USD/CHF has been following the downward bias in light of the positive economic reports from Switzerland, published this week, despite the FED's hawkish rhetoric and mixed economic data from the US. Ahead of NFP reports which are due today, USD is expected to regain momentum against CHF, leading the price much higher in the coming days.

Federal Reserve Chairman Jerome Powell recently stated that US Economy remains on a sound footing. He is especially pleased about the job market. However, he did not say anything about upcoming interest rate hike which made the market sentiment quite indecisive. USD/CHF is set to trade with higher volatility ahead of the reports of crucial importance on the US market. Today US Average Hourly Earnings report is going to be published which is expected to increase to 0.3% from the previous value of 0.2, Non-Farm Employment Change is expected to decrease to 198k from the previous figure of 250k, and Unemployment Rate is expected to be unchanged at 3.7%. Though the expectations are mixed, the market is cautiously optimistic about USD that might lead to certain gains on the USD side if better-than-expected economic data is published today.

On the CHF side, recently Retail Sales report was published with an increase to 0.8% from the previous value of -2.5% which was expected to be at -0.7%, Manufacturing PMI rose to 57.7 from the previous figure of 57.4 which was expected to decrease to 56.3, and CPI contracted to -0.3% from the previous value of 0.2% which was expected to be at -0.1%. Today, Foreign Currency Reserves report was published with a decrease to 749B from the previous figure of 753B.

Meantime, CHF has found support from the economic reports published today. As a result, the market is in the wait-and-see mode ahead of NFP today. Though NFP reports expectations are mixed, better results may lead to impulsive gains on the USD side which might sustain further in the future as well.

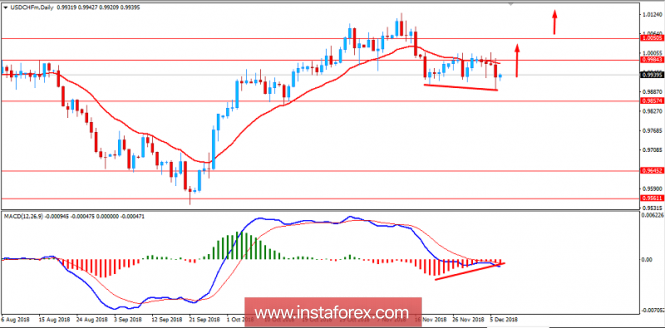

Now let us look at the technical view. The price has formed Bullish Divergence while pushing lower with certain corrections in the process. As for the current price formation, the price is expected to push higher towards 0.9980-1.0050 resistance area in the coming days. As the price remains above 0.9850 area, the bullish bias is expected to continue despite any further pullbacks or volatility in the pair.

SUPPORT: 0.9700, 0.9850

RESISTANCE: 0.9980, 1.0050

BIAS: BULLISH

MOMENTUM: VOLATILE