Dear colleagues.

On the Euro / Dollar pair, the upward structure of October 31 is expected to develop after the breakdown of 1.1424. The pair Pound / Dollar is expected to continue moving up after the breakdown of 1.3020. The pair Dollar / Franc price is still in the zone of initial conditions for the downward movement of October 31, level 1.0057 key support. On the pair Dollar / Yen, the development of the main trend is expected after the breakdown of 113.46. For the Euro / Yen pair, we expect movement to the level of 129.50, we consider the downward movement as a correction. For the pair Pound / Yen, we have expanded the potential for the upward cycle to the level of 148.40.

Forecast for November 5:

Analytical review of H1-scale currency pairs:

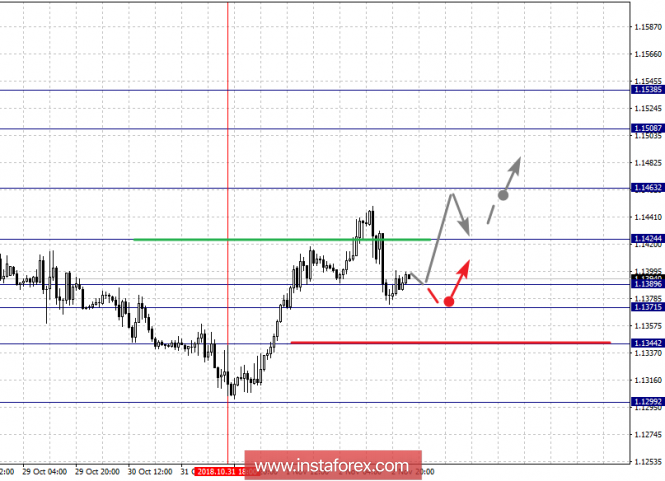

For the Euro / Dollar pair, the key levels on the H1 scale are: 1.1538, 1.1508, 1.1463, 1.1424, 1.1389, 1.1371, 1.1344 and 1.1299. Here, the price forms the potential for the top of October 31. Upward movement is expected after the breakdown of 1.1424, in this case, the target is 1.1463, price consolidation near this level. The breakdown of the level 1.1465 should be accompanied by a pronounced upward movement, here the target is 1.1508. The potential value for the top is considered the level of 1.1538, upon reaching which we expect consolidation, as well as a rollback to the correction.

Short-term downward movement is possible in the corridor 1.1389 - 1.1371, the breakdown of the latter will lead to the development of a prolonged correction, here the target is 1.1344, this level is a key support for the upward structure.

The main trend - the formation of potential for the top of October 31.

Trading recommendations:

