USD/JPY has been quite impulsive with the recent bullish momentum while residing inside the corrective range from 111.50 to 114.50 area. USD, having worse employment reports published recently, was quite indecisive in the process but gained ground against JPY yesterday due to worse economic reports published recently.

JPY has been quite impulsive with the recent bearish momentum leading the price to correct further in the process. Recently Japan's Bank Lending report was published with a decrease to 2.1% which was expected to be unchanged at 2.2%. Furthermore, the Current Account decreased to 1.21T from the previous figure of 1.33T which was expected to be at 1.29T, while the Final GDP decreased to -0.6% from the previous value of -0.3% which was expected to be at -0.5%. Besides, the Final GDP Price Index was unchanged as expected at -0.3%. As the BOJ is struggling with the recent Financial issues including monetary policy easing and trade war, worse economic results added to the disaster more. Ahead of several high impact economic reports this week, JPY is expected to struggle further if the results are dovish.

On the USD side, the Federal Reserve's plans to continue raising interest rates next year were met with more skepticism on Wall Street on Monday. Though the Fed had a plan to raise the interest rate in 2019 at least 3 times which is currently turning to a pause and indecision due to sharp tightening of financial conditions. As of the recent worse Employment reports, the economic situation in the US is currently quite cautious and ahead of probable rate hike decision this month certain volatility may be observed. Today the US PPI report is going to be published which is expected to decrease to 0.0% from the previous value of 0.6%. The Core PPI is also expected to decrease to 0.1% from the previous value of 0.5%. Moreover, tomorrow CPI report is expected to be published with a decrease to 0.0% from the previous value of 0.3% and the Core CPI is expected to be unchanged at 0.2%.

As of the current scenario, US economic reports and fundamentals are quite dovish in nature whereas JPY is also struggling with certain financial pressures. Though USD has been quite dominating with the recent price action, any worse economic results publishing in the coming days may lead to certain gains on the JPY side in the coming days. As of upcoming US rate hike became indecisive, USD may see certain shift in market sentiment in the future.

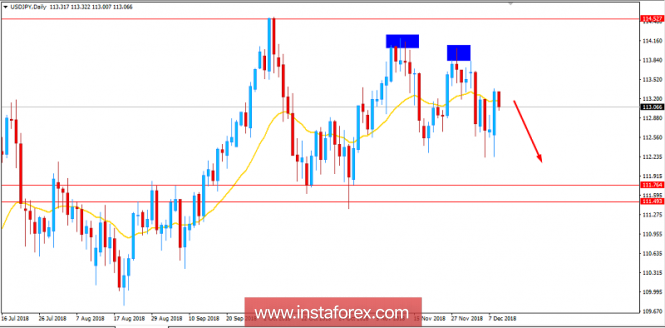

Now let us look at the technical view. The price is currently residing above 113.00 area at the edge of dynamic level of 20 EMA with a daily close. Recent bullish pressure was quite impulsive but may lead to certain weakness resulting to certain bearish pressure in the process. As the price remains below 114.00-50 area with a daily close, the bearish pressure is expected to continue with a target towards 111.50 support area in the coming days.

SUPPORT: 111.50, 112.00

RESISTANCE: 114.00-50

BIAS: BULLISH

MOMENTUM: VOLATILE