array of attempts to unblock efforts to reach deal and avoid drastic result which may cause disruption in financial markets of Britain. The time is running out for Britain before leaving the European Union, so decision for the deal or its absence is currently very important. As Prime Minister Theresa May recently stated, she tried her best during the last 18 months to re-negotiate with the EU for re-writing the deal but failed. If the House of Commons does not ratify the Brexit agreement, the UK is expected to have no trading terms for the day of Brexit, that is, March 29, which eventually carries a risk of recession which might hit the economy in the future. Last time, the Parliament Vote rejected the Theresa May's proposal; today, the vote is expected to play a vital role for GBP to gain or lose momentum in the coming days.

On the USD side, the US economy is expected to lose $3 billion or more due to the impact of partial federal government shutdown on President Donald Trump's demand for border-wall funding. The shutdown is expected to hamper the growth of the US economy in 2019 by 0.02%, whereas 800,000 federal employees are left without pay for these days. In general, the US economy lost about $11 billion, but if everything settles down, this amount can be recovered very soon, but the fact when it is going to happen is still unknown. Today, CB Consumer Confidence report is going to be published which is expected to decrease to 125.0 from the previous figure of 128.1, whereas a worse result may lead to certain weakness in USD ahead of the FOMC meeting and NFP this week.

As of the current scenario, upcoming momentum for this pair is still indecisive, but the Brexit Vote and the FOMC Meeting this week are expected to play a vital role. Though GBP gained momentum, and as for the US shutdown, any positive decision from the side of USD is expected to lead to impulsive gains in the process.

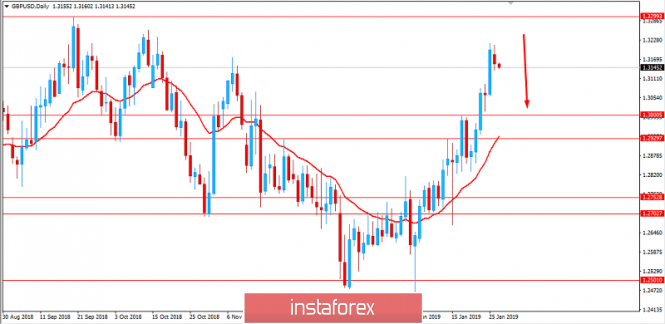

Now let us look at the technical view. The price closed with the bearish daily candle yesterday which is expected to lead to further downward pressure towards the 1.30 support area before it bounces higher in the future. As the price remains below the 1.3300 area with a daily close, the bearish pressure is expected to continue. The price is currently residing quite higher from the Mean Average which is expected to revert the price toward it in the coming days before any definite trend momentum can be established in the pair.

SUPPORT: 1.2930, 1.30

RESISTANCE: 1.3200, 1.3300

BIAS: BEARISH

MOMENTUM: VOLATILE