Buy 1.1424 Take profit: 1.1460

Buy 1.1465 Take profit: 1.1508

Sell: 1.1370 Take profit: 1.1346

Sell: 1.1342 Take profit: 1.1308

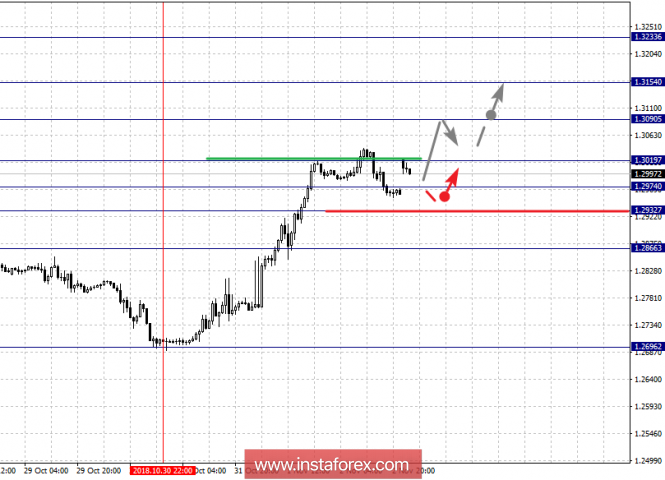

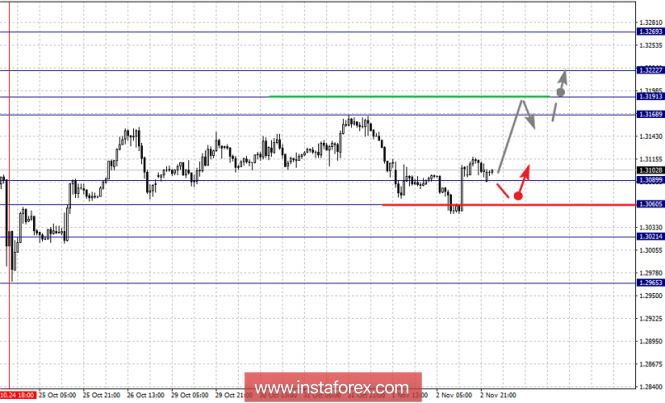

For the Pound / Dollar pair, the key levels on the H1 scale are 1.3233, 1.3154, 1.3090, 1.3019, 1.2974, 1.2932 and 1.2866. Here we are following the ascending structure of October 30. Upward movement is expected after breakdown of 1.3019, in this case the target is 1.3090, consolidation near this level, its breakdown will lead to movement up to 1.3154. The potential value for the top is considered the level of 1.3233, from which we expect the development of a prolonged correction.

Short-term downward movement is possible in the corridor 1.2974 - 1.2932, the breakdown of the latter value will lead to a prolonged correction, here the target is 1.2866, this level is a key support for the top.

The main trend is the ascending structure from October 30.

Trading recommendations:

Buy: 1.3020 Take profit: 1.3090

Buy: 1.3093 Take profit: 1.3152

Sell: 1.2974 Take profit: 1.2935

Sell: 1.2930 Take profit: 1.2870

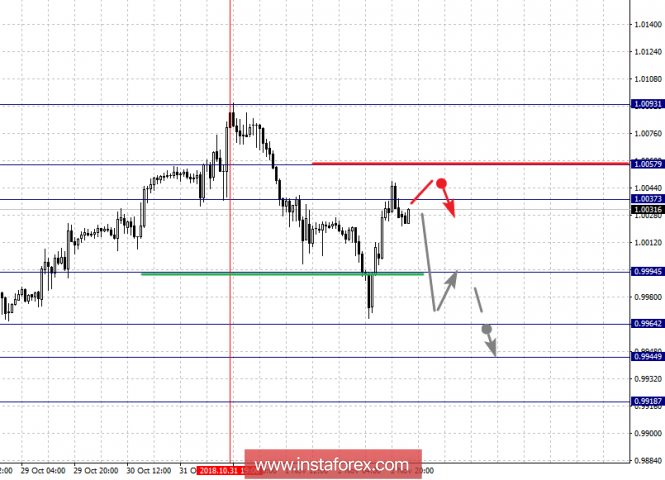

For the Dollar / Frank pair, the key levels on the H1 scale are: 1.0093, 1.0057, 1.0037, 0.9994, 0.9964, 0.9944 and 0.9918. Here, the price forms the potential for downward movement of October 31. Continuation of the downward movement is expected after the breakdown of 0.9994, in this case the target is 0.9964, in the corridor 0.9964 - 0.9944 price consolidation. The potential value for the bottom is considered the level of 0.9918, after reaching which we expect a rollback to the top.

Short-term upward movement is possible in the corridor 1.0037 - 1.0057, the breakdown of the latter value will have to form an ascending structure, in this case the goal is 1.0093.

The main trend - the formation of a downward structure of October 31.

Trading recommendations:

