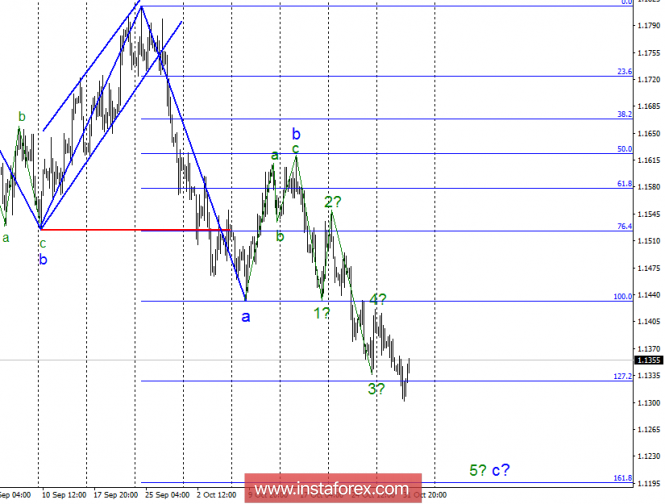

Wave counting analysis:

During Wednesday's trading, the EUR / USD currency pair lost another 35 basis points more and remains, therefore, in the framework of the construction of the proposed wave 5, c. If this is true, then the decline in quotations will continue, possibly after a small pullback, with targets located near the Fibonacci level of 161.8%. The wave 5, c, can take a shorter look, however, in the case a news background appears that will support the Eurocurrency. The breakdown of the level of 127.2% indicates that the pair is ready for a further decline.

The objectives for the option with sales:

1.1327 - 127.2% of Fibonacci

1.1194 - 161.8% of Fibonacci

The objectives for the option with purchases:

1.1522 - 76.4% of Fibonacci

1.1432 - 100.0% of Fibonacci

General conclusions and trading recommendations:

The currency pair continues to build wave 5, c. Thus, now I recommend selling the pair with a view to reducing quotes with targets near the mark of 1.1194. A successful attempt to break through the maximum of the supposed wave 4 will result in the conclusion that the construction of the downward wave is completed and the instrument moves to the upward trend section.

The material has been provided by InstaForex Company - www.instaforex.com