GBP/USD has been quite impulsive amid the bearish bias today after being rejected off the 1.3050 area with a daily close recently. After the recent rate hike from 2.00% to 2.25%, USD gained good sustainable momentum in the market against GBP which is expected to extend further in the coming days.

Today the UK Nationwide HPI report was published with an increase to 0.3% from the previous value of -0.5% which was expected to be at 0.2% but Construction PMI report showed a decline to 52.1 from the previous figure of 52.9 which was expected to be at 52.8. Ahead of the high impact Services PMI report tomorrow which is expected to decrease to 54.0 from the previous figure of 54.3, GBP is still quite weak against USD. Besides, any worse-than-expected results may deal another blow to the British currency.

On the other hand, ahead of NFP reports this week USD is trading with higher volatility. Today FED Chairman Powell is going to speak about the centeral bank's plans for further monetary tightening. In light of the recent rate hike from 2.00% to 2.25%, USD gained good momentum against all the majors which is expected to continue further though certain correction and retracement can be observed along the way.

Meanwhile, USD is still quite impressive with the recent gains. On the other hand, GBP has been undermined by weak expectations from the upcoming economic reports. Thus, soft fundamentals are the reason for further bearish pressure in the coming days.

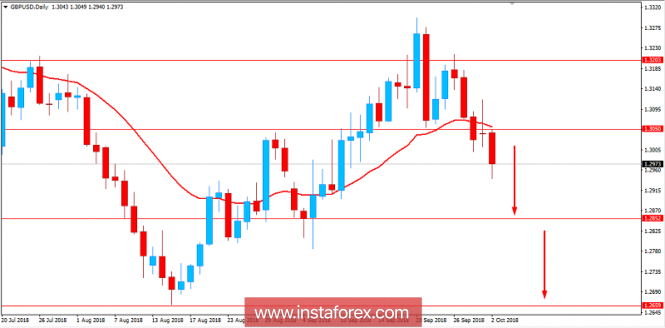

Now let us look at the technical view. The price has been quite impulsive with the bearish gains after rejecting off the 1.3050 area and dynamic level of 20 EMA which is expected to lead to further bearish pressure with target towards 1.2850 and later towards 1.2650 area. As the price remains below 1.3050 with a daily close, the bearish bias is expected to continue further.

SUPPORT: 1.2850, 1.2650

RESISTANCE: 1.3050, 1.3200

BIAS: BEARISH

MOMENTUM: IMPULSIVE