Buy: 1.0037 Take profit: 1.0055

Buy : 1.0063 Take profit: 1.0090

Sell: 0.9994 Take profit: 0.9967

Sell: 0.9962 Take profit: 0.9948

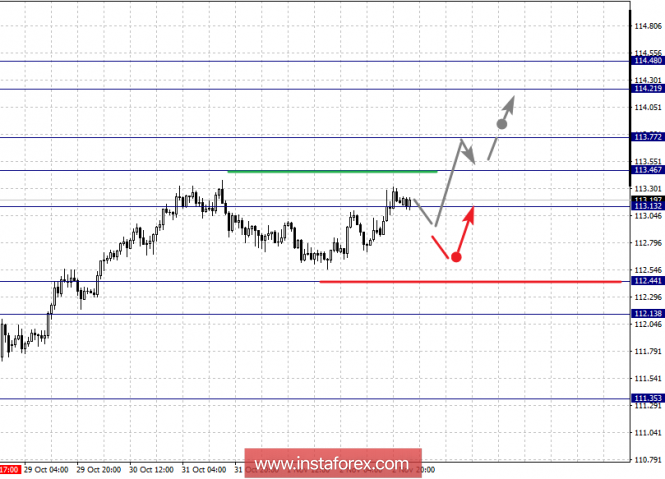

For the Dollar / Yen pair, the key levels on a scale are 114.48, 114.21, 113.77, 113.46, 113.13, 112.44 and 112.13. Here we are following the development of the ascending cycle of October 26. Upward movement is expected after breakdown of 113.13, in this case the first target is 113.46. Short-term upward movement is possible in the corridor 113.46 - 113.77, the breakdown of the last value should be accompanied by a pronounced upward movement, here the goal is 114.21. The potential value for the top is considered the level of 114.48, after reaching which we expect a rollback downwards.

The range 112.44 - 112.13 is a key support for the upward structure, in it we expect a short-term downward movement, as well as a key upward reversal. Breakdown of the level of 112.13 will lead to the formation of the initial conditions for the downward cycle.

The main trend: the ascending cycle of October 26, the stage of correction.

Trading recommendations:

Buy: 113.13 Take profit: 113.44

Buy: 113.48 Take profit: 113.75

Sell: 112.44 Take profit: 112.20

Sell: Take profit:

For the Canadian dollar / Dollar pair, the key levels on the H1 scale are: 1.3269, 1.3222, 1.3191, 1.3168, 1.3089, 1.3060 and 1.3021. Here we are following the local structure for the top of October 24, at the moment the price is in a protracted correction. Upward movement is expected after the price passes the noise range of 1.3168 - 1.3191, in this case the first target is 1.3222, consolidation near this level. The potential value for the top is considered the level of 1.3269, after reaching which we expect a rollback to the correction.

Short-term downward movement is possible in the corridor 1.3089 - 1.3060, hence a high probability of a reversal upwards, a breakdown of the level 1.3060 will lead to a prolonged correction, here the target is 1.3021.

The main trend is the local structure of October 24, the stage of deep correction.

Trading recommendations:

Buy: 1.3191 Take profit: 1.3220

Buy: 1.3224 Take profit: 1.3269

Sell : 1.3089 Take profit: 1.3062

Sell: 1.3058 Take profit : 1.3024

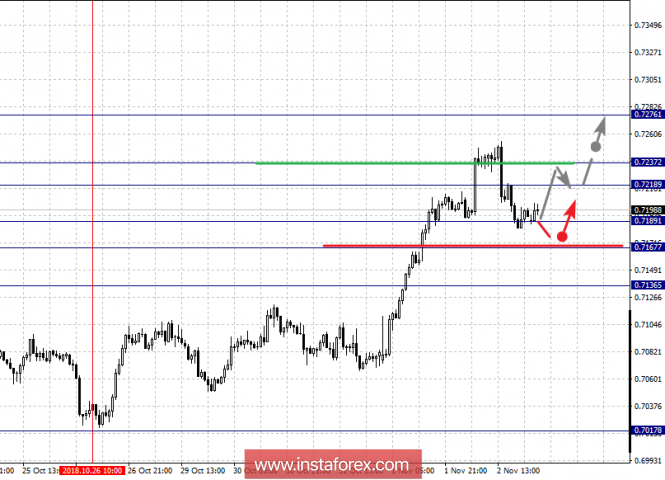

For the Australian dollar / dollar pair, the key levels on the H1 scale are : 0.7189, 0.7167, 0.7136, 0.7110, 0.7062, 0.7040 and 0.7017. Here we are following the rising structure of October 26, at the moment the price is in the correction. Short-term upward movement is possible in the corridor 0.7218 - 0.7237, the breakdown of the latter value will allow to expect movement towards a potential target - 0.7276, upon reaching this level we expect a rollback downwards.

Short-term downward movement is possible in the corridor 0.7189 - 0.7167, breaking the last value will lead to a prolonged correction, here the target is 0.7136, this level is a key support for the top.

