EUR/AUD has been consolidating at the edge of 1.5900-1.60 resistance area from where the price is expected to move lower in the coming days. EUR has been struggling to maintain momentum over AUD due to recent downbeat economic data, mounting budget crisis, and BREXIT developments.

The European Central Bank is currently expected to wait until the end of 2019 to raise its interest rates. Previously the ECB considered the rate hike by Summer 2019. The delay is assumed to be the result of a slowdown in economic growth which is proved by a series of weak economic data published recently. Though the recession risk is still alive and chances are rising significantly from 20% to 25%, Chief Euro Zone Economist Andrew Kenningham thinks that a further slowdown in the US economy or further escalation of US-China trade war may subdue the recession impact on the eurozone. The ECB is planning to raise its interest rate, including the Refinancing Rate from 0.0% to 0.20%. The first round of monetary tightening is likely to happen in early 2020. Brexit is an important risk for the eurozone which might disrupt exports to the UK. Notably, the British economy might also ease a pace of expansion. Today the eurozone Current Account report is going to be published which is expected to increase to 24.1B from the previous figure of 23.0B.

On the other hand, AUD managed to dominate EUR as the price bounced off the 1.6750 resistance area under strong bearish pressure leading the price below 1.6350. Currently AUD is making efforts to sustain bearish momentum in the pair. Australia recently published MI Inflation Expectation which was quite disappointing with a decrease to 3.5% from the previous value of 4.0% and Westpac Consumer Sentiment also showed a significant decrease to -4.7% from the previous value of 0.1%. Today Australia HIA New Home Sales report is going to be published which is tentative and previously was at 3.6%. Any positive reading will encourage gains on the AUD side, but a worse result may lead to further weakness against EUR in the process.

Meanwhile, EUR could regain momentum against AUD until AUD finds support from solid economic data.

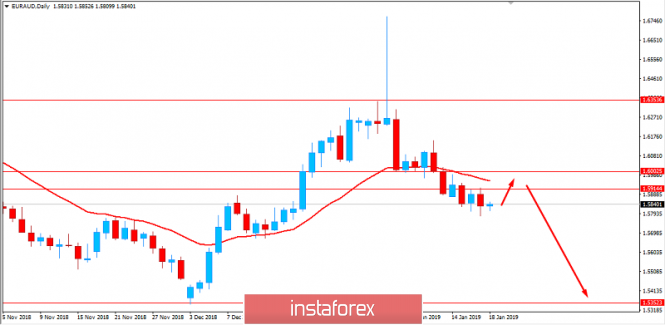

Now let us look at the technical view. The price is currently correcting itself at the edge of 1.5900-1.6000 area from where certain bullish pressure towards 1.60 is expected before the price continues with the bearish trend having target at 1.5500 and later towards 1.5350 area. As the price remains below 1.60 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 1.5350, 1.5500, 1.5750

RESISTANCE: 1.5900, 1.6000

BIAS: BEARISH

MOMENTUM: VOLATILE