EUR/JPY has been quite impulsive with the recent bullish gains which led the price to reside above 132.00 area with a daily close. JPY has lost footing against EUR despite mixed economic reports from the eurozone.

BOJ is currently keeping its monetary policy without any notable changes or rate hikes that is expected to lead to long-term weakness against EUR in the process. Today Bank of Japan Monetary Policy Meeting Minutes were released which did not have much impact on the JPY gains, leaving things neutral enough to affect the market sentiment. SPPI report was published with an increase to 1.3% which was expected to be unchanged at 1.1%. Additionally, BOJ Governor Kuroda spoke today about the nation's key interest rate and future monetary policy which did not change market sentiment, leading to further weakness of the currency.

Today German WPI report was published with an increase to 0.3% from the previous value of 0.1% which was expected to be at 0.2%. The positive reading helped EUR to gain certain momentum in the process ahead of a series of high impact economic reports yet to be published this week.

Meanwhile, EUR is still the stronger currency in the pair while JPY has been struggling to gain momentum amid the stable rhetoric taken by BOJ without any signals for monetary tightening. As EUR manages to provide better than expected results, the price is expected to proceed higher against JPY in the process.

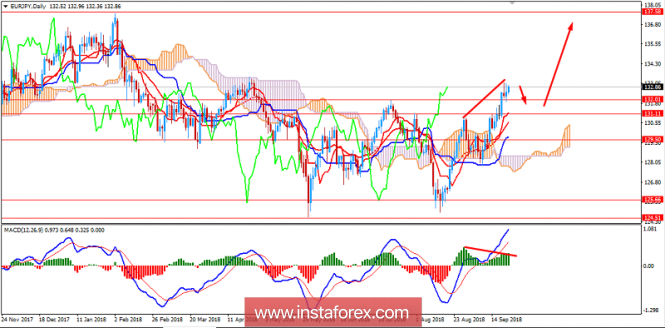

Now let us look at the technical view. The price has formed Bearish Continuous Divergence after breaking above 132.00 area with a daily close while the dynamic levels are held below the 131.00 area which is expected to attract the price lower with certain retrace before it starts to push higher again. As the price remains above 131.00 area with a daily close, the bullish bias is expected to continue despite any strong bearish pressure or pullbacks in the process.

SUPPORT: 132.00, 131.00

RESISTANCE: 133.00, 135.50

BIAS: BULLISH

MOMENTUM: VOLATILE