NZD/USD has been quite volatile and corrective after being rejected off the 0.6850 area recently that is expected to lead to certain bearish momentum. Boosted by upbeat economic data, NZD managed to dominate USD earlier, leading the price above 0.6720 area with a daily close which is expected to be retested before continuing with the trend further.

Recently New Zealand PPI Input report was published with an increase to 1.4% from the previous value of 1.0% which was expected to decrease to 0.8%, PPI Output report was published with an increase to 1.5% which was expected to be unchanged at 0.9%, and Visitors Arrival also increased to 4.0% from the previous value of -1.7%. The positive economic reports provided a required push for the currency to gain momentum but was not sufficient for NZD to sustain the momentum over USD ahead of the imminent Rate Hike.

On the USD side, recently Core Durable Goods Orders report was published with an increase to 0.1% from the previous value of 0.0% but failed to meet expectations for a 0.4% gain, Durable Goods Orders slumped to -4.4% from the previous value of 0.7% which was expected to be at -2.2% and Unemployment Claims increased to 224k from the previous figure of 221k which was expected to decrease to 215k. The worse economic reports did not undermine USD. On the contrary, USD asserted srength. Today USD Flash Manufacturing PMI report is going to be published which is expected to increase to 55.8 from the previous figure of 55.7 and Flash Services PMI is expected to increase to 55.0 from the previous figure of 54.8.

Meanwhile, despite having worse economic reports certain gains in USD signals further bearish momentum in the pair. Besides, USD is expected to extend gains before the price continues with the bullish trend in the future. Ahead of the rate hike decision next month, USD is expected to hold the upper hand over NZD.

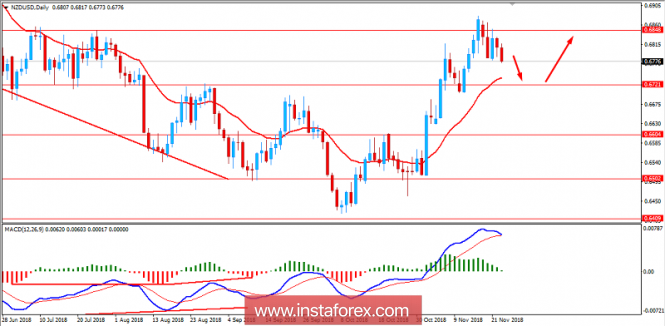

Now let us look at the technical view. The price is currently pushing lower towards 0.6720 area after bouncing off the 0.6850 area with a daily close which indicates further bearish momentum in the pair. As the price remains below 0.6850, bearish pressure created by pullbacks is expected in the coming days. The bullish bias is expected to remain constant as the price remains above 0.6500 area with a daily close.

SUPPORT: 0.65, 0.66, 0.6720

RESISTANCE: 0.6850, 0.70

BIAS: BULLISH

MOMENTUM: VOLATILE