EUR/AUD has been corrective and volatile between the range of 1.5900-1.6000 from where it is expected to move lower in the coming days. EUR has been hurt by a series of painful economic data from the eurozone, BREXIT issue, and the interest rate dilemma. These factors derived the market sentiment away from EUR in favor of AUD.

According to ECB Policymaker Villeroy de Galhau, The European Central Bank is committed to keeping the interest rates low and unchanged as it winds down its monetary stimulus to the economy. The ECB believes that monetary policy of low rates is beneficial for the eurozone's economy in the long run which will let businesses grow under stable conditions. The UK is well set to leave the EU without a deal. This dismal scenario is expected to affect the EU as well as some of bigger manufacturing businesses like Ford. Yesterday the ECB maintained the key refinancing rate unchanged at a record low of 0.00% as expected that held back EUR from further gains. In Frankfurt, ECB President Draghi stated that the eurozone economy is already suffering from its biggest slowdown in half a decade which is putting questions on the interest rate hike agenda. The ECB confirmed that interest rates will be put on hold at least until summer 2019.

On the AUD side, Australian Employment Change report was published yesterday with a decrease to 21.6k which was better than the forecast of decreasing to 17.3k from the previous figure of 39.0k and an unemployment rate edged down to 5.0% which was expected to be unchanged at 5.1%. Though the Employment Change report revealed better than expected figures, it nearly decreased by 50% from the previous figure which hurt the economy by a certain extent. The Reserve Bank of Australia is currently taking a patient approach to monetary policy. The main market-moving report will be Q4 inflation report which is due next week. Economists generally expect consumer inflation to ease a pace of growth which could lead to a rate cut in the future. Today Australian Finance Minister Cormann said that both the US and China will benefit from ending their trade dispute that will help Australia to regain momentum.

Meanwhile, AUD found support from yesterday's employment reports. On the other hand, EURO is still struggling amid dismal economic data, thus losing favor with investors. During the global trading day, AUD is expected to extend its gains over EUR at least until the BREXIT deal is cleared up, thus propping up EUR.

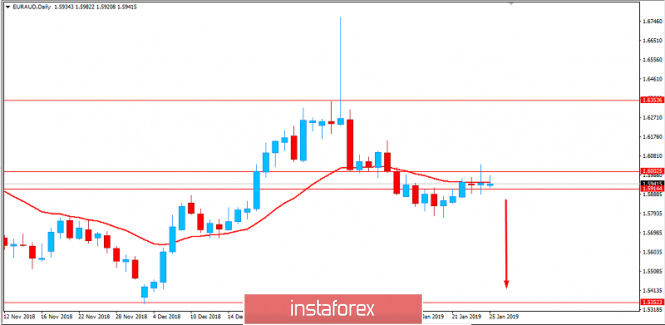

Now let us look at the technical view. The price has recently rejected off the 1.60 area with a bullish rejection in a daily candle which does indicate that the bears are currently trying to push the price lower with a target towards 1.55 and later towards 1.5350 support area. As the price remains below 1.60 area with a daily close, the bearish bias is expected to continue further.

SUPPORT: 1.5350, 1.5500

RESISTANCE: 1.6000, 1.6100-50

BIAS: BEARISH

MOMENTUM: VOLATILE