USD/CAD has been quite impulsive with the bullish gains recently. The price is expected to climb bit higher before a bearish counter-move off the 1.3300-50 area with a daily close. USD gained good momentum over CAD because of strong employment reports published recently. Thus, CAD is still struggling.

US employment reports were quite positive but as the US Budget report for October showed deficit of $100.5 billion which had a negative impact on the US currency. Though USD is currently going through an indecision phase, there are still certain reasons for USD to regain its momentum in the future which include a rate hike by the US central bank, equity market pressure, and protectionist trade policy. Moreover, better economic data will also be a fire-sure tool for the US currency to regain its momentum in the coming days. Fed Chair Powell's speech this week could provide clues for Fed's intentions on monetary policy. Thus, Powell's public remarks may detemine definite trend pressure in the short term.

On the CAD side, lasy week Bank of Canada's Governor spoke about headwinds in Canada's economy and how to overcome troubles. The optimistic approach gave certain clues for long-term development which had no immediate impact on CAD's growth versus USD. This week on Friday, Canada's Manufacturing Sales report is going to be published which is expected to increase to 0.3% from the previous negative value of -0.4% and Foreign Security Purchase is also expected have an increase from the previous figure of 2.82B.

Meanwhile, CAD is quite firm with the upcoming economic reports. On the other hand, hawkish remarks from Fed officials about further rate hikes could trigger volatility in the pair.

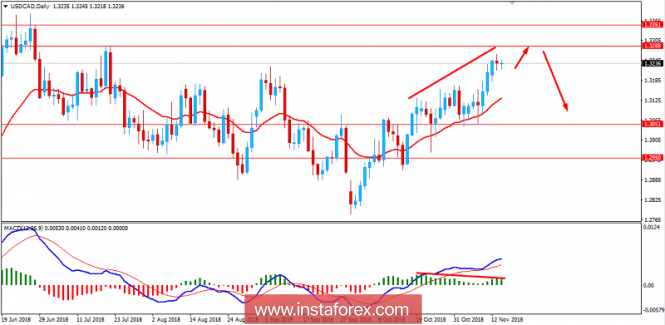

Now let us look at the technical view. The price has formed Bearish Divergence while pushing higher towards 1.3300-50 area from where the price is expected to reject with the bearish counter-move, leading to certain bearish pressure. As the price remains below 1.3350 area, there are certain chances of a bearish intervention in the bullish trend which might lead to certain counter-move with a target towards 1.3050 support area.

SUPPORT: 1.2950, 1.3050

RESISTANCE: 1.3300-50

BIAS: BULLISH

MOMENTUM: IMPULSIVE and NON-VOLATILE