The general market climate is taken over by the stock market moves, where the sell-off of technology companies stretches from Wall Street through Asia and was weighing at the opening in Europe. For the currency market, it means an escape to JPY and CHF, but also a reduction in the long position in USD.

Investors must now balance the two trends. On the one hand, the weakness of the stock market speaks for an escape to safe assets, which can be seen in the strengthening of JPY and CHF. But in the face of a shorter week (Thanksgiving Holiday in the US on Thursday), it is reasonable to leave the market completely and wait for perturbations from aside without risking indigestion after consuming a huge turkey. In this respect, the largest threat concerns the holders of positions in USD. The seeds of anxiety sown by the Fed's representatives before the weekend and disappointing data (as in the index of developers' moods yesterday) are exactly that. With the withdrawal of US government bond yields (10-year olds are already at 3.05% against 3.17% a week ago), pressure on the dollar has many supporting arguments. This is above all good news for EUR, which has ceased to be a blacksmith of his own fate. If the market will decide to reduce long positions in the dollar, it will be the main force for pulling EUR / USD higher.

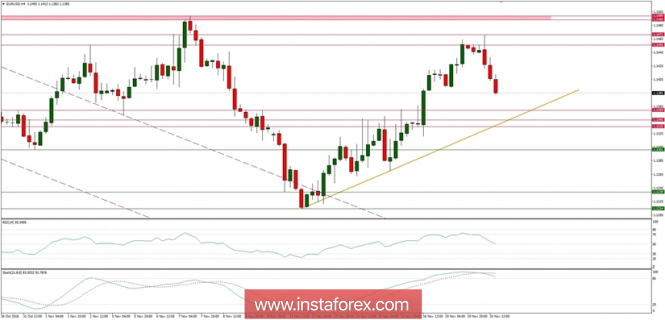

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The market has bounced from the level of 1.1400, made a new locl high at the level of 1.1471, but it was too weak to break through the technical resistance at the level of 1.1499. The price reversed and now is again testing the level of 1.1400 on neutral momentum in overboight market conditions. It all suggest the price might go lower towards the level of 1.1335 in order to test the golden trend line support. Breakout below the trend line is clearly bearish and the level of 1.1301 would be in view.