The main trend is the upward cycle of October 26, the stage of correction.

Trading recommendations:

Buy: 0.7218 Take profit: 0.7235

Buy: 0.7240 Take profit: 0.7274

Sell : 0.7187 Take profit : 0.7170

Sell: 0.7165 Take profit: 0.7143

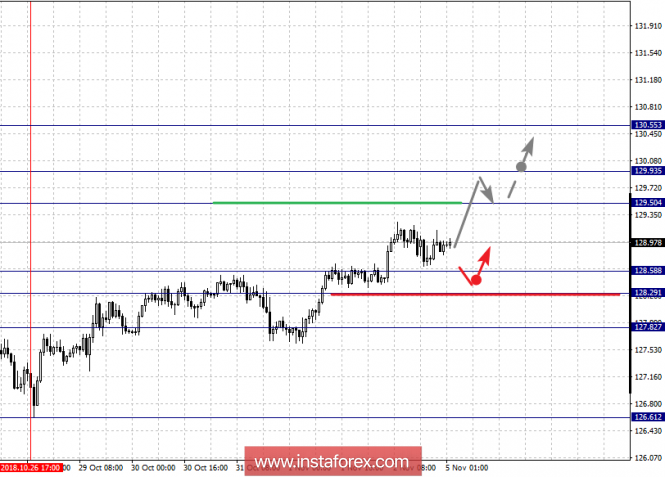

For the Euro / Yen pair, the key levels on the H1 scale are: 130.55, 129.93, 129.50, 128.58, 128.29 and 127.82. Here we are following the rising structure of October 26. Short-term upward movement is expected in the corridor 129.50 - 129.93, the breakdown of the last value will lead to the movement to the potential target - 130.55, after reaching which we expect a rollback to the correction.

Short-term downward movement is possible in the corridor 128.58 - 128.29, the breakdown of the last value will lead to a prolonged correction, here the goal is 127.82, this level is a key support for the top.

The main trend is the upward structure of October 26.

Trading recommendations:

Buy: 129.50 Take profit: 129.90

Buy: 130.00 Take profit: 130.50

Sell: 128.55 Take profit: 128.33

Sell: 128.25 Take profit: 127.90

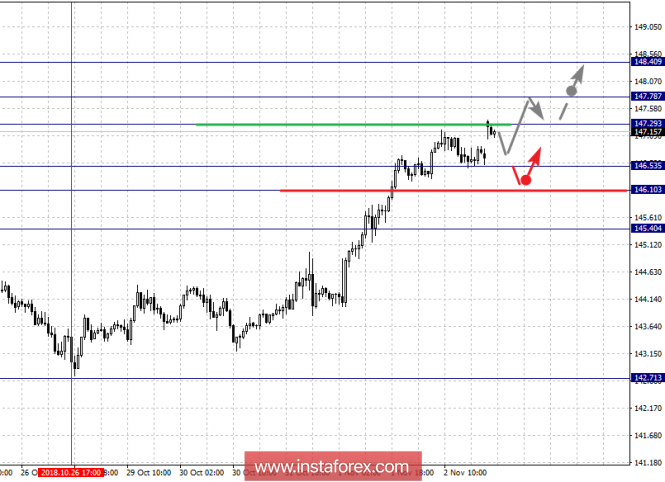

For the Pound / Yen pair, the key levels on the H1 scale are: 148.40, 147.78, 147.29, 146.53, 146.10 and 145.40. Here we are following the ascending cycle of October 26th. Short-term upward movement is possible in the corridor 147.29 - 147.78, the breakdown of the latter value will lead to movement to the potential target - 148.40, upon reaching this level we expect a rollback downwards.

Short-term downward movement is possible in the corridor 146.53 - 146.10, the breakdown of the latter value will lead to a prolonged correction, here the target is 145.40, this level is a key support for the upward structure.

The main trend is the upward cycle of October 26.

Trading recommendations:

Buy: 147.30 Take profit: 147.74

Buy: 147.85 Take profit: 148.40

Sell: 146.50 Take profit: 146.15

Sell: 146.05 Take profit: 145.50

The material has been provided by InstaForex Company - www.instaforex.com